Discovering Undiscovered Gems in Global Markets This July 2025

As global markets navigate a landscape marked by robust corporate earnings and fluctuating inflation, small-cap stocks have shown resilience, with the Russell 2000 Index posting positive returns. In this dynamic environment, identifying undiscovered gems involves seeking companies that demonstrate strong fundamentals and potential for growth amidst economic shifts.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ampire | NA | -2.21% | 8.00% | ★★★★★★ |

| Orient Pharma | 17.16% | 26.65% | 68.11% | ★★★★★★ |

| Oriental Precision & EngineeringLtd | 39.11% | 5.91% | 0.76% | ★★★★★☆ |

| E J Holdings | 21.62% | 4.30% | 3.77% | ★★★★★☆ |

| Tokyo Tekko | 8.47% | 8.06% | 24.39% | ★★★★★☆ |

| Zhejiang Jinghua Laser TechnologyLtd | 2.85% | 4.02% | -2.43% | ★★★★★☆ |

| Uju Holding | 33.18% | 8.01% | -15.93% | ★★★★★☆ |

| Iljin DiamondLtd | 2.55% | -3.23% | 0.91% | ★★★★☆☆ |

| Shenzhen Leaguer | 63.12% | 1.96% | -16.52% | ★★★★☆☆ |

| ASRock Rack Incorporation | 77.35% | 311.61% | 693.05% | ★★★★☆☆ |

Click here to see the full list of 3167 stocks from our Global Undiscovered Gems With Strong Fundamentals screener.

Here's a peek at a few of the choices from the screener.

IVD Medical Holding (SEHK:1931)

Simply Wall St Value Rating: ★★★★☆☆

Overview: IVD Medical Holding Limited is an investment holding company that distributes in vitro diagnostic products in Mainland China and internationally, with a market capitalization of HK$5.64 billion.

