Benign Growth For Koda Ltd (SGX:BJZ) Underpins Its Share Price

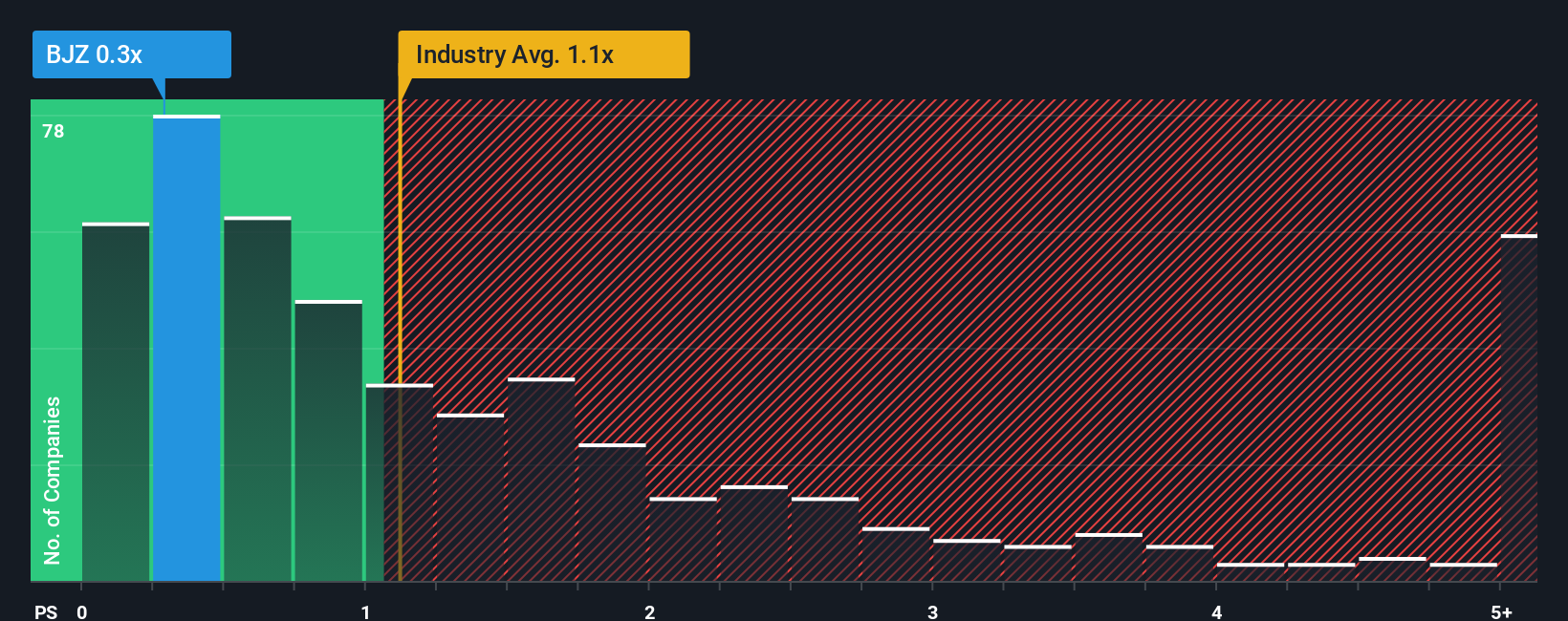

Koda Ltd's (SGX:BJZ) price-to-sales (or "P/S") ratio of 0.3x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Consumer Durables industry in Singapore have P/S ratios greater than 1.1x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Trump has pledged to "unleash" American oil and gas and these 15 US stocks have developments that are poised to benefit.

View our latest analysis for Koda

What Does Koda's P/S Mean For Shareholders?

Koda certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. Those who are bullish on Koda will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Koda's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Koda would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 37% last year. Still, revenue has fallen 31% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 5.3% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we understand why Koda's P/S is lower than most of its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Bottom Line On Koda's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's no surprise that Koda maintains its low P/S off the back of its sliding revenue over the medium-term. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

Plus, you should also learn about these 3 warning signs we've spotted with Koda (including 2 which are potentially serious).

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Koda might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10