ASX Stocks Estimated To Be Undervalued By Up To 42% Offering Investment Opportunities

The Australian stock market has experienced a mixed performance recently, with declines in materials and financials sectors, while energy and IT showed resilience. In this fluctuating environment, identifying undervalued stocks can present potential investment opportunities, especially for those looking to capitalize on discrepancies between current prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| PolyNovo (ASX:PNV) | A$1.29 | A$2.58 | 50% |

| PointsBet Holdings (ASX:PBH) | A$1.20 | A$2.08 | 42.4% |

| Lindsay Australia (ASX:LAU) | A$0.78 | A$1.19 | 34.3% |

| Infomedia (ASX:IFM) | A$1.28 | A$2.06 | 37.8% |

| Hillgrove Resources (ASX:HGO) | A$0.038 | A$0.073 | 47.6% |

| Flight Centre Travel Group (ASX:FLT) | A$13.15 | A$20.81 | 36.8% |

| Fenix Resources (ASX:FEX) | A$0.31 | A$0.49 | 36.8% |

| Domino's Pizza Enterprises (ASX:DMP) | A$18.17 | A$29.45 | 38.3% |

| Collins Foods (ASX:CKF) | A$9.10 | A$15.68 | 42% |

| Charter Hall Group (ASX:CHC) | A$19.53 | A$35.43 | 44.9% |

Click here to see the full list of 29 stocks from our Undervalued ASX Stocks Based On Cash Flows screener.

Here we highlight a subset of our preferred stocks from the screener.

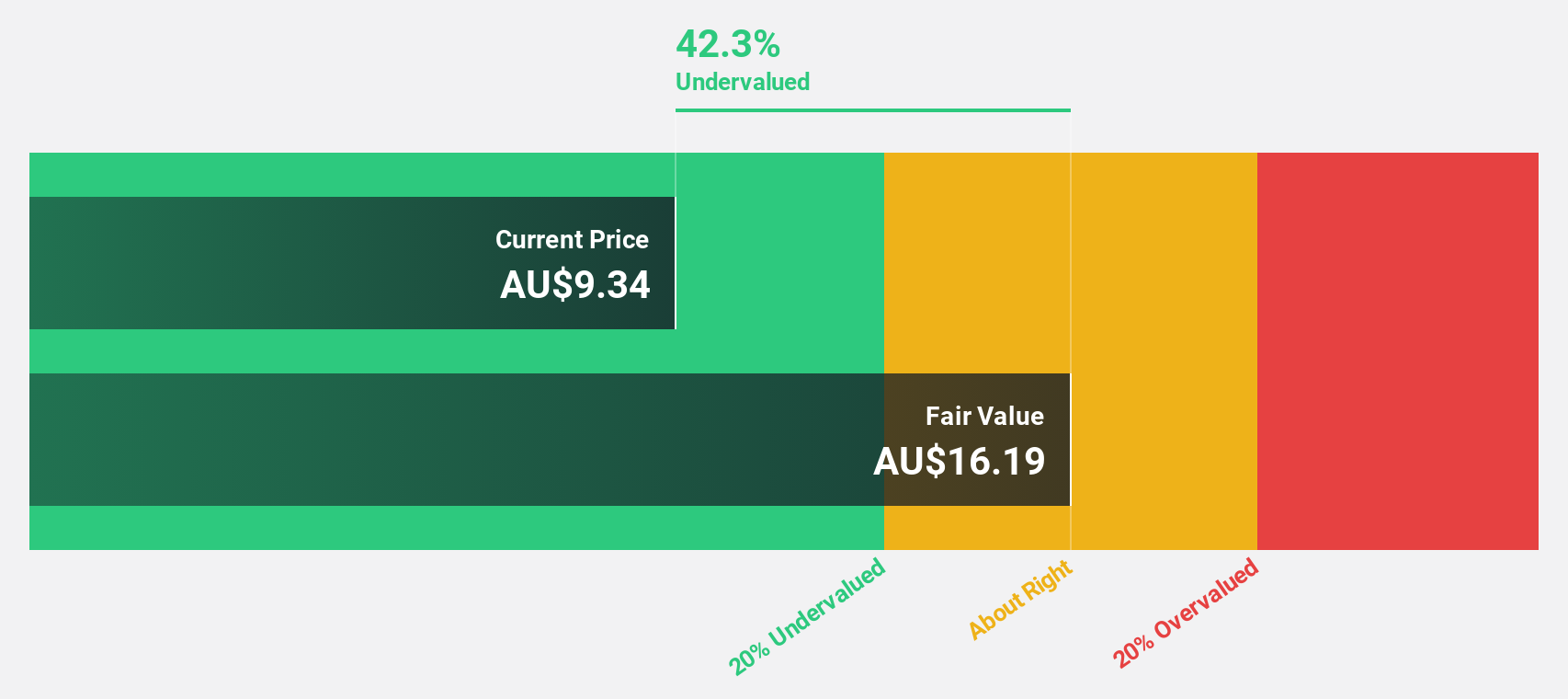

Collins Foods (ASX:CKF)

Overview: Collins Foods Limited operates, manages, and administers restaurants in Australia and Europe with a market cap of A$1.07 billion.