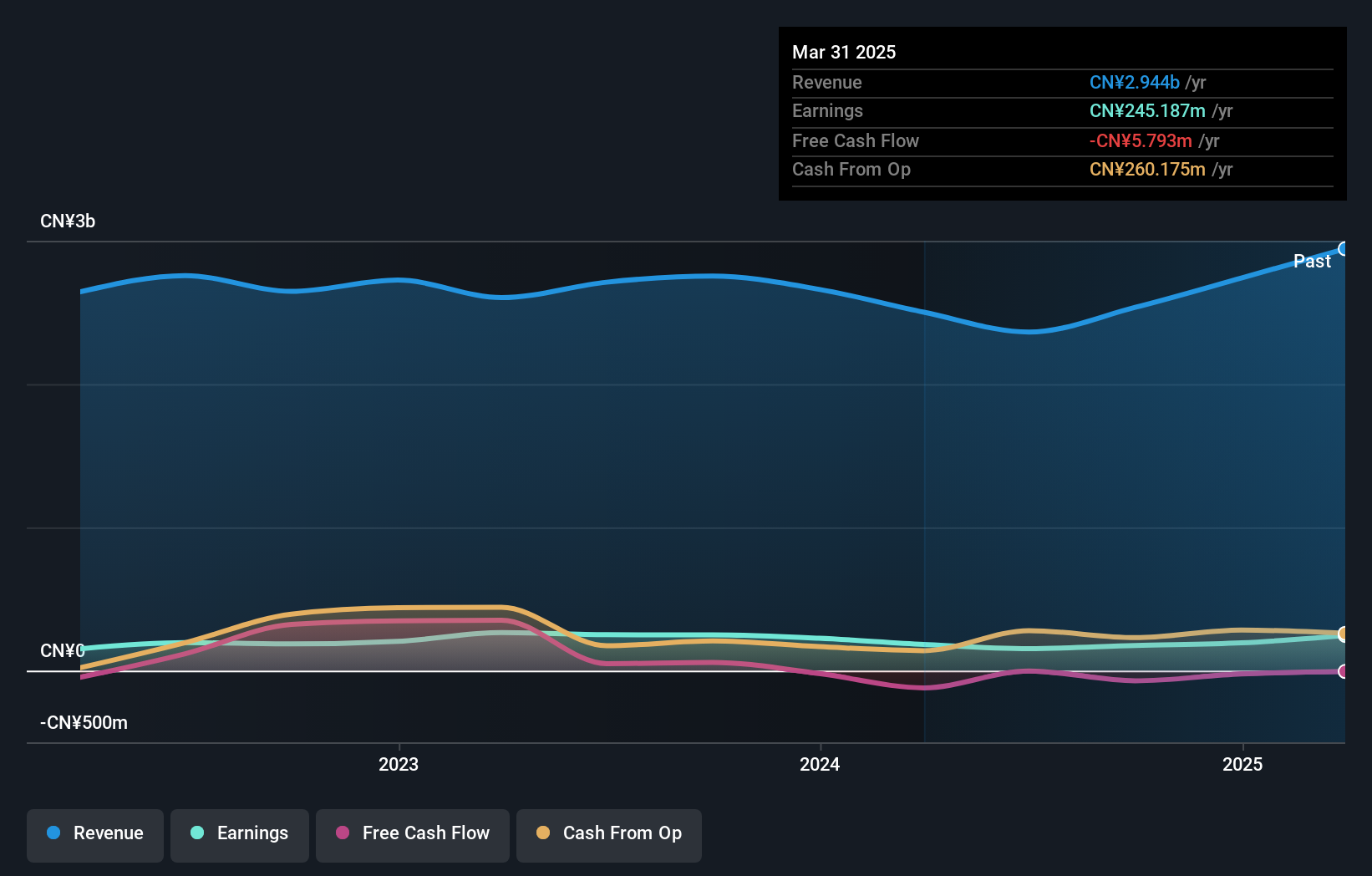

Operations: IVD Medical Holding generates revenue primarily through its distribution business, which accounts for CN¥2.95 billion, followed by after-sales services at CN¥205.99 million and self-branded products at CN¥9.64 million.

