Mondelez International (MDLZ) Unveils CHIPS AHOY! x Stranger Things Cookie Collaboration

Mondelez International (MDLZ) announced an exciting collaboration last week, launching the CHIPS AHOY! x Stranger Things Limited-Edition Cookie. This innovative product, with its captivating elements and augmented-reality game, aims to create a buzz among consumers. Coinciding with this launch, MDLZ experienced a 3% increase in its share price, aligning broadly with the upward trend in major indices such as the S&P 500 and Nasdaq, which hit new highs amid strong earnings reports. The collaboration likely added positive momentum to Mondelez's stock performance during a period of market enthusiasm.

We've identified 1 possible red flag for Mondelez International that you should be aware of.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

The recent CHIPS AHOY! x Stranger Things launch by Mondelez International may have bolstered consumer engagement and contributed positively to the company's current 3% share price increase. This buzz around innovative product collaborations is expected to align with the company's strategic growth agenda, potentially impacting revenue and earnings forecasts positively by expanding consumer reach.

Over the past five years, Mondelez's total shareholder return, inclusive of dividends and share price appreciation, amounted to 41.56%, reflecting significant long-term performance. However, over the past year, the stock underperformed relative to the broader US Market, which saw a 14.8% gain, though it exceeded the US Food industry, which had a decline of 8.6%.

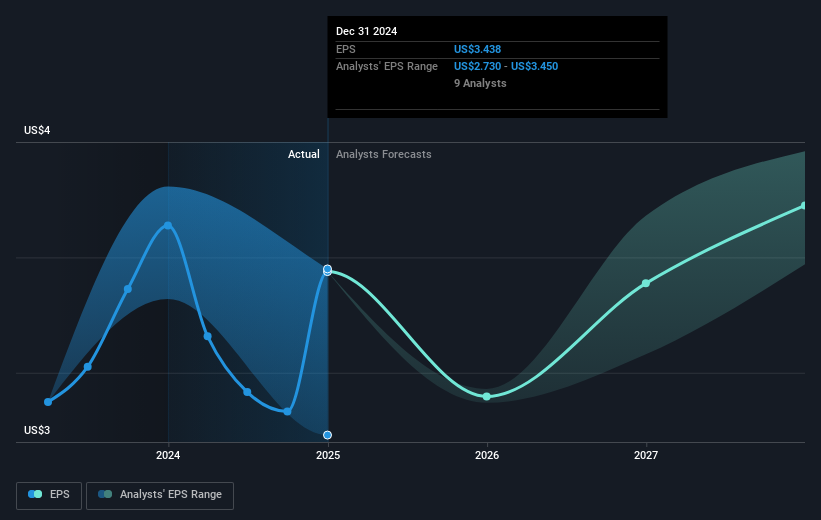

Given that the current share price is US$69.81, the movement towards the analyst price target of US$72.63 indicates a modest potential upside. The continued focus on pricing strategies and brand collaborations could enhance long-term value creation, though elevated cocoa costs and fluctuating demand remain risks to future revenue and earnings stability.

Learn about Mondelez International's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10