Asian Undervalued Small Caps With Insider Action In July 2025

The Asian markets have been buoyed by optimism surrounding trade negotiations, with key indices experiencing gains amidst favorable developments in U.S.-Asia trade relations. As the market sentiment continues to improve, small-cap stocks in Asia present intriguing opportunities for investors, particularly those that demonstrate strong fundamentals and insider activity.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Credit Corp Group | 9.6x | 2.2x | 27.70% | ★★★★★★ |

| East West Banking | 3.5x | 0.8x | 25.33% | ★★★★★☆ |

| Growthpoint Properties Australia | NA | 5.5x | 22.85% | ★★★★★☆ |

| Lion Rock Group | 5.1x | 0.4x | 49.75% | ★★★★☆☆ |

| Eureka Group Holdings | 17.7x | 5.4x | 28.42% | ★★★★☆☆ |

| Daiwa House Logistics Trust | 11.6x | 7.0x | 19.60% | ★★★★☆☆ |

| China XLX Fertiliser | 5.6x | 0.4x | -21.22% | ★★★☆☆☆ |

| Dicker Data | 20.2x | 0.7x | -22.12% | ★★★☆☆☆ |

| China Lesso Group Holdings | 8.1x | 0.5x | -283.69% | ★★★☆☆☆ |

| Chinasoft International | 25.7x | 0.8x | 6.91% | ★★★☆☆☆ |

Click here to see the full list of 37 stocks from our Undervalued Asian Small Caps With Insider Buying screener.

We're going to check out a few of the best picks from our screener tool.

