Will FDA Response and New Stock Offering Change Ultragenyx Pharmaceutical's (RARE) Narrative?

- Earlier this month, Ultragenyx Pharmaceutical announced it received a Complete Response Letter from the FDA regarding its Biologics License Application for UX111 gene therapy in Sanfilippo syndrome type A, with the FDA requesting additional manufacturing-related information, and subsequently filed a shelf registration for up to US$95.94 million in common stock linked to an ESOP-related offering.

- This sequence of regulatory and capital-raising actions highlights Ultragenyx's dual emphasis on advancing gene therapy approvals and ensuring funding flexibility as it addresses regulatory requirements.

- We'll explore how the FDA's recent feedback on manufacturing processes may impact Ultragenyx's path to future gene therapy approvals and growth.

Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

Ultragenyx Pharmaceutical Investment Narrative Recap

Ultragenyx Pharmaceutical's investment case centers around belief in its ability to advance and commercialize gene therapies for rare diseases, with the UX111 program standing out as a key catalyst. The recent FDA Complete Response Letter for UX111 focuses on manufacturing issues but does not materially impact the immediate clinical outlook since no new clinical data concerns were raised; however, it may delay the timing of potential regulatory approval, which remains the most important short-term catalyst. The company’s ongoing financial losses remain a prominent risk as it manages high expenses and unpredictable revenue streams without near-term profitability.

Of the recent announcements, the FDA’s feedback on the UX111 manufacturing process is most relevant, given that approval and commercialization of this gene therapy are central to Ultragenyx’s revenue growth plans. Addressing the regulatory observations swiftly could reset the approval timeline, directly influencing when, or if, this anticipated revenue stream will materialize, and thus impacting the company’s ability to offset its continued operating losses.

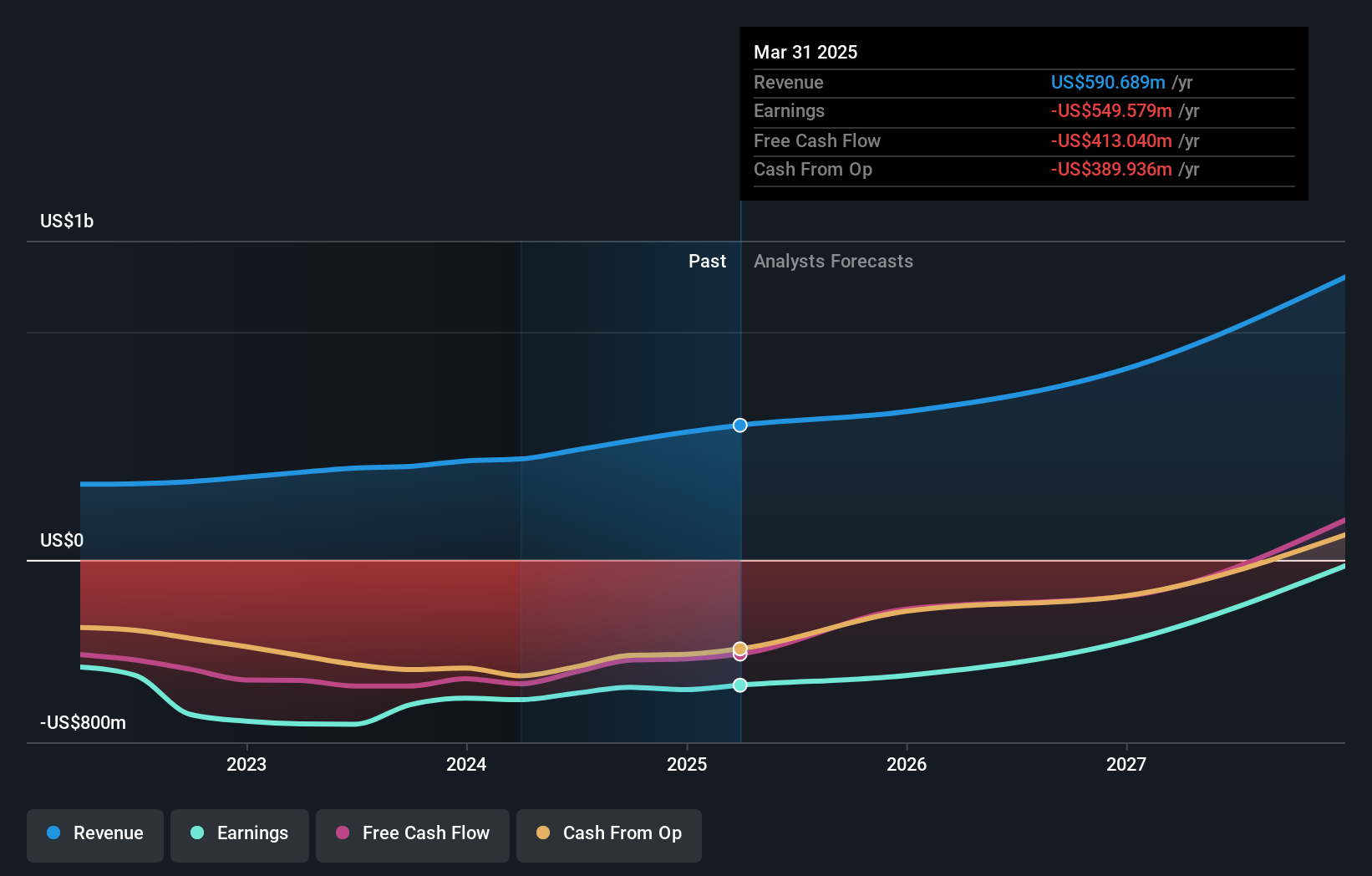

Yet, even if clinical progress is maintained, investors should be aware that with losses exceeding US$500 million annually, the outlook for future profitability remains a question...

Read the full narrative on Ultragenyx Pharmaceutical (it's free!)

Ultragenyx Pharmaceutical's narrative projects $1.3 billion in revenue and $140.6 million in earnings by 2028. This requires 31.2% yearly revenue growth and a $690.2 million increase in earnings from the current level of -$549.6 million.

Uncover how Ultragenyx Pharmaceutical's forecasts yield a $87.21 fair value, a 211% upside to its current price.

Exploring Other Perspectives

Community members at Simply Wall St have shared two fair value estimates on Ultragenyx Pharmaceutical, ranging from US$87.21 to US$447.66 per share. With revenue growth projections strong yet continued net losses a reality, opinions on future potential can vary widely, explore more viewpoints from fellow investors.

Explore 2 other fair value estimates on Ultragenyx Pharmaceutical - why the stock might be worth just $87.21!

Build Your Own Ultragenyx Pharmaceutical Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ultragenyx Pharmaceutical research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ultragenyx Pharmaceutical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ultragenyx Pharmaceutical's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover 16 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10