Goldman Sachs Group (GS) Advises F&F Co. Ltd. In TaylorMade Acquisition Plan

Goldman Sachs Group (GS) recently saw a 33% price increase, potentially influenced by its new role as financial advisor to F&F Co. Ltd. for TaylorMade's acquisition. This association may have enhanced the company's market perception, supporting its robust Q2 earnings report where net income rose to USD 3,723 million. Additionally, the appointment of Raghav Maliah as Chairman of Investment Banking reinforces confidence in leadership. Amid market conditions that saw mixed movements in indexes like the S&P 500 and Nasdaq, these events likely added momentum to GS's substantial upswing, aligning with the overall buoyant corporate earnings climate.

Be aware that Goldman Sachs Group is showing 2 possible red flags in our investment analysis.

Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

Goldman Sachs Group's recent role as financial advisor in the TaylorMade acquisition has likely bolstered market confidence, potentially enhancing advisory revenues and influencing shareholder perception positively. This development complements the company's strong trajectory in advisory and asset management, marked by a shift toward stable, high-margin revenue streams. The integration of strategic AI and digital transformation efforts may further enhance operational efficiencies and strengthen long-term earnings potential. However, geopolitical and regulatory risks remain, posing potential challenges to these positive projections.

Over a five-year horizon, Goldman Sachs delivered a substantial total shareholder return of 294.80%, reflecting the company's resilience and growth potential. Contrastingly, in the past year, its performance surpassed both the US Capital Markets industry, which returned 33.3%, and the broader US market, which returned 13.7%. This indicates Goldman Sachs' general outperformance relative to its peers and the overall market recently.

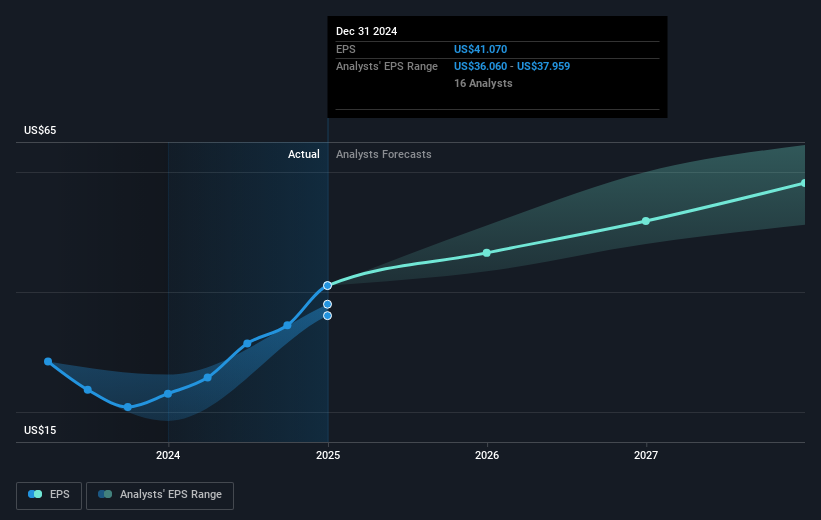

Revenue and earnings forecasts could see a positive impact from the advisory role in high-profile deals, supporting increases in investment banking backlog and deal flow. Despite a current share price of US$706.00 exceeding the analyst consensus price target of US$701.37 by a slight margin of 0.66%, market participants may believe the stock is nearing fair valuation underpinned by expected revenue growth and profit margin improvements. Analysts anticipate revenue growth to US$59.09 billion, and a consistent earnings increase, suggesting the stock might have limited upward flexibility without exceeding these forecasts. As always, investors should evaluate these projections against their individual expectations for a balanced perspective.

Insights from our recent valuation report point to the potential undervaluation of Goldman Sachs Group shares in the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10