High Insider Confidence In These Growth Stocks For July 2025

Over the last 7 days, the United States market has risen by 1.7%, contributing to an impressive 18% climb over the past year, with earnings projected to grow by 15% annually in the coming years. In this favorable environment, growth companies with high insider ownership often signal strong confidence from those closest to the business, making them noteworthy considerations for investors seeking potential opportunities.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Wallbox (WBX) | 24.6% | 75.8% |

| Super Micro Computer (SMCI) | 13.9% | 38.2% |

| Prairie Operating (PROP) | 34.4% | 80.8% |

| Niu Technologies (NIU) | 36% | 88.1% |

| FTC Solar (FTCI) | 28.3% | 62.5% |

| Enovix (ENVX) | 10.5% | 47% |

| Credo Technology Group Holding (CRDO) | 11.7% | 36.9% |

| Atour Lifestyle Holdings (ATAT) | 22.2% | 23.6% |

| Astera Labs (ALAB) | 12.8% | 45.4% |

| ARS Pharmaceuticals (SPRY) | 14.3% | 63.1% |

Click here to see the full list of 190 stocks from our Fast Growing US Companies With High Insider Ownership screener.

Let's dive into some prime choices out of the screener.

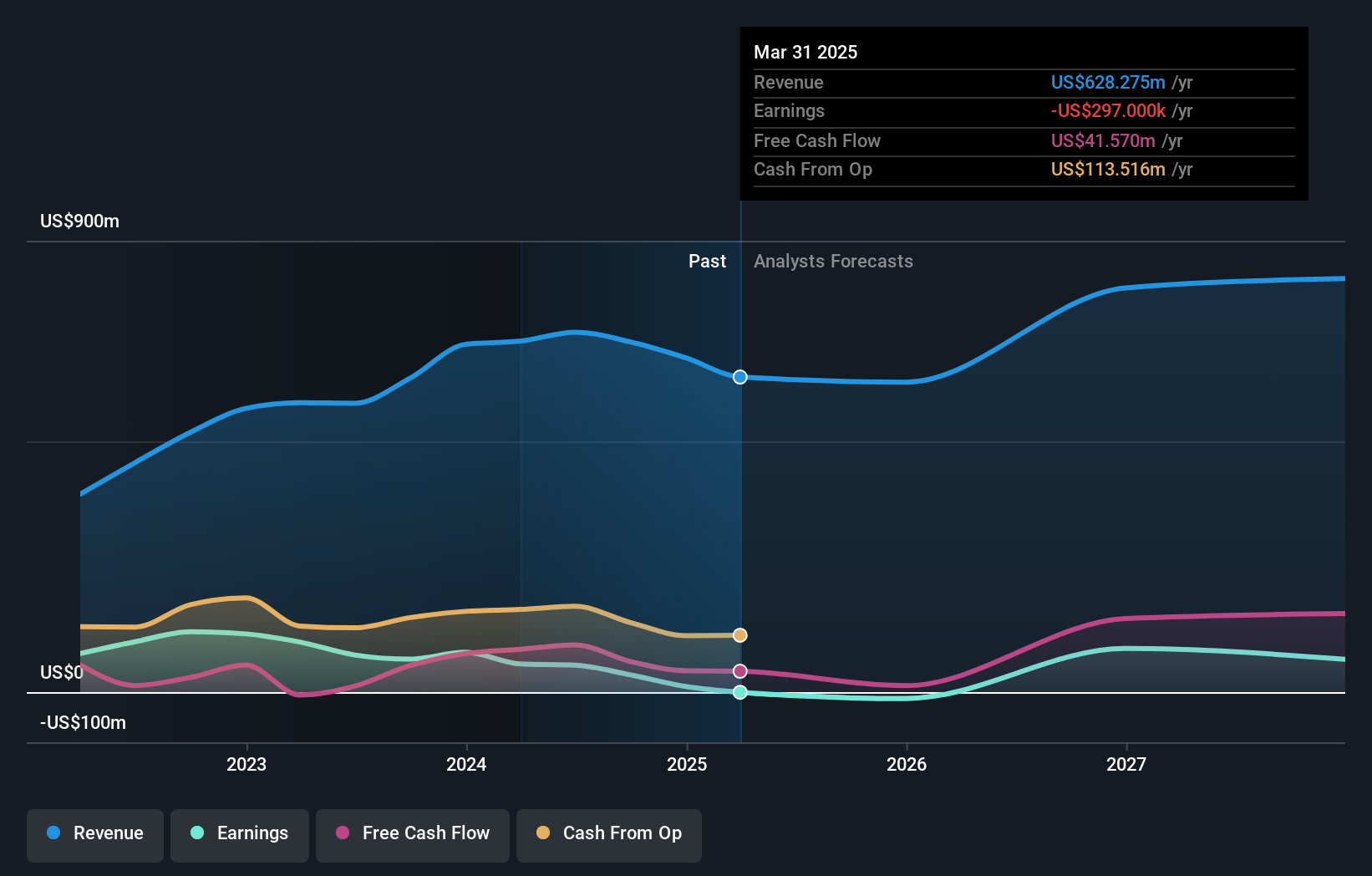

Ramaco Resources (METC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ramaco Resources, Inc. focuses on the development, operation, and sale of metallurgical coal with a market capitalization of approximately $1.11 billion.

Operations: The company generates revenue primarily through its Metals & Mining - Coal segment, which accounts for $628.28 million.

Insider Ownership: 10.8%

Revenue Growth Forecast: 11.2% p.a.

Ramaco Resources is positioned for growth with a forecasted revenue increase of 11.2% annually, outpacing the US market. Despite recent volatility and index drops, the company is trading at a significant discount to its estimated fair value. Insider ownership remains high, although no recent insider buying or selling has been reported. The company recently completed a $57 million fixed-income offering and appointed Michael Woloschuk to lead its critical minerals operations at Brook Mine.

- Navigate through the intricacies of Ramaco Resources with our comprehensive analyst estimates report here.

- The analysis detailed in our Ramaco Resources valuation report hints at an deflated share price compared to its estimated value.

Stagwell (STGW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stagwell Inc. offers digital transformation, performance media and data, consumer insights and strategy, as well as creativity and communications services across the United States, the United Kingdom, and globally with a market cap of $1.35 billion.

