Airbnb's Cash Cow Can Thrive Despite Its Challenges

-

Airbnb faces regulatory hurdles that management must attempt to overcome.

-

The company benefits from significant demographic tailwinds.

-

Airbnb is a cash-flow machine and a great stock to own.

The travel industry is a lucrative but tricky realm in which to do business. This is especially true when it comes to short-term rentals. Navigating local regulations and international expansion while satisfying thousands of hosts and even more guests are a few of the daunting challenges faced by Airbnb (ABNB -0.25%), one of the leaders in the space.

Its management is working to increase its cooperation with localities and promote what it views as commonsense regulations while maintaining its ability to operate freely. Still, in some major markets, such as Hawaii, New York City, and Paris, local and state governments have imposed stringent restrictions on how short-term rentals can be operated. Many homeowners' associations also have rules that are unfriendly to owners who want to turn their properties into short-term rentals. However, the news isn't all bad for Airbnb.

The market it operates in is massive and continues to grow. There are also demographic tailwinds, as younger generations tend to gravitate toward Airbnbs more than their parents. Short-term rentals (labelled vacation rentals on the chart below) make up a significant portion of a market that is forecast to exceed $1.1 trillion by 2029.

Statista.

What does this mean for Airbnb? Cash, and lots of it.

Terrific business model

Airbnb is just a software platform at its core. There is also a customer service element. However, companies in this industry lack the factories, expensive equipment, and other major infrastructure that many other industries have. Property and equipment purchases are often referred to as capex (short for capital expenditures) and reduce the amount of cash a company can keep. Free cash flow is one reason why software companies, such as CrowdStrike (NASDAQ: CRWD) and Palantir (NASDAQ: PLTR), often trade at higher valuations than companies in other industries.

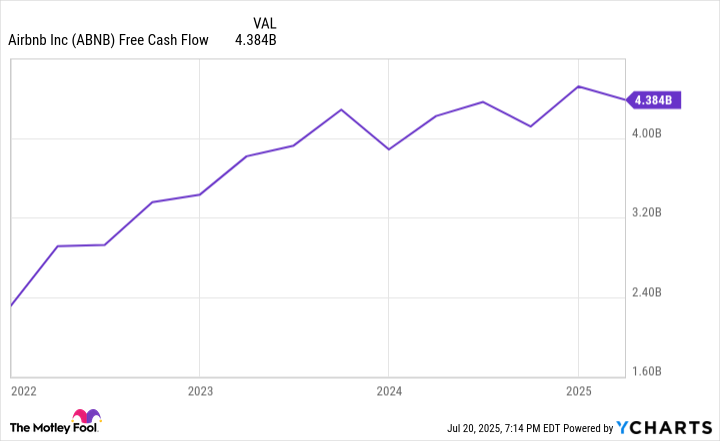

For instance, Intel (NASDAQ: INTC), a semiconductor designer and manufacturer, spent $5.2 billion on capex in its most recent quarter, a whopping 40% of its revenue. Airbnb spent just $14 million last quarter on capex, less than 1% of its revenue. Meanwhile, its free cash flow -- the amount that's left over after operating expenses and capital expenditures -- has soared.

ABNB Free Cash Flow data by YCharts.

The $4.4 billion shown above is 40% of revenue over the same period. A 40% free cash flow margin is an incredible figure and bodes well for shareholders.

Airbnb uses its cash to fund growth initiatives and reward shareholders through stock buybacks, which reduce the number of shares available, thereby increasing the value of each remaining share. Think of a company like a giant pizza, and every share is a slice. If the number of slices decreases, each of the remaining slices represents a larger portion of the pizza. Airbnb has repurchased $3.5 billion worth of its stock over the last 12 months, accounting for approximately 4% of its total market capitalization. It's likely to continue in this pattern for a long time, given its fantastic cash-producing business model.

Is Airbnb a buy?

Since free cash flow is what attracts me to Airbnb, the price-to-free-cash-flow ratio is my preferred metric for valuing the company. Airbnb currently trades for around 20 times free cash flow. This is well under its 2024 high of 29, and slightly below its 3-year average of 22. It is also lower than rival Booking Holdings, which trades for 23 times its own excellent free cash flow. In short, Airbnb is a better value based on cold, hard cash.

Booking Holdings is also a fantastic company and is worth having in a portfolio. However, its market cap is more than twice that of Airbnb's, which means that Airbnb could have an easier time growing faster from here. At this valuation, it is an excellent buy-and-hold stock.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10