Should Battlefield 6 Reveal and Strong Capital Returns Prompt Action From Electronic Arts (EA) Investors?

- Electronic Arts Inc. recently reported its first quarter 2025 earnings, affirmed its fiscal year guidance, declared a quarterly dividend of US$0.19 per share, and completed a fresh tranche of share repurchases totaling 3 million shares for US$375 million.

- A standout development was the full reveal of Battlefield 6, with Electronic Arts highlighting it as the most ambitious entry in the franchise to date, expected to capture significant player and market attention.

- We'll explore how the major Battlefield 6 announcement and steady financial outlook influence Electronic Arts' broader investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Electronic Arts Investment Narrative Recap

To be a shareholder in Electronic Arts right now, you have to believe that the company can convert major franchise releases and live services into sustained revenue growth despite ongoing headwinds in key properties like Apex Legends. The recent earnings report confirms a steady financial outlook, but the Battlefield 6 launch remains the most important near-term catalyst, and the softness in legacy live service titles is still the biggest risk; the latest news does not materially shift these underlying dynamics.

Among the recent announcements, the unveiling of Battlefield 6 stands out as particularly relevant. The scale and ambition of this release are likely to shape player engagement and bookings, underscoring the company's reliance on blockbuster launches to offset pressures elsewhere in the portfolio and maintain momentum through ongoing portfolio shifts.

However, investors should also be aware that, despite headline-making new titles, ongoing challenges around underperforming live service revenue streams and player retention mean...

Read the full narrative on Electronic Arts (it's free!)

Electronic Arts' narrative projects $8.6 billion in revenue and $1.6 billion in earnings by 2028. This requires 4.7% yearly revenue growth and a $0.5 billion earnings increase from $1.1 billion.

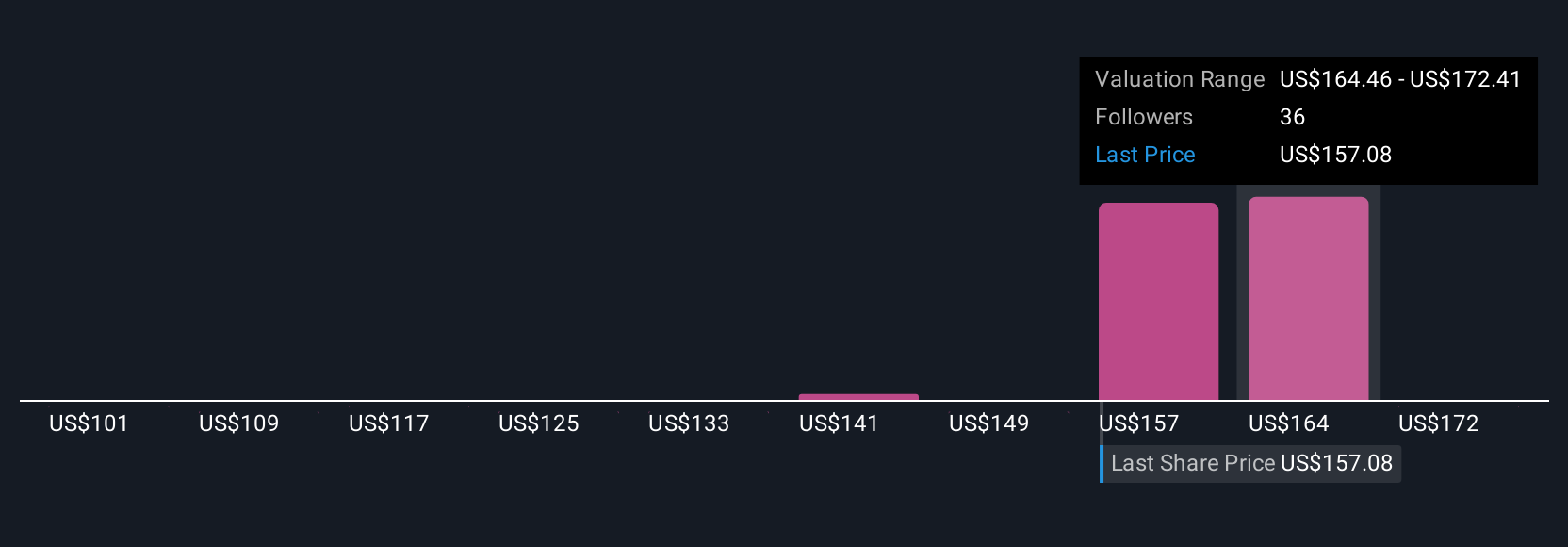

Uncover how Electronic Arts' forecasts yield a $169.60 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community estimate Electronic Arts’ fair value between US$100.87 and US$180.36 per share. While opinions vary, many continue to watch for evidence that new game launches can offset declines in older franchises and support overall growth. Explore more perspectives to see the full range of views.

Explore 7 other fair value estimates on Electronic Arts - why the stock might be worth as much as 15% more than the current price!

Build Your Own Electronic Arts Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Electronic Arts research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Electronic Arts research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Electronic Arts' overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Electronic Arts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10