Avidity Biosciences (RNA) Is Up 6.0% After FDA Breakthrough and Phase 3 Trial Milestones - Has The Bull Case Changed?

- Last week, Avidity Biosciences announced that the FDA granted Breakthrough Therapy designation to its drug candidate delpacibart zotadirsen for Duchenne muscular dystrophy, while also completing enrollment in its global Phase 3 HARBOR trial for myotonic dystrophy type 1.

- These milestones mark significant steps forward for Avidity’s pipeline, as there are currently no approved therapies for these serious neuromuscular diseases.

- We'll explore how these regulatory advances enhance Avidity's investment narrative, especially as delpacibart zotadirsen targets a critical unmet medical need.

AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Avidity Biosciences' Investment Narrative?

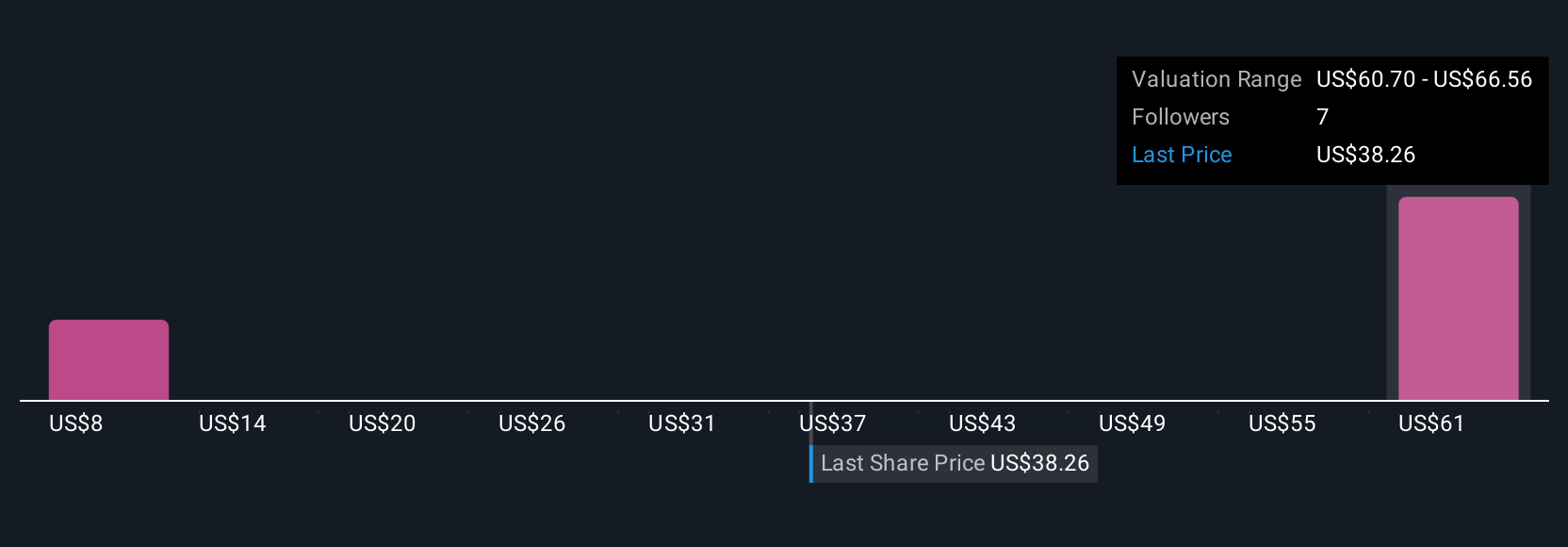

To believe in Avidity Biosciences as a shareholder is to see the company as a frontrunner in developing treatments for rare neuromuscular diseases with no approved therapies. The recent Breakthrough Therapy designation for delpacibart zotadirsen (DMD44) and the completion of enrollment in the HARBOR study for del-desiran (DM1) heighten the company's near-term visibility and reinforce the potential for regulatory catalysts. These drug candidates are the anchors of Avidity’s pipeline, and positive regulatory news typically boosts confidence ahead of key data releases. However, the business remains deeply unprofitable, requiring ongoing access to capital, and is trading above some estimates of fair value. While recent achievements are meaningful, the biggest risk continues to be whether late-stage trials will succeed and lead to product approvals, which remains to be seen given upcoming data timelines. In contrast, the uncertainty around clinical outcomes adds a layer of risk investors should weigh carefully.

Avidity Biosciences' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on Avidity Biosciences - why the stock might be worth less than half the current price!

Build Your Own Avidity Biosciences Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Avidity Biosciences research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Avidity Biosciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Avidity Biosciences' overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 25 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10