Discover Catalyst Metals And 2 Other Undiscovered Gems In Australia

As the Australian market navigates fluctuations, with the ASX dipping slightly due to Commonwealth Bank's recent performance and a materials sector rotation driven by China's infrastructure developments, investors continue to seek opportunities amidst these dynamic conditions. In this environment, identifying promising stocks often involves looking beyond immediate market movements to uncover companies with solid fundamentals and growth potential. In this article, we explore Catalyst Metals and two other lesser-known Australian stocks that may offer such opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.78% | 4.30% | ★★★★★★ |

| Schaffer | 25.47% | 6.03% | -5.20% | ★★★★★★ |

| Fiducian Group | NA | 9.97% | 7.85% | ★★★★★★ |

| Hearts and Minds Investments | NA | 47.09% | 49.82% | ★★★★★★ |

| Euroz Hartleys Group | NA | 5.92% | -17.96% | ★★★★★★ |

| Djerriwarrh Investments | 1.14% | 8.17% | 7.54% | ★★★★★★ |

| Red Hill Minerals | NA | 95.16% | 40.06% | ★★★★★★ |

| Lycopodium | 6.89% | 16.56% | 32.73% | ★★★★★☆ |

| Carlton Investments | 0.02% | 4.45% | 3.97% | ★★★★★☆ |

| K&S | 20.24% | 1.58% | 25.54% | ★★★★☆☆ |

Click here to see the full list of 50 stocks from our ASX Undiscovered Gems With Strong Fundamentals screener.

We're going to check out a few of the best picks from our screener tool.

Catalyst Metals (ASX:CYL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Catalyst Metals Limited engages in the exploration and evaluation of mineral properties across Australia, with a market capitalization of A$1.27 billion.

Operations: Catalyst Metals Limited generates revenue primarily from its operations in Western Australia (A$178.04 million) and Tasmania (A$46.14 million).

Catalyst Metals, a promising player in the Australian mining sector, has seen its debt to equity ratio rise slightly from 0% to 1% over five years. Despite this, it holds more cash than total debt and boasts high-quality earnings. The company is trading at a significant discount of 53.6% below its estimated fair value and has become profitable recently, outpacing industry growth of 14.3%. In recent developments, Catalyst raised A$150 million through a follow-on equity offering at A$6 per share and appointed new joint company secretaries following Mr. Frank Campagna's retirement.

- Dive into the specifics of Catalyst Metals here with our thorough health report.

Understand Catalyst Metals' track record by examining our Past report.