Operations: The company's revenue segments include $509.02 million from the Communications Network, $700.14 million from the Brand Performance Network, and $1.56 billion from the Integrated Agencies Network.

Insider Ownership: 13.9%

Revenue Growth Forecast: 19.6% p.a.

Stagwell is poised for significant earnings growth, forecasted at 79.8% annually, surpassing the US market's average. Despite being dropped from several indices, it trades at a substantial discount to its fair value and has seen substantial insider buying recently. The company launched the Stagwell Media Platform to enhance global media operations and announced executive changes aimed at strengthening strategic roles. However, interest payments are not well covered by earnings, indicating financial challenges ahead.

- Dive into the specifics of Stagwell here with our thorough growth forecast report.

- According our valuation report, there's an indication that Stagwell's share price might be on the cheaper side.

Workiva (WK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Workiva Inc., along with its subsidiaries, offers cloud-based reporting solutions across the Americas and internationally, with a market cap of $3.74 billion.

Operations: The company's revenue primarily comes from its data processing segment, which generated $769.29 million.

Insider Ownership: 10.6%

Revenue Growth Forecast: 15.4% p.a.

Workiva, despite recent index removals, is positioned for growth with forecasted earnings expansion of 87.97% annually and revenue growth surpassing the US market. The company trades at a favorable value relative to peers and industry standards. However, there has been significant insider selling recently. Workiva's strategic board appointment of Astha Malik aims to leverage her extensive SaaS experience for further scaling operations, while maintaining guidance for 2025 revenue between US$864 million and US$868 million.

- Unlock comprehensive insights into our analysis of Workiva stock in this growth report.

- Our expertly prepared valuation report Workiva implies its share price may be lower than expected.

Make It Happen

- Click this link to deep-dive into the 190 companies within our Fast Growing US Companies With High Insider Ownership screener.

- Interested In Other Possibilities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Workiva might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10