Exploring High Growth Tech Stocks In The US Market

As the U.S. stock market continues to reach new heights, with the S&P 500 and Nasdaq hitting record levels amid easing trade tensions and strong corporate earnings, investors are closely monitoring developments in the tech sector, particularly as major companies prepare to release their quarterly results. In this dynamic environment, identifying high-growth tech stocks involves examining those with robust innovation capabilities and adaptability to evolving market trends, which can potentially offer significant opportunities for growth within the ever-changing landscape of technology investments.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 25.17% | 38.20% | ★★★★★★ |

| Circle Internet Group | 30.81% | 60.66% | ★★★★★★ |

| Ardelyx | 20.96% | 62.26% | ★★★★★★ |

| TG Therapeutics | 26.14% | 39.04% | ★★★★★★ |

| AVITA Medical | 27.39% | 61.05% | ★★★★★★ |

| Alkami Technology | 20.57% | 76.67% | ★★★★★★ |

| Alnylam Pharmaceuticals | 24.07% | 59.30% | ★★★★★★ |

| Ascendis Pharma | 34.90% | 59.91% | ★★★★★★ |

| Caris Life Sciences | 24.80% | 72.64% | ★★★★★★ |

| Lumentum Holdings | 21.59% | 106.24% | ★★★★★★ |

Click here to see the full list of 220 stocks from our US High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Verra Mobility (VRRM)

Simply Wall St Growth Rating: ★★★★☆☆

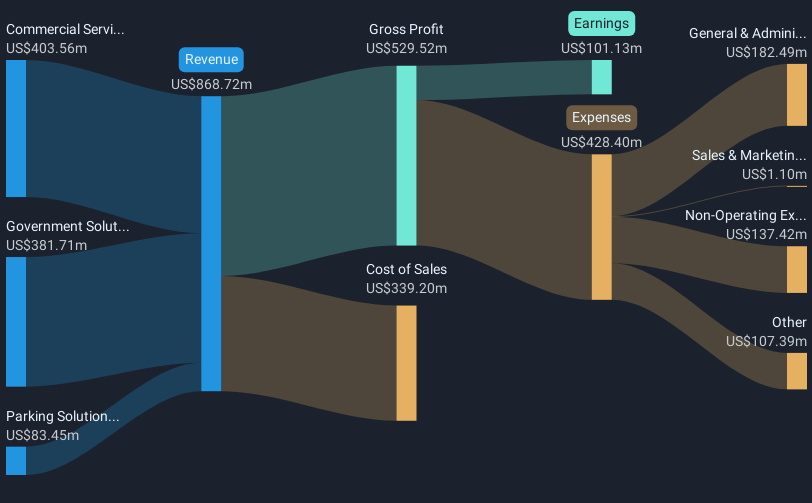

Overview: Verra Mobility Corporation offers smart mobility technology solutions across the United States, Australia, Europe, and Canada with a market cap of approximately $3.98 billion.

Operations: The company generates revenue through three primary segments: Parking Solutions ($81.01 million), Commercial Services ($413.18 million), and Government Solutions ($398.54 million).

Verra Mobility, amidst a challenging market backdrop with a recent drop from the Russell 2000 Dynamic Index, is navigating through significant shifts. The appointment of Stacey Moser as Executive Vice President and General Manager of the Commercial Services business unit could inject fresh strategic insights, given her extensive background in global commercial roles and product management. Financially, Verra's first quarter results showed a revenue increase to $223.25 million from $209.73 million year-over-year, with net income also rising to $32.34 million from $29.15 million. Despite these gains, the company's overall annual revenue growth forecast at 6.8% lags behind the U.S market projection of 9%. However, its earnings are expected to surge by 46.8% annually, outpacing general market predictions significantly.

- Get an in-depth perspective on Verra Mobility's performance by reading our health report here.

Assess Verra Mobility's past performance with our detailed historical performance reports.

