The Bull Case For Praxis Precision Medicines (PRAX) Could Change Following FDA Breakthrough Status for Relutrigine in Rare Epilepsies

- Praxis Precision Medicines recently announced that the FDA granted Breakthrough Therapy Designation (BTD) for relutrigine in pediatric patients with SCN2A and SCN8A developmental and epileptic encephalopathies (DEEs), based on strong Phase 2 study results showing substantial seizure reduction.

- This recognition underscores relutrigine’s potential to address significant unmet needs in a population with limited effective treatment options and a history of challenging disease management.

- We’ll explore how regulatory momentum with relutrigine may influence Praxis’s investment narrative and future growth opportunities in rare epilepsies.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Praxis Precision Medicines' Investment Narrative?

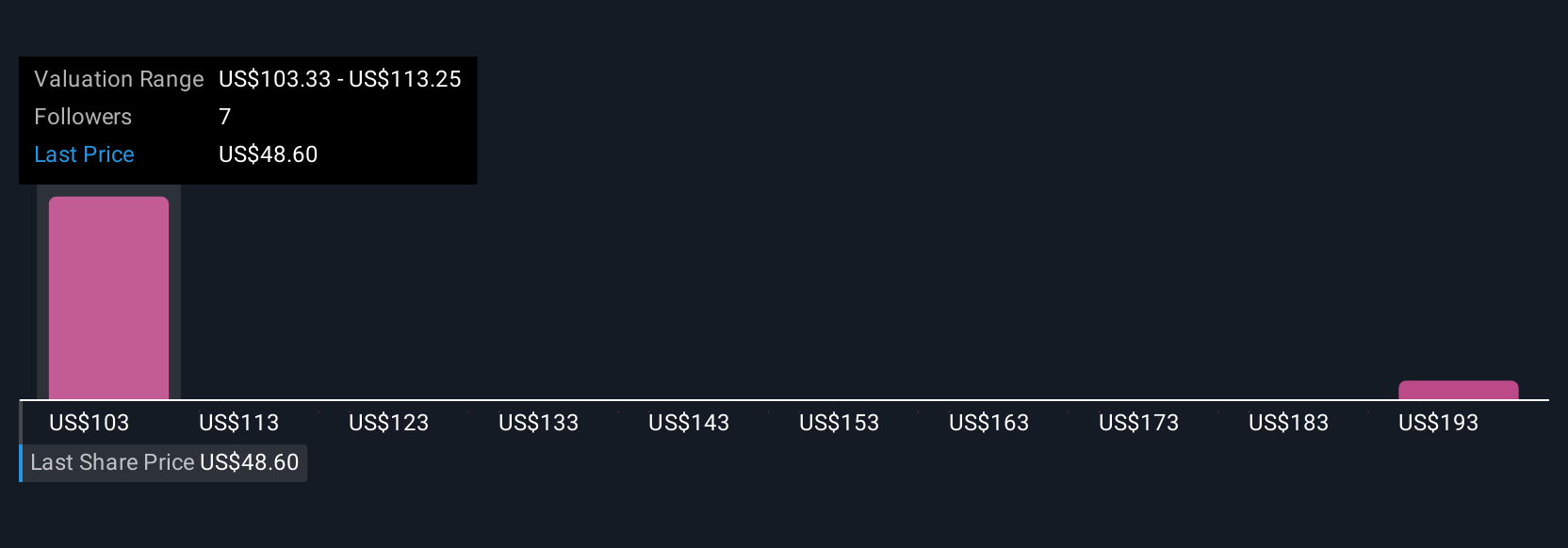

For investors considering Praxis Precision Medicines, the investment case hinges on belief in the company's ability to bring innovative treatments for pediatric epilepsies to patients with urgent needs. The recent FDA Breakthrough Therapy Designation for relutrigine marks a significant regulatory milestone, providing tangible momentum for Praxis’s pipeline and potentially accelerating development timelines. This news positions relutrigine as a front-runner among the company’s near-term catalysts and may alter investors’ views on the timing and probability of eventual approval, though commercial prospects are still several steps away. While regulatory progress is encouraging, Praxis remains unprofitable, faces ongoing high R&D expenses, and has diluted shareholders in the past year. As the excitement around BTD fuels short-term optimism, the most pressing risks remain around financial sustainability and execution of later-stage studies.

But risks like ongoing cash burn are important for investors to keep in mind. Praxis Precision Medicines' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on Praxis Precision Medicines - why the stock might be worth over 4x more than the current price!

Build Your Own Praxis Precision Medicines Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Praxis Precision Medicines research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Praxis Precision Medicines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Praxis Precision Medicines' overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10