Will Automotive Inventory Easing and Strong Q3 Guidance Shift NXP Semiconductors' (NXPI) Trajectory?

- NXP Semiconductors recently reported second quarter 2025 results, with sales of US$2.93 billion and net income of US$445 million, while providing third quarter guidance above analyst expectations as inventory pressures in automotive markets began to ease.

- A noteworthy development is management’s observation that inventory normalization at key automotive customers is now underway, and recovery signals are emerging in both industrial and IoT markets.

- As easing automotive inventory pressures mark a turning point, we'll explore how this may shift NXP Semiconductors' investment outlook.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 25 companies in the world exploring or producing it. Find the list for free.

NXP Semiconductors Investment Narrative Recap

At its core, being a shareholder in NXP Semiconductors means believing in a cyclical upswing in automotive semiconductors, driven by normalization of Tier 1 inventory and growing demand for vehicle electrification and automation. The recent Q2 report confirms signs that Western automotive destocking is ending, which is material to the short-term outlook, while ongoing risks around competitive pricing in China and macroeconomic headwinds remain significant for revenue visibility and margins.

Among the company's recent announcements, NXP's above-consensus Q3 guidance stands out. This aligns directly with easing inventory headwinds and hints at a return to more predictable shipments and financial performance in automotive and expanding industrial and IoT demand, factors that shape near-term market confidence.

By contrast, investors should be aware that even as inventory pressures ease in Western regions, increased market competition and pricing pressure in China could still...

Read the full narrative on NXP Semiconductors (it's free!)

NXP Semiconductors' outlook anticipates $15.6 billion in revenue and $3.5 billion in earnings by 2028. This is based on an expected 8.7% annual revenue growth rate and a $1.4 billion increase in earnings from the current $2.1 billion.

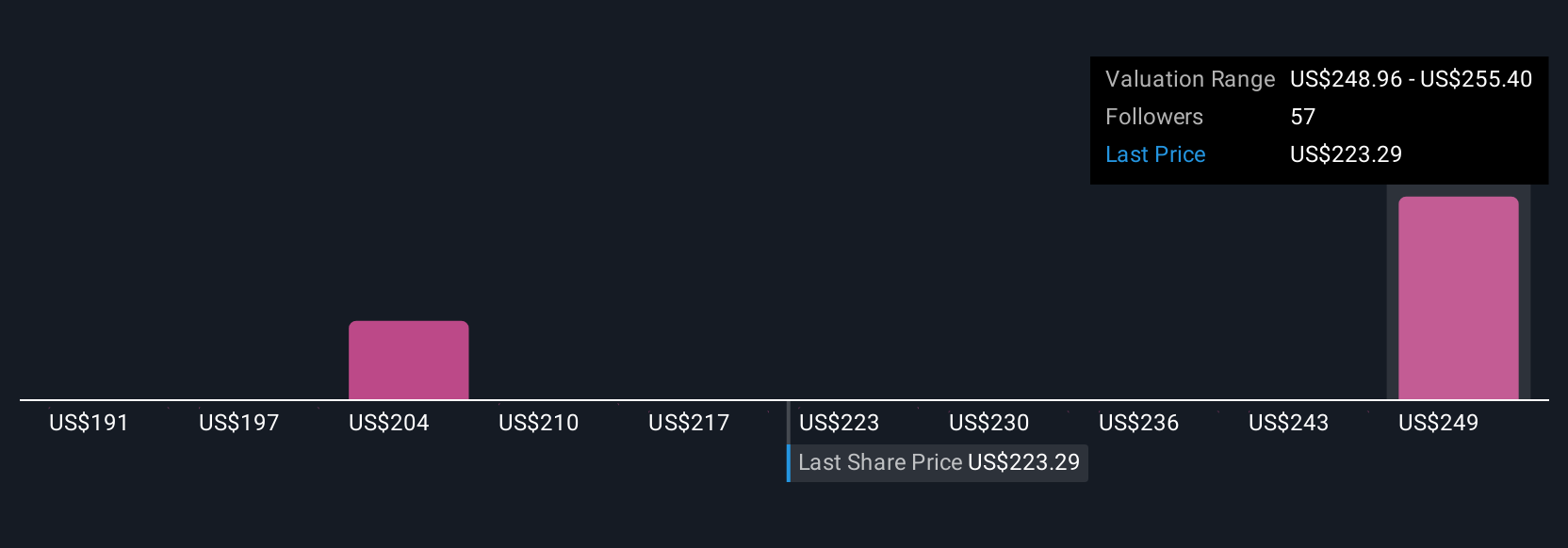

Uncover how NXP Semiconductors' forecasts yield a $255.40 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided eight fair value estimates for NXP Semiconductors, ranging from US$191 to US$255. Some highlight ongoing competitive threats in China as a critical factor for future returns and encourage readers to consider several contrasting viewpoints before forming their own outlook.

Explore 8 other fair value estimates on NXP Semiconductors - why the stock might be worth as much as 12% more than the current price!

Build Your Own NXP Semiconductors Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NXP Semiconductors research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NXP Semiconductors research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NXP Semiconductors' overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NXP Semiconductors might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10