Global's Top Penny Stocks To Watch In July 2025

Global markets have been buoyed by favorable trade deal news, pushing major indices like the S&P 500 and Nasdaq Composite to record highs. Amid this backdrop of optimism, investors are turning their attention to smaller companies that may offer unique opportunities for growth. Although the term "penny stocks" might seem outdated, these often represent newer or less-established companies that can provide value when backed by strong financials and a clear growth path.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.20 | A$100.95M | ✅ 4 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.48 | HK$921.19M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.485 | SGD196.57M | ✅ 4 ⚠️ 1 View Analysis > |

| MGB Berhad (KLSE:MGB) | MYR0.515 | MYR304.7M | ✅ 5 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.54 | SGD10B | ✅ 5 ⚠️ 0 View Analysis > |

| Libertas 7 (BME:LIB) | €2.30 | €49.01M | ✅ 4 ⚠️ 4 View Analysis > |

| Zetrix AI Berhad (KLSE:ZETRIX) | MYR0.91 | MYR7B | ✅ 5 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.22 | £194.14M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.97 | €32.71M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 3,832 stocks from our Global Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Vibrant Group (SGX:BIP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vibrant Group Limited is an investment holding company involved in integrated logistics, real estate, and financial services globally, with a market cap of SGD105.39 million.

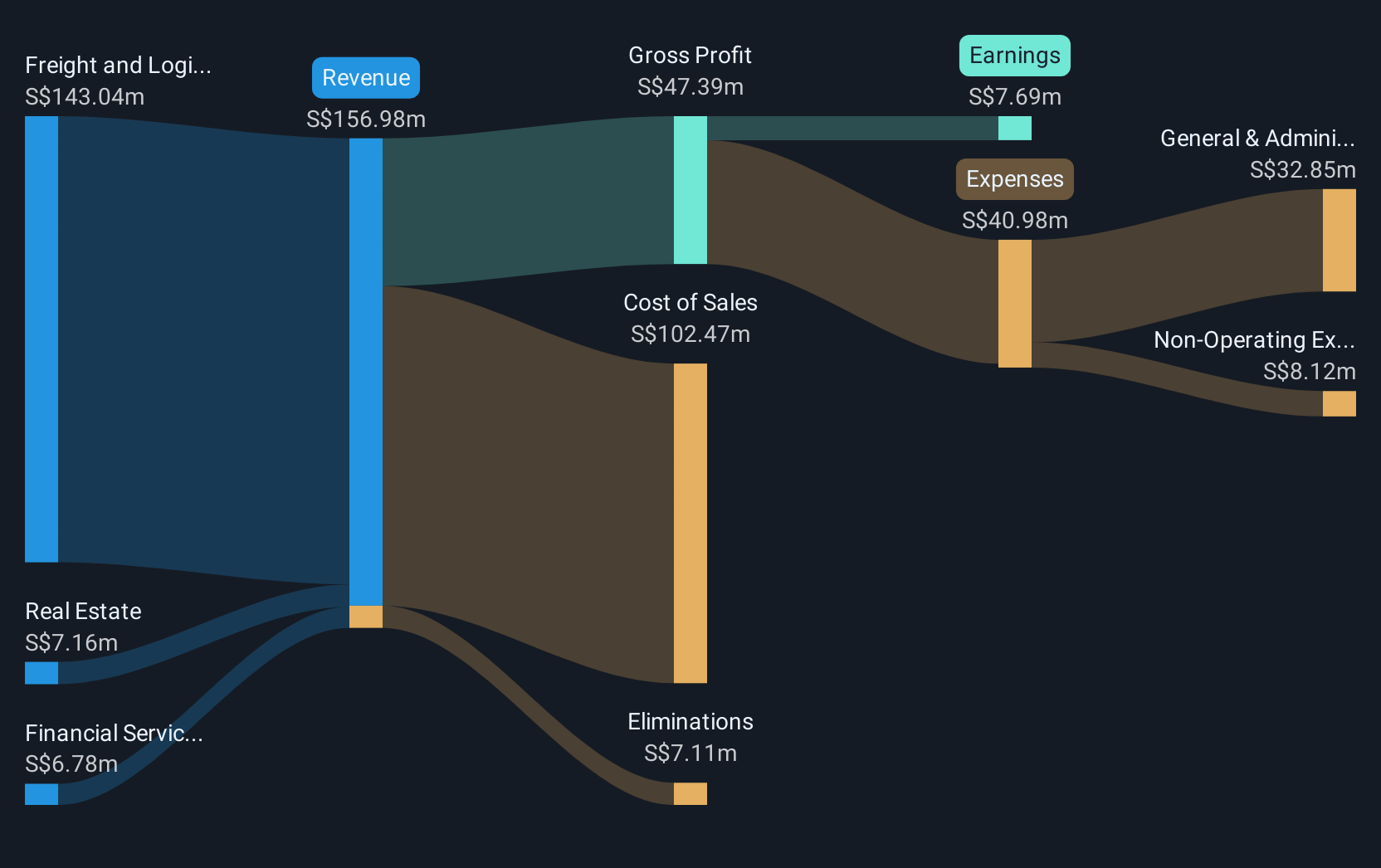

Operations: The company's revenue is primarily derived from its Freight and Logistics segment at SGD143.04 million, followed by Financial Services at SGD6.78 million and Real Estate at SGD7.16 million.