Arcutis Biotherapeutics (ARQT)

Simply Wall St Growth Rating: ★★★★★☆

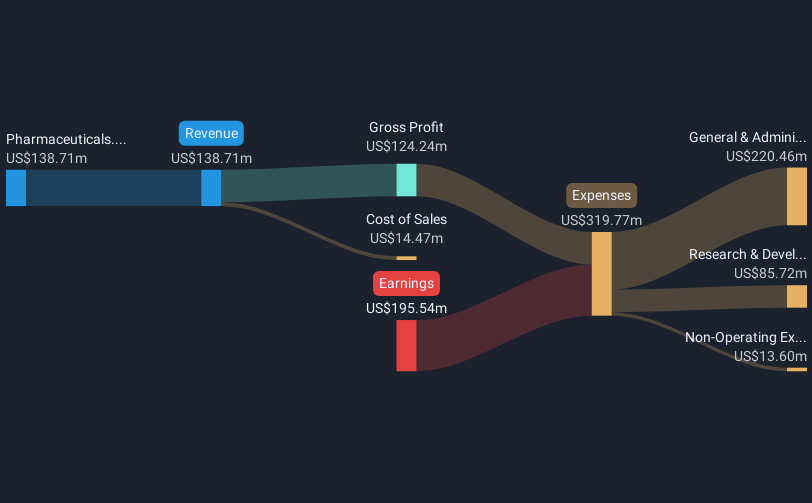

Overview: Arcutis Biotherapeutics, Inc. is a biopharmaceutical company dedicated to the development and commercialization of treatments for dermatological diseases, with a market cap of approximately $1.77 billion.

Operations: Arcutis Biotherapeutics generates its revenue primarily from the development and commercialization of treatments for dermatological diseases, amounting to $212.82 million. The company's focus on this niche market segment is reflected in its business operations and financial performance.

Arcutis Biotherapeutics, with its recent FDA approval for ZORYVE® topical foam 0.3%, is making strides in the treatment of plaque psoriasis, a condition affecting nearly 9 million Americans. This approval underscores the company's commitment to addressing unmet medical needs through innovative dermatological solutions. Furthermore, Arcutis has demonstrated robust revenue growth at an annual rate of 26.7%, outpacing the broader U.S market's growth forecast of 9%. The company’s R&D efforts are substantial, as evidenced by their ongoing clinical trials and product development initiatives aimed at expanding treatment options across various age groups and severities of dermatological conditions. These strategic moves could significantly influence future revenue streams and market positioning in specialized healthcare sectors.

- Navigate through the intricacies of Arcutis Biotherapeutics with our comprehensive health report here.

Explore historical data to track Arcutis Biotherapeutics' performance over time in our Past section.

Lumentum Holdings (LITE)

Simply Wall St Growth Rating: ★★★★★★

Overview: Lumentum Holdings Inc. is a company that manufactures and sells optical and photonic products across various regions including the Americas, Asia-Pacific, Europe, the Middle East, and Africa with a market capitalization of $7.25 billion.

Operations: Lumentum Holdings generates revenue primarily from its Industrial Tech and Cloud & Networking segments, with the latter contributing $1.24 billion. The company's market capitalization is approximately $7.25 billion.

Lumentum Holdings has been making significant strides in the high-growth tech sector, particularly with its recent inclusion in various Russell growth indices, signaling robust investor confidence. The company's focus on advanced laser technologies and 3D sensing solutions, as showcased at the Laser World of Photonics 2025, positions it well within industrial photonics and precision manufacturing—a sector poised for expansion. Despite current unprofitability, Lumentum's strategic R&D investments are set to foster innovation in consumer electronics and energy storage, with revenue expected to grow by 21.6% annually. Moreover, the company is projected to shift towards profitability with an anticipated earnings growth of 106.24% per year, underpinning its potential rebound in financial health.

- Unlock comprehensive insights into our analysis of Lumentum Holdings stock in this health report.

Gain insights into Lumentum Holdings' historical performance by reviewing our past performance report.

Make It Happen

- Reveal the 220 hidden gems among our US High Growth Tech and AI Stocks screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10