HubSpot (HUBS) Launches First CRM Connector For Claude To Enhance Team Productivity

HubSpot (HUBS) made headlines with the launch of its new CRM connector for Claude, enabling functionalities like plain language queries and data visualizations that enhance user productivity and decision-making. This product announcement aligns with the broader market dynamics, as the market rose 1.5% over the same period supported by investor optimism around strong corporate earnings and economic data. With HubSpot's share price increasing 2% last week, this move slightly outpaced the market's performance, indicating that the innovation did not significantly deviate from general market trends and likely aligned with broader tech sector optimism.

Buy, Hold or Sell HubSpot? View our complete analysis and fair value estimate and you decide.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 25 companies in the world exploring or producing it. Find the list for free.

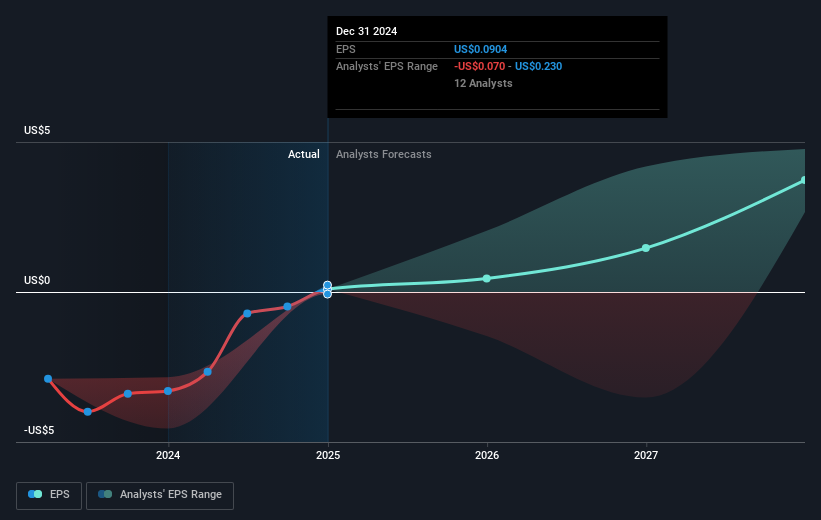

The recent product enhancement by HubSpot integrating AI capabilities with its CRM platform highlights its ongoing commitment to drive innovation. This move aligns with the company's narrative of leveraging AI for improved customer insights and operational efficiency. Analysts expect such advancements to potentially bolster revenue and earnings forecasts over the coming years, despite reported earnings of US$23.10 million loss. The share price increase following the announcement suggests investor confidence in these initiatives, albeit moderate when viewed against a market rise of 1.5% over the same period.

Over the past five years, HubSpot's total shareholder return, including both share price changes and dividends, has been substantial at 132.91%. However, over the past year, the company's shareholders saw a performance lag compared to both the US Software industry, which returned 29.7%, and the broader US Market's return of 17.7%. Currently, at US$559.23, the share price remains significantly below the consensus analyst target of US$736.74, indicating potential room for growth based on future prospects. The company's ongoing AI integration and upmarket expansion strategies will be crucial in closing this valuation gap.

Explore historical data to track HubSpot's performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HubSpot might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10