We Ran A Stock Scan For Earnings Growth And MercadoLibre (NASDAQ:MELI) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like MercadoLibre (NASDAQ:MELI). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Trump has pledged to "unleash" American oil and gas and these 15 US stocks have developments that are poised to benefit.

How Fast Is MercadoLibre Growing Its Earnings Per Share?

MercadoLibre has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. Thus, it makes sense to focus on more recent growth rates, instead. Impressively, MercadoLibre's EPS catapulted from US$22.43 to US$40.65, over the last year. It's not often a company can achieve year-on-year growth of 81%. The best case scenario? That the business has hit a true inflection point.

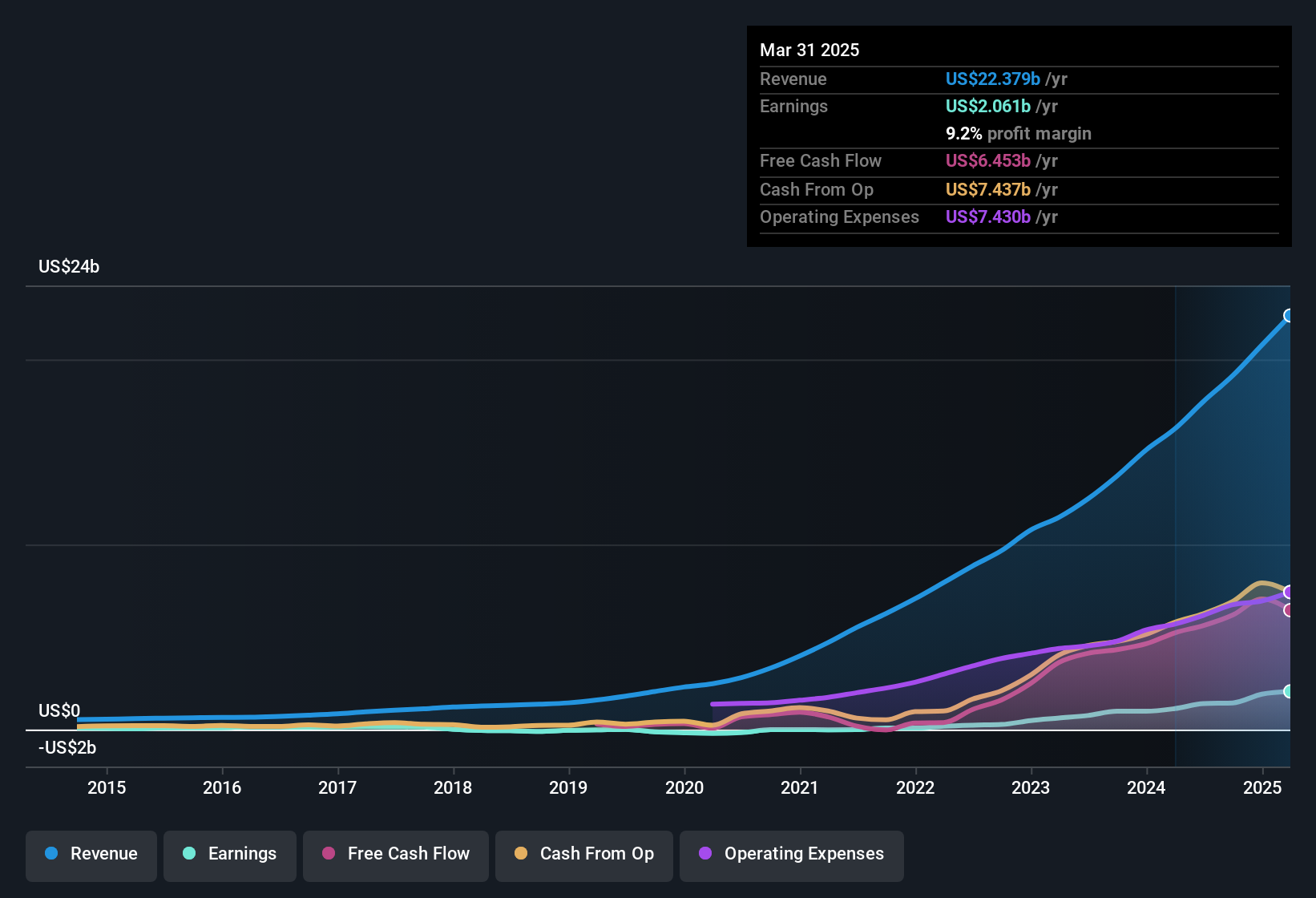

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note MercadoLibre achieved similar EBIT margins to last year, revenue grew by a solid 38% to US$22b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Check out our latest analysis for MercadoLibre

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for MercadoLibre's future profits.

Are MercadoLibre Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a US$120b company like MercadoLibre. But we are reassured by the fact they have invested in the company. Notably, they have an enviable stake in the company, worth US$344m. While that is a lot of skin in the game, we note this holding only totals to 0.3% of the business, which is a result of the company being so large. So despite their percentage holding being low, company management still have plenty of reasons to deliver the best outcomes for investors.

Is MercadoLibre Worth Keeping An Eye On?

MercadoLibre's earnings per share have been soaring, with growth rates sky high. This level of EPS growth does wonders for attracting investment, and the large insider investment in the company is just the cherry on top. At times fast EPS growth is a sign the business has reached an inflection point, so there's a potential opportunity to be had here. So at the surface level, MercadoLibre is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. Of course, profit growth is one thing but it's even better if MercadoLibre is receiving high returns on equity, since that should imply it can keep growing without much need for capital. Click on this link to see how it is faring against the average in its industry.

Although MercadoLibre certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10