Market Cap: SGD105.39M

Vibrant Group Limited, with a market cap of SGD105.39 million, has demonstrated significant growth in its earnings, increasing by 1182% over the past year and surpassing industry averages. The company's revenue is primarily driven by its Freight and Logistics segment. Despite a highly volatile share price recently, Vibrant's financial health appears solid with reduced debt levels and satisfactory coverage of both short- and long-term liabilities by assets. However, the return on equity remains low at 4.7%. Recent announcements include improved earnings results and an increased dividend to $0.004 per share for the financial year ended April 2025.

- Click here and access our complete financial health analysis report to understand the dynamics of Vibrant Group.

- Gain insights into Vibrant Group's historical outcomes by reviewing our past performance report.

Zhongzhu Healthcare HoldingLtd (SHSE:600568)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhongzhu Healthcare Holding Co., Ltd is involved in the research, development, production, and sale of drugs in China with a market capitalization of CN¥3.19 billion.

Operations: The company generates revenue primarily from its operations in China, amounting to CN¥532.84 million.

Market Cap: CN¥3.19B

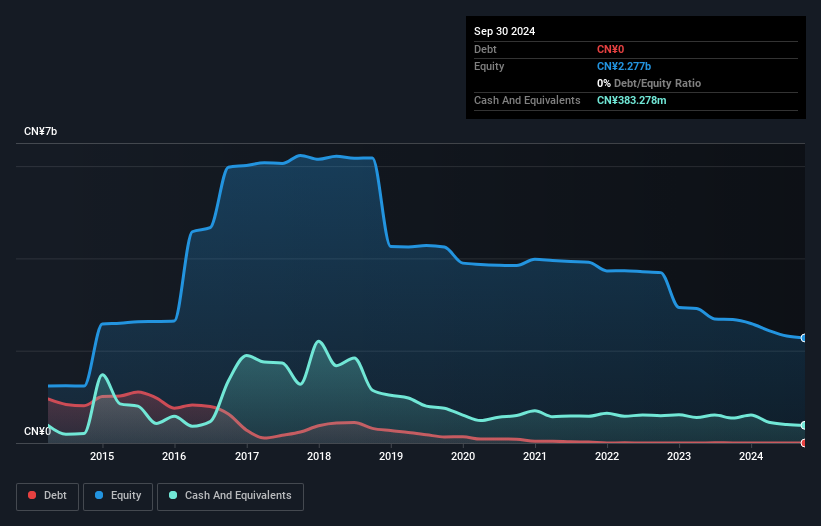

Zhongzhu Healthcare Holding Co., Ltd, with a market cap of CN¥3.19 billion, reported first-quarter 2025 revenue of CN¥141.46 million, up from CN¥130 million the previous year, yet remains unprofitable with a net loss reduction to CN¥17.78 million from CNY 22.89 million. The company benefits from strong financial health, as its short-term assets (CN¥1.2 billion) exceed both short- and long-term liabilities significantly and it operates debt-free after eliminating past debt levels. While earnings have declined over the last five years by 21.6% annually, Zhongzhu maintains a sufficient cash runway exceeding three years due to positive free cash flow growth.

- Jump into the full analysis health report here for a deeper understanding of Zhongzhu Healthcare HoldingLtd.

- Evaluate Zhongzhu Healthcare HoldingLtd's historical performance by accessing our past performance report.

Guangdong DFP New Material Group (SHSE:601515)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Guangdong DFP New Material Group Co., Ltd. operates in the new materials industry and has a market cap of CN¥7.27 billion.

Operations: No specific revenue segments are reported for this company.

Market Cap: CN¥7.27B

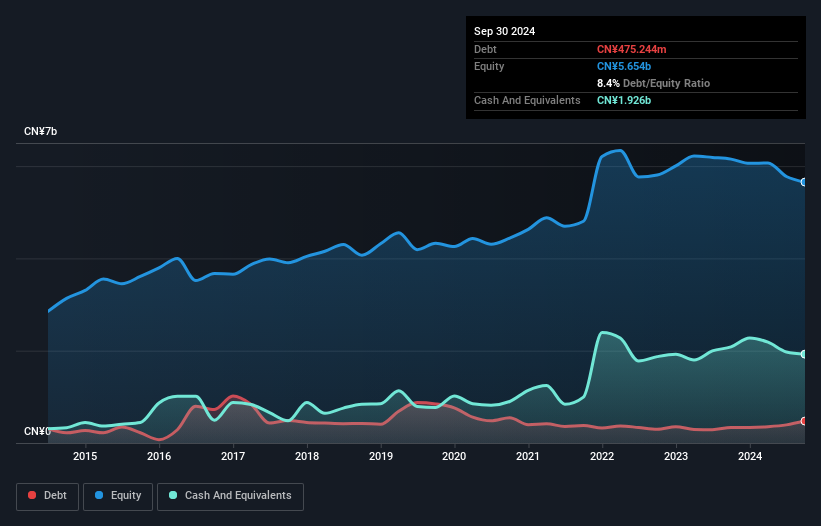

Guangdong DFP New Material Group, with a market cap of CN¥7.27 billion, faces challenges as it remains unprofitable and has seen losses increase by 45% annually over the past five years. Despite this, the company is trading at a significant discount to its estimated fair value and maintains strong financial health with short-term assets of CN¥3.3 billion covering both short- and long-term liabilities. Recent strategic moves include a 29.90% stake acquisition by Quzhou entities for CNY 1.9 billion, potentially indicating investor confidence in its future prospects despite current financial setbacks.

- Take a closer look at Guangdong DFP New Material Group's potential here in our financial health report.

- Explore Guangdong DFP New Material Group's analyst forecasts in our growth report.

Turning Ideas Into Actions

- Access the full spectrum of 3,832 Global Penny Stocks by clicking on this link.

- Ready For A Different Approach? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10