Operations: The company's revenue segments comprise A$53.02 million from Taco Bell Australia, A$312.27 million from KFC Restaurants Europe, and A$1.15 billion from KFC Restaurants Australia.

Estimated Discount To Fair Value: 42%

Collins Foods is trading at A$9.1, significantly below its estimated fair value of A$15.68, indicating undervaluation based on discounted cash flow analysis. Despite a recent dividend decrease to A$0.15 per share and a sharp decline in net income from last year, the company is forecasted to achieve annual earnings growth of 28.5%, outpacing the Australian market's average growth rate of 11.1%. However, profit margins have decreased from 3.7% to 0.6%.

- In light of our recent growth report, it seems possible that Collins Foods' financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Collins Foods.

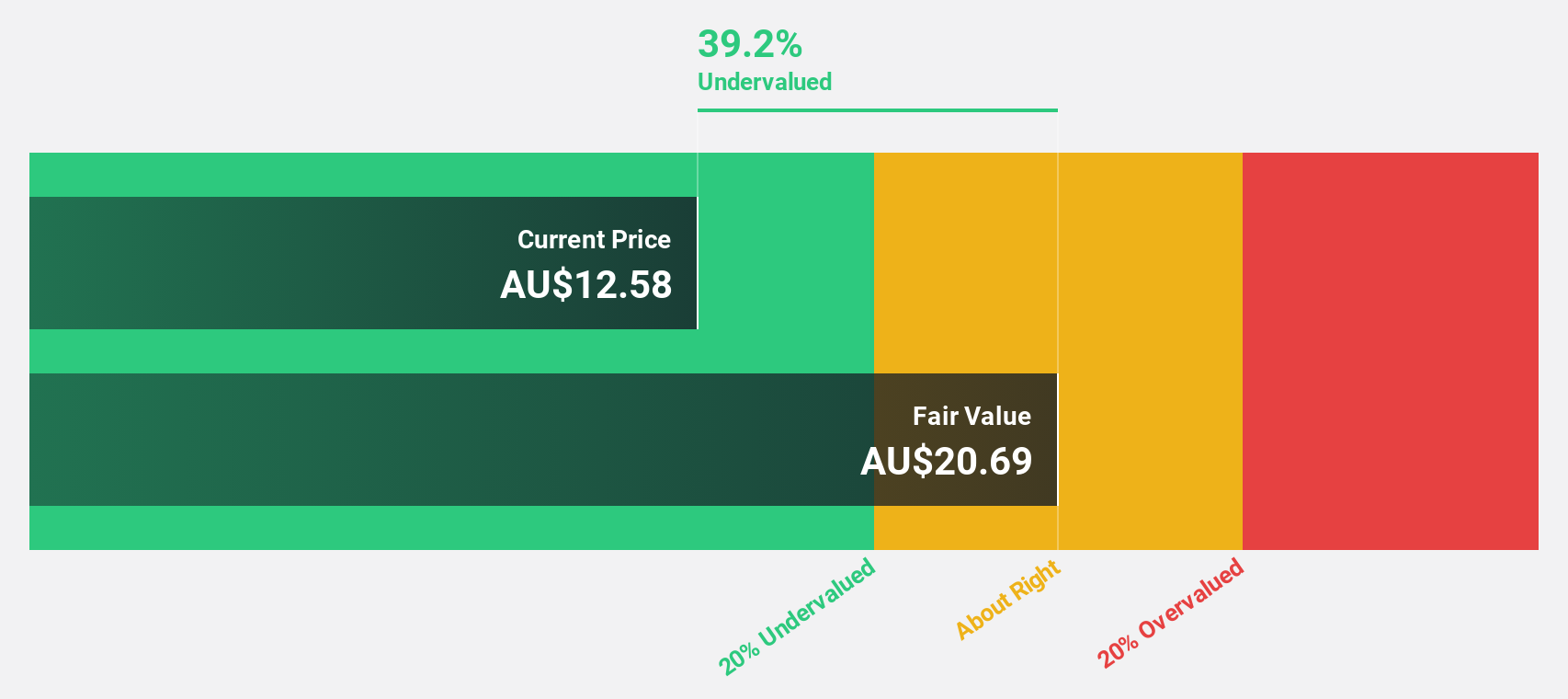

Flight Centre Travel Group (ASX:FLT)

Overview: Flight Centre Travel Group Limited is a global travel retailing company offering services for both leisure and corporate sectors across various regions, with a market capitalization of A$2.85 billion.

Operations: The company's revenue segments include A$1.38 billion from leisure travel services and A$1.13 billion from corporate travel services across its operational regions.

