Lower Dividend from Black Stone Minerals (BSM) Might Change the Case for Income-Focused Investors

- Black Stone Minerals, L.P. recently announced that its board of directors approved a reduced cash distribution of US$0.30 per common unit for the second quarter of 2025, with payment scheduled for August 14 to unitholders of record as of August 7.

- This lower dividend payout can reflect shifts in cash flow priorities or outlook, and often prompts investors to reevaluate income expectations from the company.

- We'll consider how this decrease in cash distribution factors into Black Stone Minerals’ investment narrative and future income outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Black Stone Minerals Investment Narrative Recap

To own Black Stone Minerals, investors need to believe in the company’s ability to grow oil and gas production and improve revenue through strategic development and acquisitions, despite commodity price swings. The recent reduction in the quarterly cash distribution to US$0.30 per unit does not appear to materially shift the near-term catalyst of project execution in core acreage, but it does draw attention to ongoing risks around lower production volumes and softer natural gas pricing. The most important short-term catalyst, a rebound in production and improving realized prices, remains at the forefront, while downside risk is heightened if cost pressures or pricing headwinds continue.

A closely related recent announcement is the May 2025 partnership with Revenant Energy to accelerate development in the Shelby Trough Haynesville and Bossier acreage. This initiative aligns directly with efforts to rejuvenate production and address the lull in recent output, which is crucial as investors assess the sustainability of distributions and future income potential in the face of fluctuating revenues.

However, investors should be aware that falling production volumes continue to present a material risk if...

Read the full narrative on Black Stone Minerals (it's free!)

Black Stone Minerals' outlook forecasts $592.3 million in revenue and $375.6 million in earnings by 2028. This implies annual revenue growth of 12.0% and an increase in earnings of $181.7 million from the current $193.9 million.

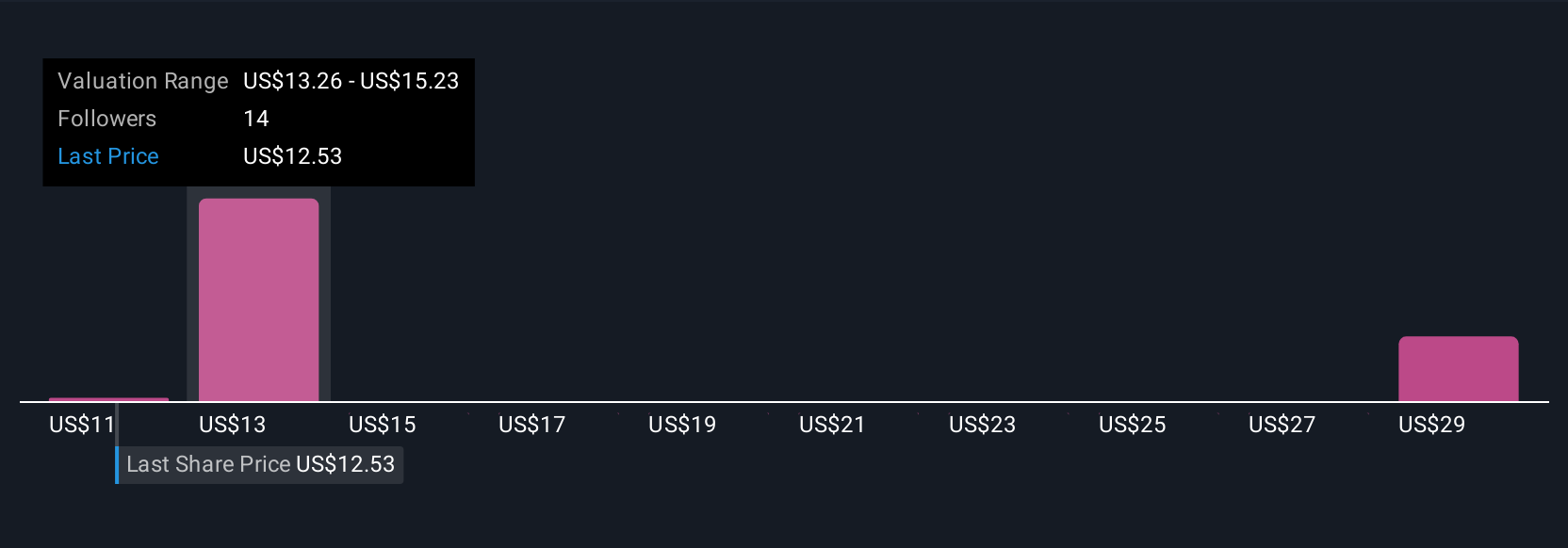

Uncover how Black Stone Minerals' forecasts yield a $14.00 fair value, a 11% upside to its current price.

Exploring Other Perspectives

With four fair value estimates from the Simply Wall St Community ranging between US$11.29 and US$30.98, opinions about Black Stone Minerals’ upside are widely split. Some see meaningful value despite the recent distribution cut while others are cautious due to production and price risks, so it pays to see how different investors approach these challenges.

Explore 4 other fair value estimates on Black Stone Minerals - why the stock might be worth over 2x more than the current price!

Build Your Own Black Stone Minerals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Black Stone Minerals research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Black Stone Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Black Stone Minerals' overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Black Stone Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10