热点栏目

客户端

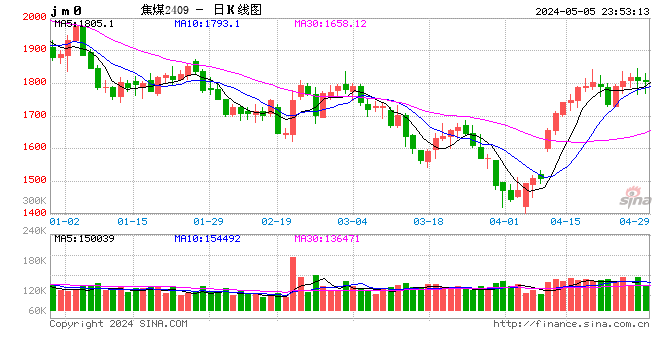

2025年7月28日,早盘开盘,国内期货主力合约多数下跌,焦煤跌超9%,多晶硅跌超8%,碳酸锂、焦炭跌超7%,纯碱、、氧化铝、玻璃跌超6%,烧碱跌超4%,甲醇、20号胶、热卷、沪银、燃料油跌超2%。

8月关税大限逼近,欧盟再度反击,拟对1000亿欧元的美国商品征收30%关税,但随着特朗普称美日达成协议,日本接受15%税率,市场对欧美也能达成协议表示乐观,欧盟委员会主席冯德莱恩应特朗普的邀请前往苏格兰,于周日会面讨论贸易问题,双方有望就一项贸易协议达成框架性协议,以避免跨大西洋贸易战的爆发。而美财长称美中第三轮磋商将于下周在瑞典举行。在市场对关税预期偏乐观的情况下,市场避险情绪有所弱化,美元企稳小幅反弹,金价承压回落。

下周美联储将公布7月利率决议,特朗普上周访问美联储本部,此举意在加大对美联储的压力,这是他为推动美联储降息而采取的部分非常规行动。在特朗普持续施压之下,交易员们开始下注美联储将在明年更积极降息,但7月不降息概率仍然较大,一定程度上抑制黄金走势。另外,金价再度呈现冲高回落,这也是自4月震荡以来第三次反弹失利,显示多空当前的分歧,也表明市场对当前以关税、稳定币以及美联储是否降息这些主要因素并未达成一致共识,继续关注黄金在震荡区间内的表现,以及即将到来的贸易谈判、美联储议息会议和非农就业数据。

新浪合作大平台期货开户 安全快捷有保障

![]()

责任编辑:赵思远

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.