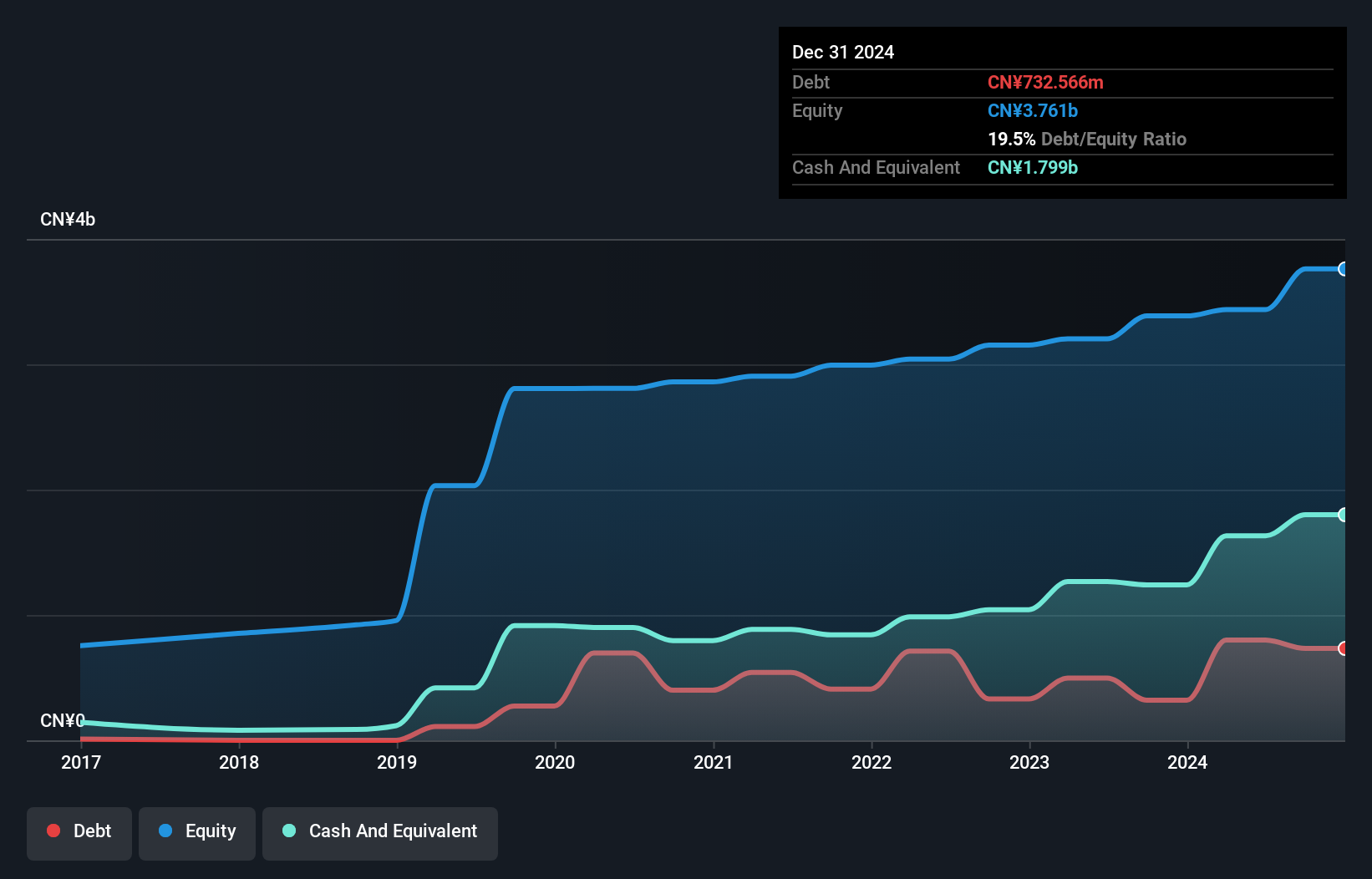

IVD Medical Holding, a nimble player in the healthcare sector, has shown robust earnings growth of 9% over the past year, outpacing the broader industry. The company boasts high-quality earnings and maintains a solid financial footing with cash exceeding total debt. Their debt-to-equity ratio has risen from 10% to 20% over five years, yet interest payments are comfortably covered at 13 times by EBIT. Recent strategic moves include establishing a US subsidiary and developing a Web3 exchange ecosystem for medical assets. Despite recent volatility in share price, these initiatives could enhance their global presence and operational efficiency.

- Click here and access our complete health analysis report to understand the dynamics of IVD Medical Holding.

Learn about IVD Medical Holding's historical performance.

Senci Electric MachineryLtd (SHSE:603109)

Simply Wall St Value Rating: ★★★★★☆

Overview: Senci Electric Machinery Co., Ltd. is engaged in the manufacturing and sale of gasoline generators, engines, water pumps, pressure washers, mufflers, control panels, and related frames both in China and internationally with a market capitalization of CN¥6.89 billion.

Operations: Senci Electric Machinery generates revenue primarily through the sale of gasoline generators, engines, and related equipment. The company's financial performance is reflected in its market capitalization of CN¥6.89 billion.

Senci Electric Machinery Ltd. showcases a compelling mix of growth and value characteristics, with recent earnings surging to CNY 69.57 million from CNY 18.08 million year-on-year, highlighting robust profitability despite a debt to equity ratio increase from 7.8% to 22.7% over five years. The company's price-to-earnings ratio at 28x remains attractive compared to the broader CN market's 41x, suggesting potential undervaluation in its sector. Although free cash flow isn't positive, Senci's earnings growth outpaces the electrical industry average significantly by growing at an impressive rate of 34%, indicating strong operational performance amidst market volatility.

- Navigate through the intricacies of Senci Electric MachineryLtd with our comprehensive health report here.

Gain insights into Senci Electric MachineryLtd's historical performance by reviewing our past performance report.

Shanghai Prisemi ElectronicsLtd (SHSE:688230)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Prisemi Electronics Co., Ltd. focuses on the research, development, production, and sale of power ICs and power devices in China with a market cap of CN¥6.46 billion.

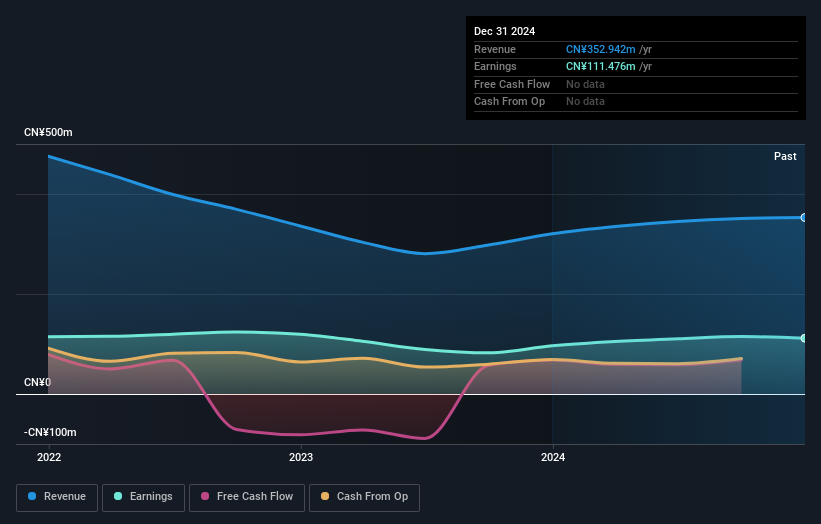

Operations: Prisemi generates revenue primarily from its Integrated Circuit segment, which reported CN¥358.51 million. The company's financial performance is characterized by a focus on this key revenue stream.

Prisemi Electronics, a nimble player in the semiconductor space, showcases a compelling financial profile. With a Price-To-Earnings ratio of 58.1x, it sits attractively below the industry average of 67.8x, hinting at potential value. The company has been debt-free for five years, suggesting prudent financial management and resilience. While earnings growth over the past year was 5.9%, slightly lagging behind the industry's 8%, Prisemi's consistent annual earnings increase of 2% over five years reflects stability in its operations. Its high-quality earnings further reinforce investor confidence in its long-term prospects within this competitive sector.

- Click here to discover the nuances of Shanghai Prisemi ElectronicsLtd with our detailed analytical health report.

Understand Shanghai Prisemi ElectronicsLtd's track record by examining our Past report.

Seize The Opportunity

- Explore the 3167 names from our Global Undiscovered Gems With Strong Fundamentals screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10