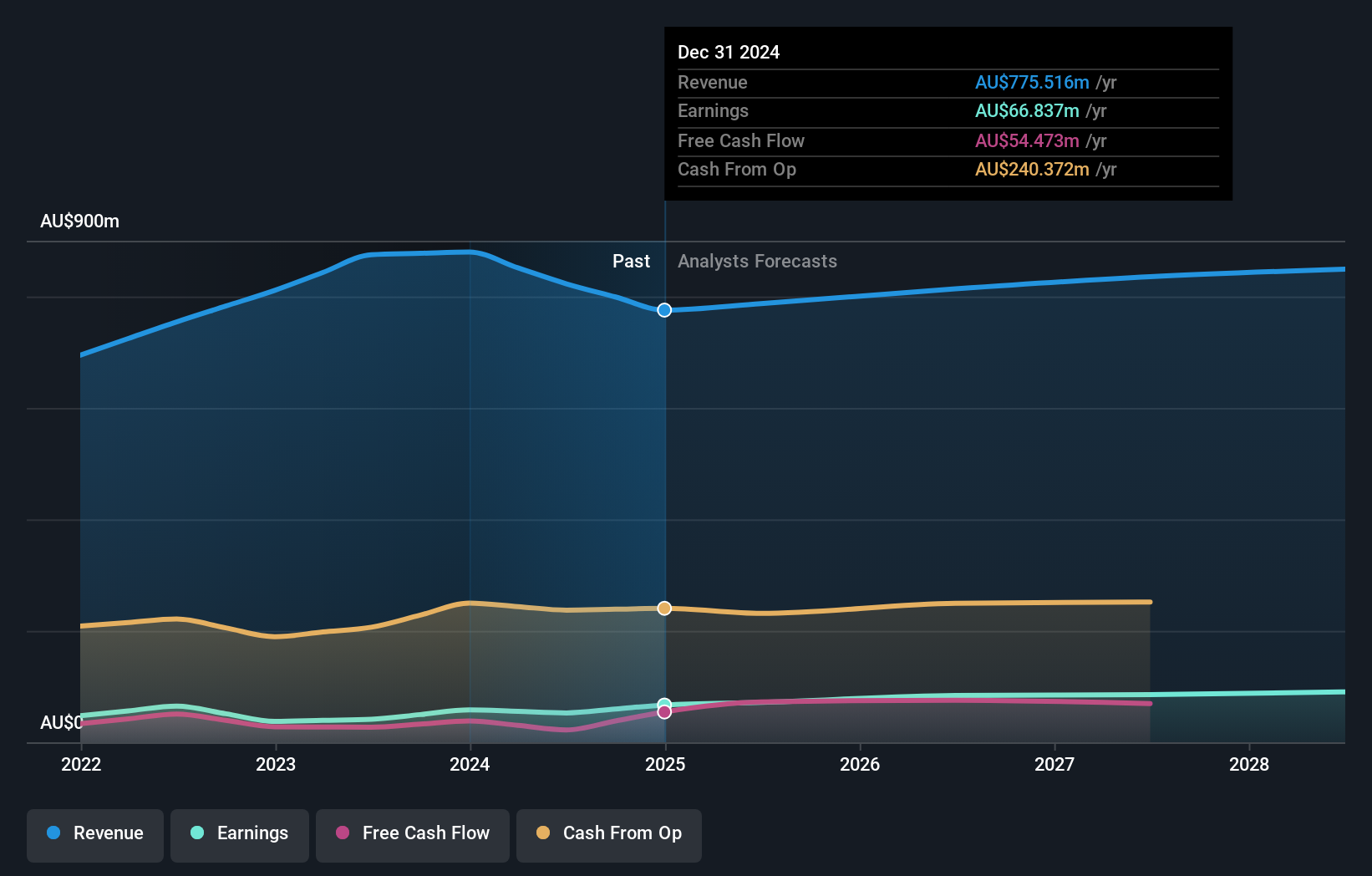

Emeco Holdings (ASX:EHL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Emeco Holdings Limited is an Australian company specializing in the rental of surface and underground mining equipment, along with providing complementary equipment and mining services, with a market capitalization of A$457.90 million.

Operations: Emeco Holdings generates revenue primarily through its rental segment, contributing A$579.43 million, and workshops adding A$292.97 million. The company experienced a segment adjustment of A$25.44 million and intersegment revenue of -A$122.31 million.

Emeco Holdings, a notable player in the equipment rental industry, showcases a solid financial footing with high-quality earnings and a satisfactory net debt to equity ratio of 26%. Over the past five years, its debt to equity ratio has impressively decreased from 197.1% to 42.4%, reflecting effective leverage management. The company is trading at nearly half its estimated fair value, indicating potential for capital appreciation. Emeco's EBIT covers interest payments comfortably at 4.9 times, underscoring robust financial health. However, challenges such as dependency on maintained projects and weather-related equipment utilization risks remain considerations for investors.

- Emeco Holdings' simplified model and disciplined capital management enhance margins and earnings growth. Click here to explore the full narrative on Emeco Holdings.

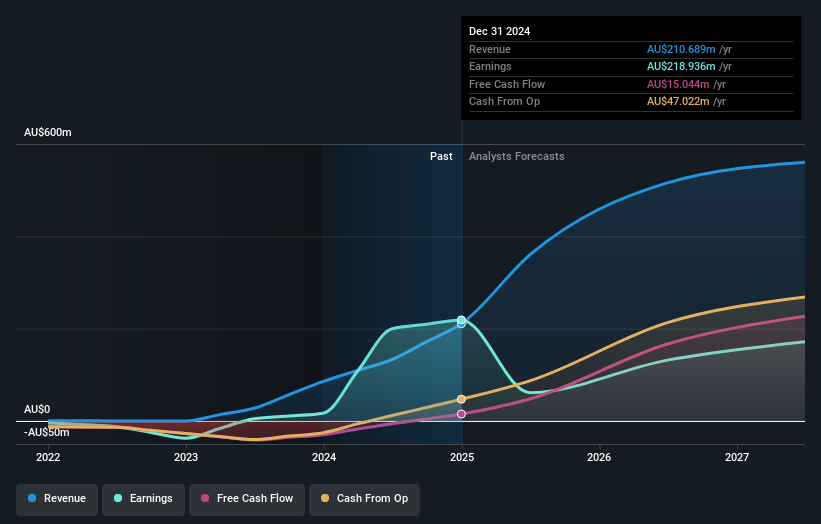

Kingsgate Consolidated (ASX:KCN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kingsgate Consolidated Limited is involved in the exploration, development, and mining of gold and silver mineral properties with a market capitalization of A$643.97 million.

Operations: Kingsgate Consolidated generates revenue primarily from its Chatree segment, amounting to A$210.69 million.

Kingsgate Consolidated, a dynamic player in the mining sector, has shown impressive financial strides with earnings skyrocketing by 1203% last year, far outpacing the industry average of 14.3%. The company's net debt to equity ratio stands at a satisfactory 17.9%, reflecting prudent financial management as it reduced from 52.5% over five years. Trading at nearly 92% below its estimated fair value suggests potential for investors seeking undervalued opportunities. Recent executive changes bring seasoned expertise to Kingsgate's leadership, likely enhancing strategic initiatives around their Chatree Gold Mine and Nueva Esperanza Project. Additionally, their share repurchase program aims to bolster shareholder value further.

- Unlock comprehensive insights into our analysis of Kingsgate Consolidated stock in this health report.

Gain insights into Kingsgate Consolidated's past trends and performance with our Past report.

Make It Happen

- Navigate through the entire inventory of 50 ASX Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kingsgate Consolidated might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10