Does Raytheon's MTS-A HD Launch Reinforce RTX's Edge in Global Defense Technology Leadership (RTX)?

- In July 2025, Raytheon, an RTX business, launched the MTS-A HD, a new multispectral targeting system offering advanced imaging and targeting capabilities for maritime helicopter missions, with rapid integration potential and strong international customer interest.

- The MTS-A HD rollout highlights RTX’s ongoing focus on next-generation defense innovation and collaborative industry partnerships to accelerate production and reduce costs.

- We'll examine how the launch of this advanced naval targeting system strengthens RTX's investment narrative centered on technology leadership and global defense demand.

Find companies with promising cash flow potential yet trading below their fair value.

RTX Investment Narrative Recap

To be a shareholder in RTX, you need conviction in the company's long-term ability to leverage defense tech leadership and global demand, while managing risks linked to government budgets, tariffs, and aerospace challenges. The launch of the MTS-A HD significantly supports the catalyst of international defense contract momentum, but does not eliminate core risks like government contract volatility or margin pressure from trade costs; the launch itself likely does not materially change the most immediate risk or short-term catalyst.

A recent $250 million contract for ESSM Block 2 missile production, announced in late June, stands out as especially relevant to RTX’s growth drivers in international naval defense, mirroring the global interest reported for the MTS-A HD. This alignment highlights how proprietary product rollouts and new contracts strengthen RTX’s backlog, which remains a key financial catalyst for visibility, while ongoing exposure to shifting defense budgets and programs remains a caution.

By contrast, investors should not overlook the potential impact of future defense budget shifts on...

Read the full narrative on RTX (it's free!)

RTX's outlook anticipates $97.8 billion in revenue and $9.0 billion in earnings by 2028. This relies on a 5.4% annual revenue growth rate and a $2.9 billion increase in earnings from the current $6.1 billion level.

Uncover how RTX's forecasts yield a $164.52 fair value, a 4% upside to its current price.

Exploring Other Perspectives

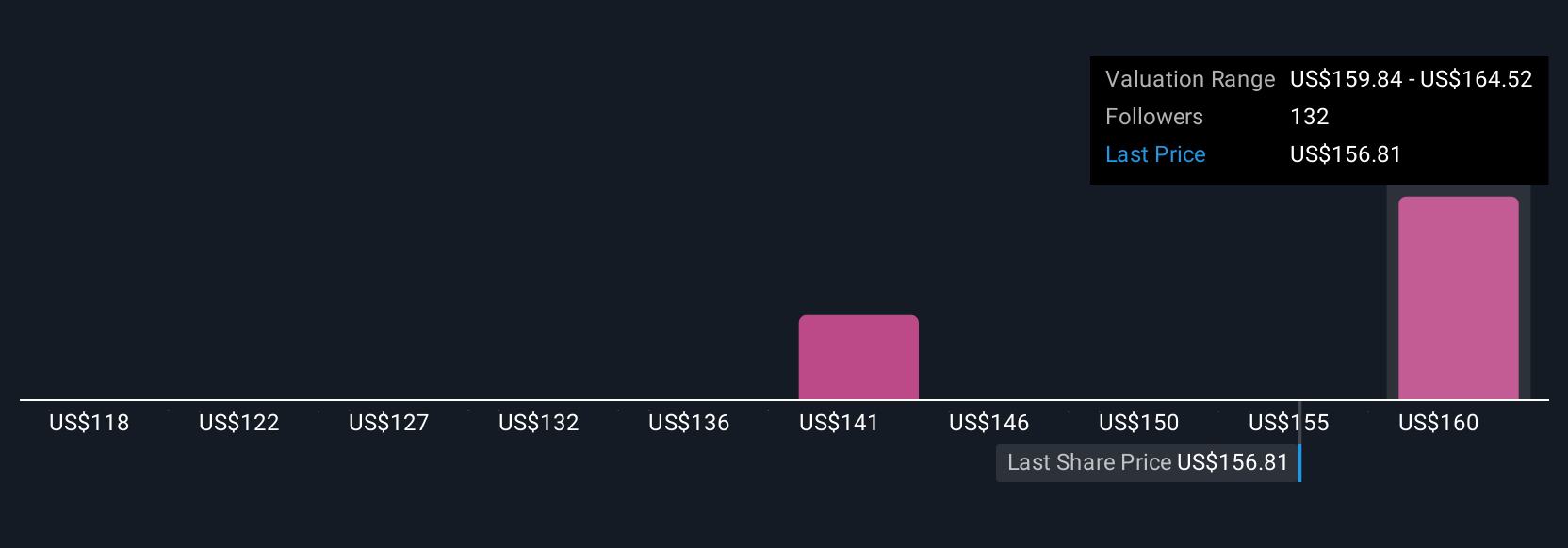

Eight private investors in the Simply Wall St Community estimated RTX’s fair value between US$117.66 and US$164.52 per share. With ongoing international product launches fueling contract growth, the divergence in valuation outlooks reflects how strongly opinions can vary on RTX’s future trajectory, take time to consider the full spread of perspectives.

Explore 8 other fair value estimates on RTX - why the stock might be worth 26% less than the current price!

Build Your Own RTX Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RTX research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free RTX research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RTX's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10