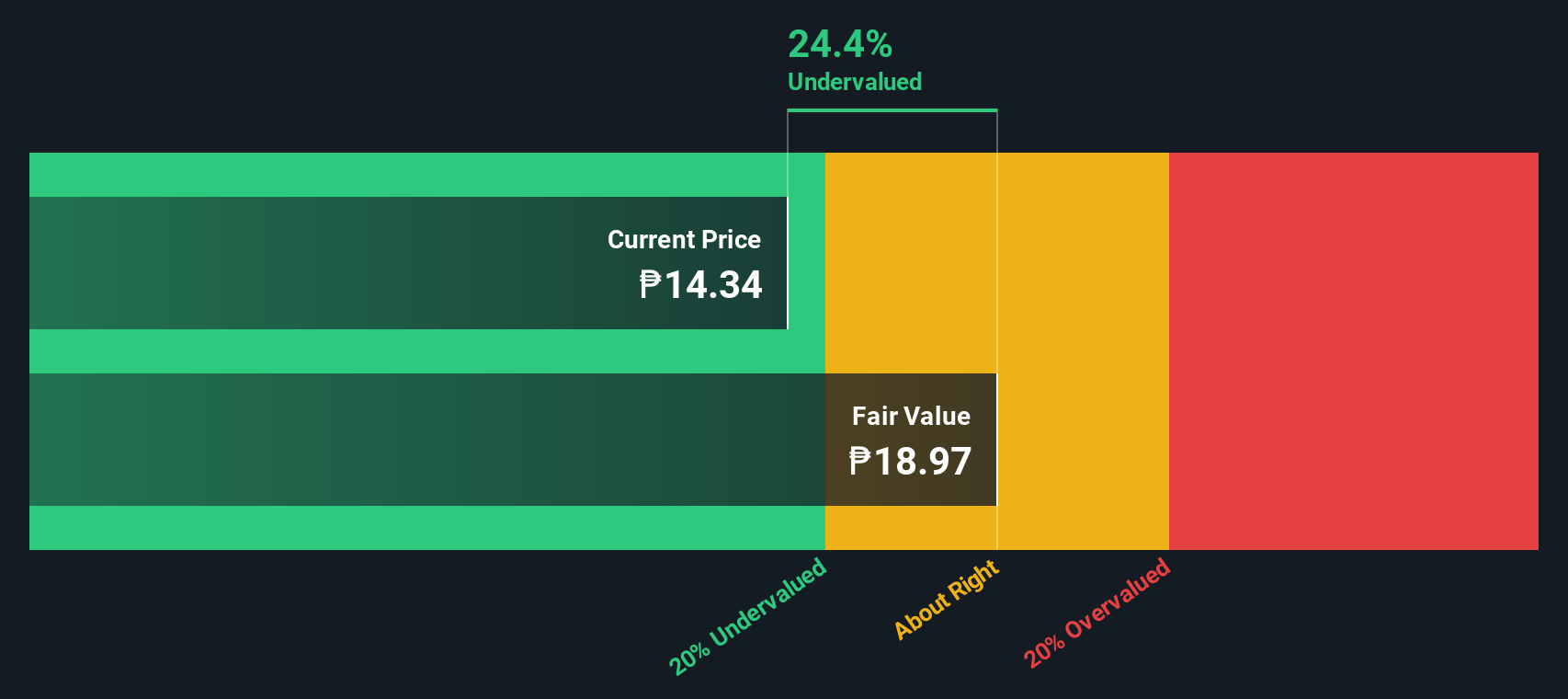

MREIT (PSE:MREIT)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MREIT is a real estate investment trust focused on leasing its portfolio of buildings, with a market capitalization of ₱53.2 billion.

Operations: The primary revenue stream comes from leasing buildings, generating ₱3.65 billion. Gross profit margin has shown fluctuations, with the latest recorded at 73.74%. Operating expenses and non-operating expenses have varied significantly over time, impacting net income results.

PE: 12.6x

MREIT has recently seen insider confidence, with Jose Arnulfo Batac purchasing 100,000 shares for approximately PHP 1.38 million in May 2025. This move coincides with their appointment as CEO and President on June 1, following a reshuffle of key executives. Despite past shareholder dilution and reliance on external borrowing, MREIT's revenue is forecasted to grow by over 16% annually. Their Q1 results showed an increase in net income to PHP 963 million from PHP 733 million year-on-year, indicating potential growth prospects amidst management changes.

- Delve into the full analysis valuation report here for a deeper understanding of MREIT.

Gain insights into MREIT's historical performance by reviewing our past performance report.

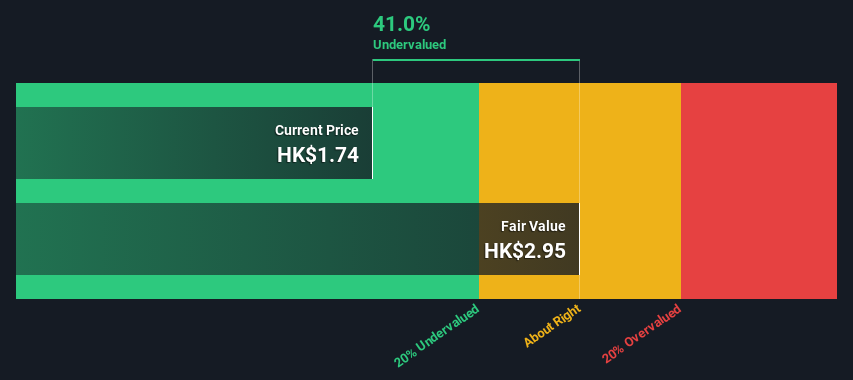

Spring Real Estate Investment Trust (SEHK:1426)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Spring Real Estate Investment Trust focuses on property investment and has a market capitalization of CN¥1.72 billion.

Operations: Spring Real Estate Investment Trust generates revenue primarily from property investment, with the latest reported revenue at CN¥702.47 million. The company's cost of goods sold (COGS) is CN¥171.19 million, leading to a gross profit margin of 75.63%. Operating expenses are CN¥80.01 million, and non-operating expenses significantly impact net income, which was reported as negative in recent periods.

PE: -49.2x

Spring Real Estate Investment Trust, a smaller player in the Asian market, has seen its earnings decline by 11.9% annually over the past five years. Despite this, insider confidence is evident with recent share repurchases initiated on June 19, 2025. The company plans to buy back up to 146.9 million shares, potentially boosting net asset value and earnings per unit. However, its financial position shows reliance on higher-risk external borrowing for funding needs.

- Unlock comprehensive insights into our analysis of Spring Real Estate Investment Trust stock in this valuation report.

Review our historical performance report to gain insights into Spring Real Estate Investment Trust's's past performance.