Estimated Discount To Fair Value: 36.8%

Flight Centre Travel Group is currently trading at A$13.15, well below its estimated fair value of A$20.81, highlighting its undervaluation based on cash flow analysis. The company has initiated a share buyback program worth up to A$200 million, funded by existing cash reserves, reflecting strong capital management. Earnings are projected to grow significantly at 21% per year over the next three years, surpassing the Australian market's growth rate of 11.1%, although current profit margins have decreased from last year.

- Our earnings growth report unveils the potential for significant increases in Flight Centre Travel Group's future results.

- Click here to discover the nuances of Flight Centre Travel Group with our detailed financial health report.

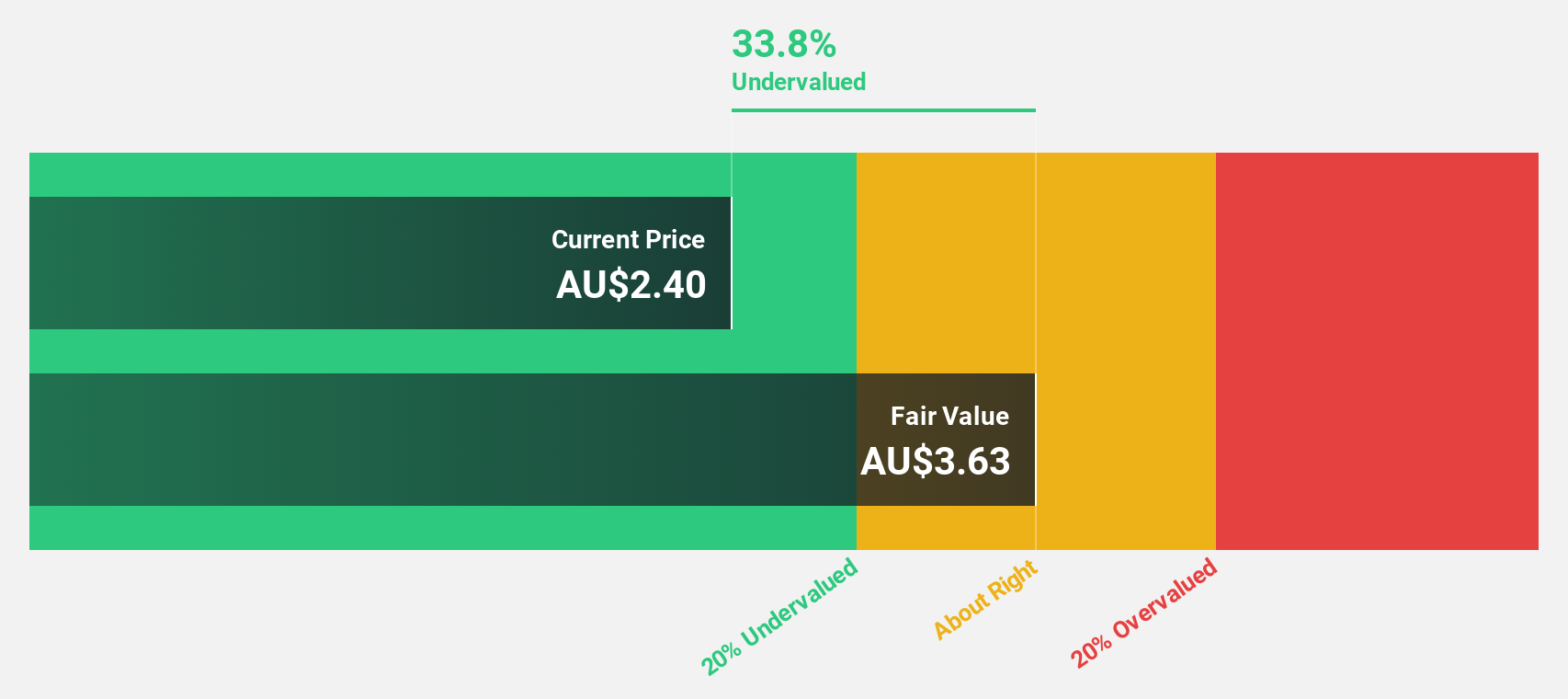

Regal Partners (ASX:RPL)

Overview: Regal Partners Limited is a privately owned hedge fund sponsor with a market cap of A$975.05 million.

Operations: The company's revenue is primarily derived from the provision of investment management services, amounting to A$257.55 million.

Estimated Discount To Fair Value: 20.3%

Regal Partners is trading at A$2.9, significantly below its estimated fair value of A$3.64, indicating it is undervalued based on cash flows. The company forecasts robust earnings growth of 21.7% annually, outpacing the Australian market's 11.1%. However, its dividend yield of 6.9% isn't well covered by free cash flows, presenting a risk factor for investors focused on income stability. Regal Partners is actively seeking acquisitions to enhance earnings per share through disciplined M&A strategies.

- Our comprehensive growth report raises the possibility that Regal Partners is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Regal Partners stock in this financial health report.

Make It Happen

- Delve into our full catalog of 29 Undervalued ASX Stocks Based On Cash Flows here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10