生意社07月30日讯

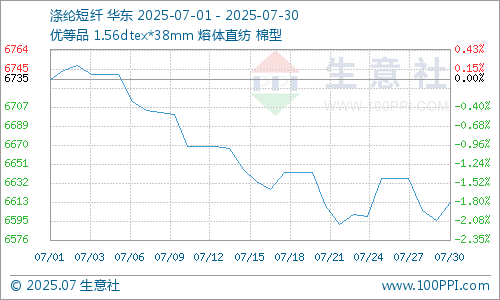

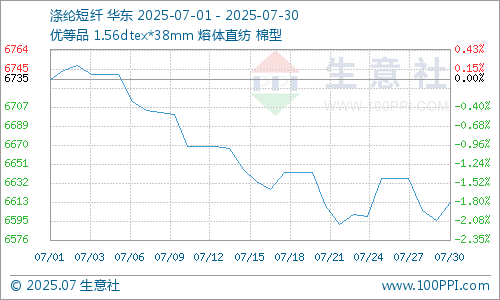

据生意社商品行情分析系统,7月份国内涤纶短纤价格小幅震荡下行,截止7月30日国内涤纶短纤(1.4D*38mm)市场均价在6613元/吨,较月初下跌1.81%。

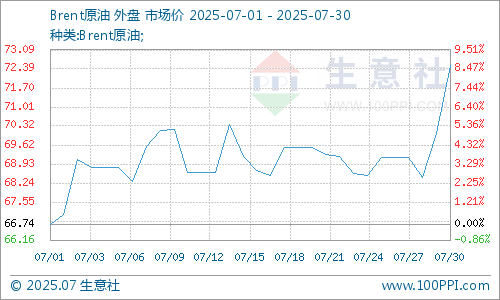

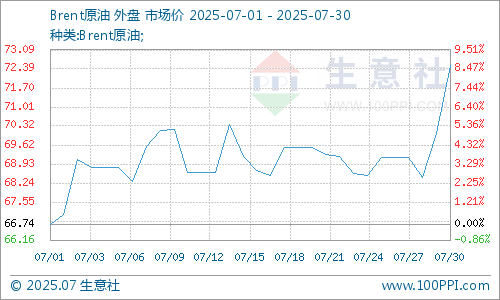

近期多空因素共同影响,美国传统燃油消费旺季仍在,供应端风险并未消除,国际油价短期内维持震荡为主。截止7月29日,美国WTI原油期货9月合约结算价报69.21美元/桶,布伦特原油期货9月合约结算价报72.51美元/桶。

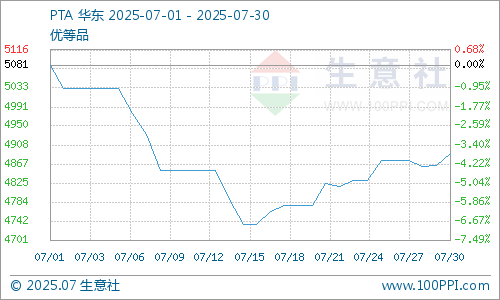

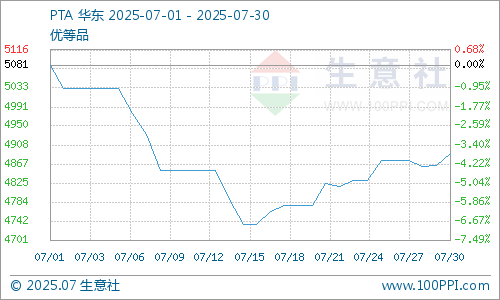

7月国内PTA现货市场行情呈现V型走势,截止7月30日华东地区PTA市场均价在4889元/吨,较月初下跌3.79%。上半月原油震荡成本支撑有限,PTA产业扩能预期叠加聚酯减产预期,供需双弱之下,PTA呈现偏弱格局。但随着宏观情绪回暖,商品走势坚挺,受此影响PTA市场弱势反弹。

高温天气、传统淡季等多重因素影响需求改善乏力,下游纱线工厂订单不足,亏损开始扩大,采购积极性受阻,维持刚需采购。月末宏观情绪回暖气氛之下,刺激买盘情绪,需求小幅增加。

生意社分析师认为,宏观情绪回暖成本弱势反弹,终端低位有所补库,涤纶短纤工厂库存压力有所缓解。但后续供需预期仍偏弱,上行驱动有限,预计8月份涤纶短纤价格仍以跟随成本端及需求波动为主。

(文章来源:生意社)

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.