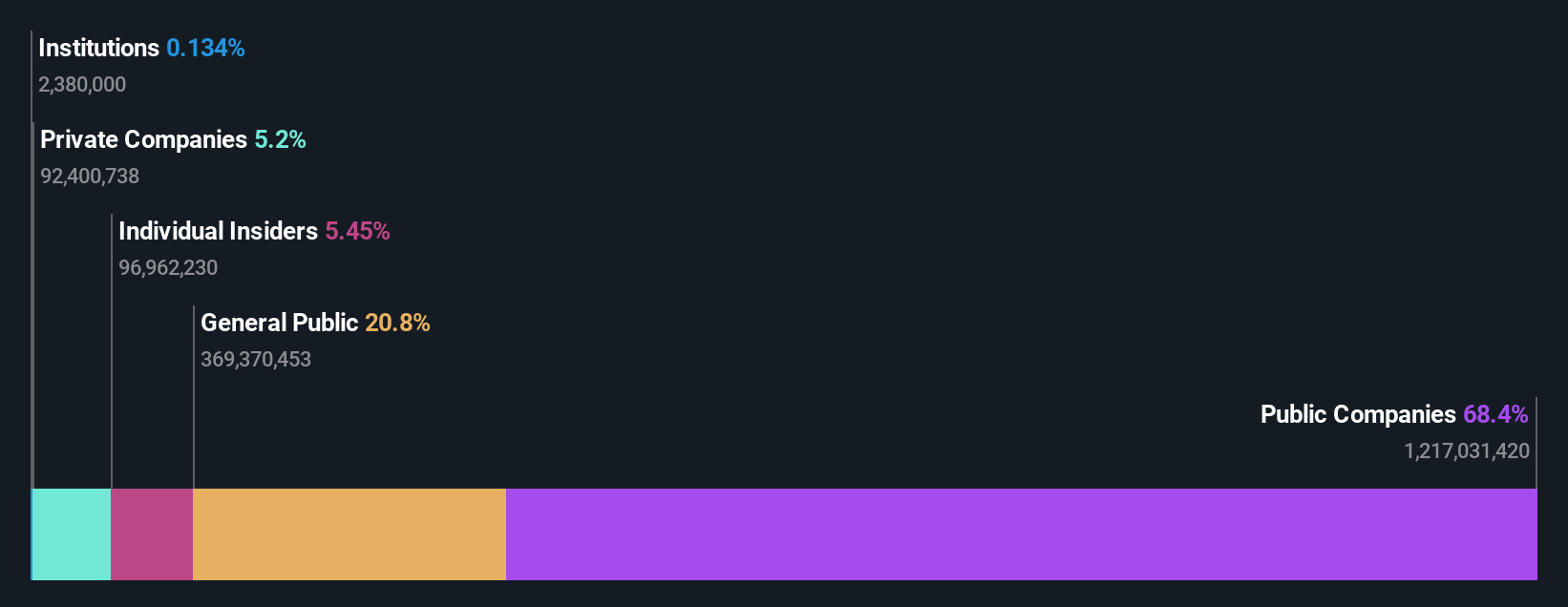

Ausnutria Dairy (SEHK:1717)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Ausnutria Dairy is a company that specializes in the production and distribution of nutrition and dairy-related products, with a market capitalization of approximately CN¥7.24 billion.

Operations: The company's revenue is primarily derived from its Dairy and Related Products segment, contributing significantly to its total income. Cost of goods sold (COGS) has consistently impacted the gross profit margin, which was 41.98% as of December 2024. Operating expenses are largely driven by sales and marketing efforts, with general and administrative expenses also playing a notable role in the cost structure.

PE: 15.8x

Ausnutria Dairy, a key player in the Asian dairy market, has seen insider confidence with recent share purchases. The company's earnings are projected to grow by 16.75% annually, indicating strong potential for future performance. Despite relying entirely on external borrowing for funding, which carries higher risk, Ausnutria maintains a stable financial outlook. Recent executive changes saw Ms. Yang Ruijie take over as CFO on June 30, 2025, bringing extensive financial management experience from major corporations like Procter & Gamble and Yili Group.

- Click here and access our complete valuation analysis report to understand the dynamics of Ausnutria Dairy.

Explore historical data to track Ausnutria Dairy's performance over time in our Past section.

Key Takeaways

- Click this link to deep-dive into the 37 companies within our Undervalued Asian Small Caps With Insider Buying screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10