Why Investors Shouldn't Be Surprised By Repligen Corporation's (NASDAQ:RGEN) P/S

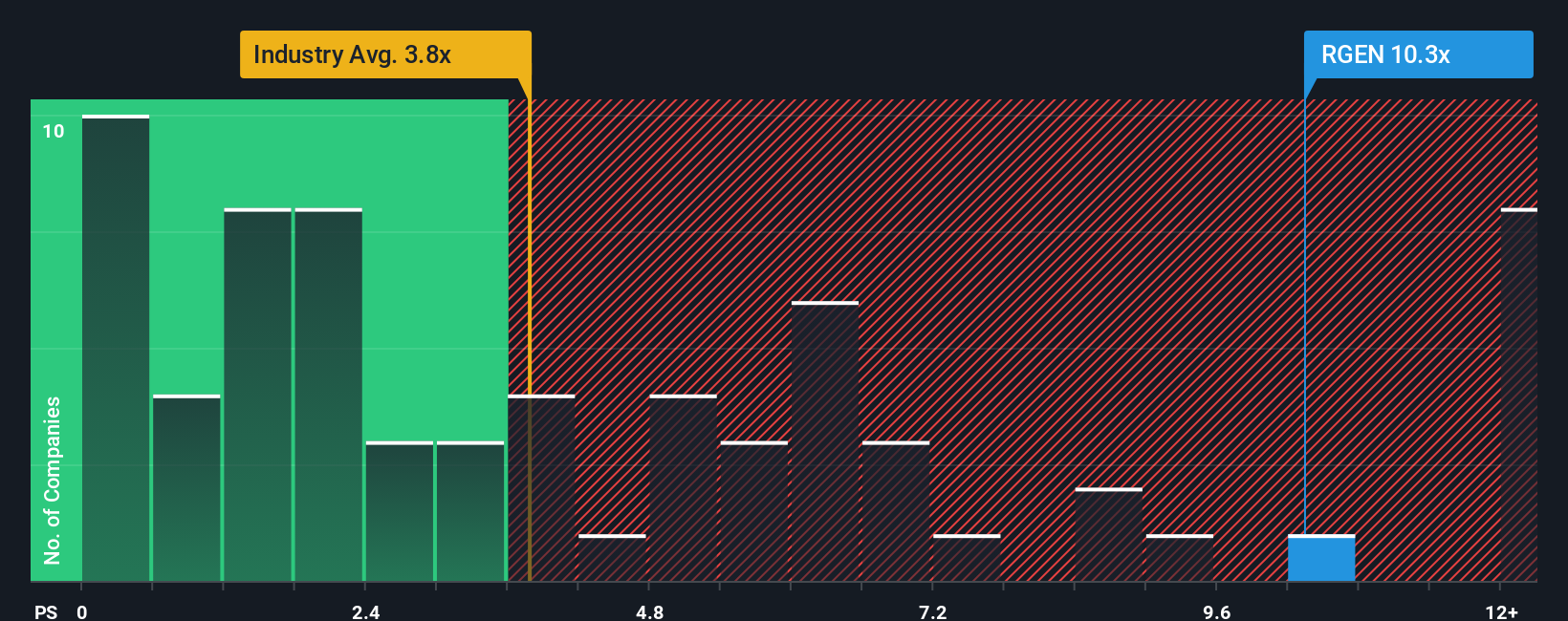

When you see that almost half of the companies in the Life Sciences industry in the United States have price-to-sales ratios (or "P/S") below 3.8x, Repligen Corporation (NASDAQ:RGEN) looks to be giving off strong sell signals with its 10.3x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

See our latest analysis for Repligen

What Does Repligen's P/S Mean For Shareholders?

Repligen's revenue growth of late has been pretty similar to most other companies. It might be that many expect the mediocre revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Repligen.How Is Repligen's Revenue Growth Trending?

In order to justify its P/S ratio, Repligen would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a decent 4.9% gain to the company's revenues. Still, lamentably revenue has fallen 11% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 15% per year during the coming three years according to the analysts following the company. With the industry only predicted to deliver 7.3% per annum, the company is positioned for a stronger revenue result.

With this information, we can see why Repligen is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Repligen's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 1 warning sign for Repligen that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10