Fifth Third Bancorp And 2 More Top Dividend Stocks To Consider

As the U.S. stock market navigates recent volatility spurred by tariff concerns and a weaker-than-expected jobs report, investors are increasingly seeking stability through dividend stocks. In such uncertain times, companies that consistently reward shareholders with dividends can offer a measure of financial resilience and income potential, making them an attractive consideration for those looking to weather market fluctuations.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Universal (UVV) | 6.02% | ★★★★★★ |

| Huntington Bancshares (HBAN) | 3.77% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 6.53% | ★★★★★★ |

| Ennis (EBF) | 5.62% | ★★★★★★ |

| Employers Holdings (EIG) | 3.10% | ★★★★★☆ |

| Douglas Dynamics (PLOW) | 4.13% | ★★★★★☆ |

| Dillard's (DDS) | 5.57% | ★★★★★★ |

| CompX International (CIX) | 5.15% | ★★★★★★ |

| Columbia Banking System (COLB) | 6.05% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.89% | ★★★★★☆ |

Click here to see the full list of 145 stocks from our Top US Dividend Stocks screener.

We'll examine a selection from our screener results.

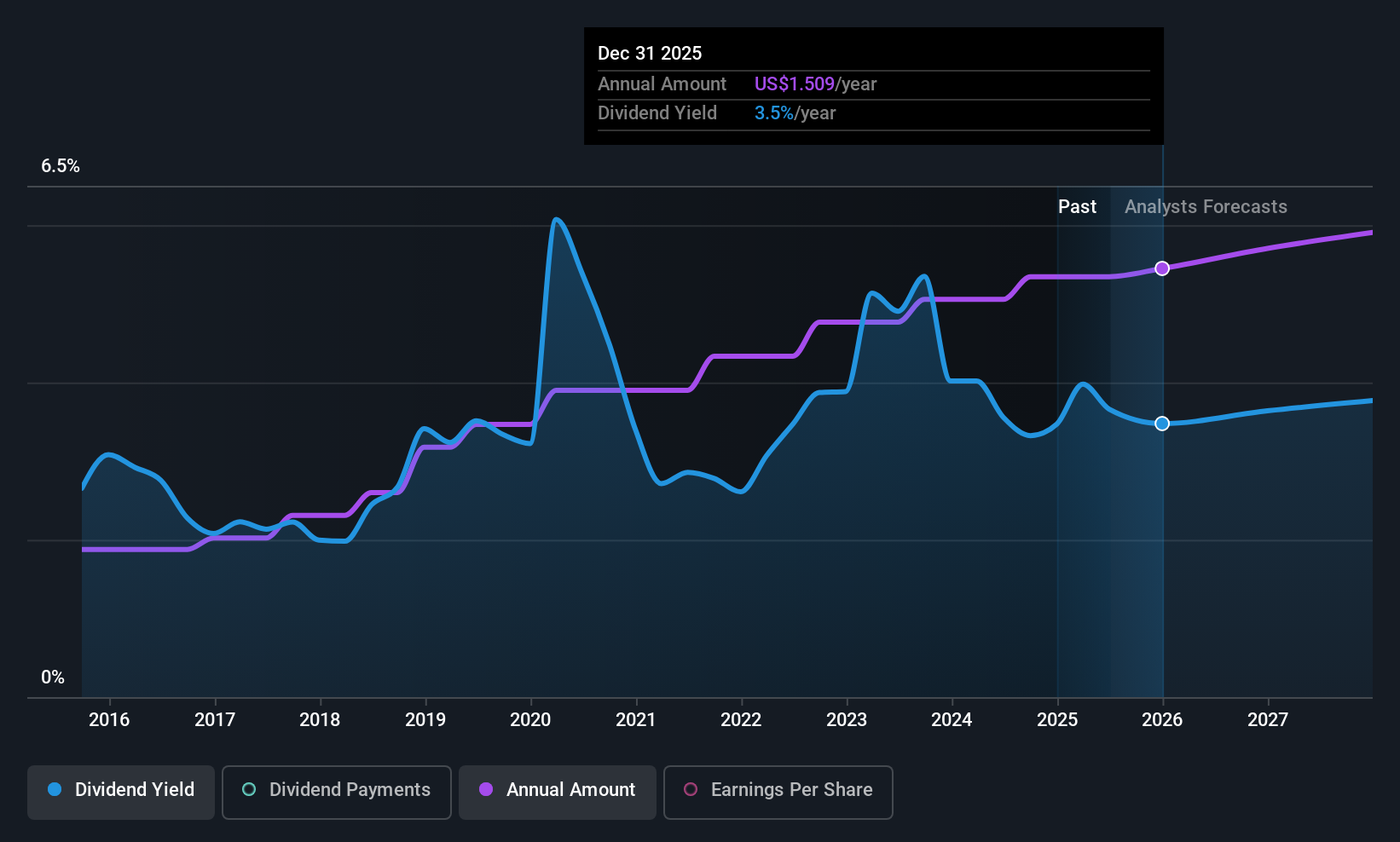

Fifth Third Bancorp (FITB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fifth Third Bancorp is a bank holding company for Fifth Third Bank, National Association, offering a variety of financial products and services across the United States, with a market cap of approximately $28.19 billion.

Operations: Fifth Third Bancorp generates its revenue through various financial products and services offered by Fifth Third Bank, National Association, across the United States.

Dividend Yield: 3.6%

Fifth Third Bancorp offers a stable dividend, supported by a low payout ratio of 45.7%, ensuring dividends are well covered by earnings. Recent strategic partnerships and consistent earnings growth enhance its financial position, while the addition to indices like the Russell 1000 Value-Defensive reflects its defensive qualities. However, with a dividend yield of 3.56%, it falls short compared to top-tier US dividend payers. The company's dividends have been reliable and steadily growing over the past decade.

- Delve into the full analysis dividend report here for a deeper understanding of Fifth Third Bancorp.

- Our valuation report unveils the possibility Fifth Third Bancorp's shares may be trading at a discount.

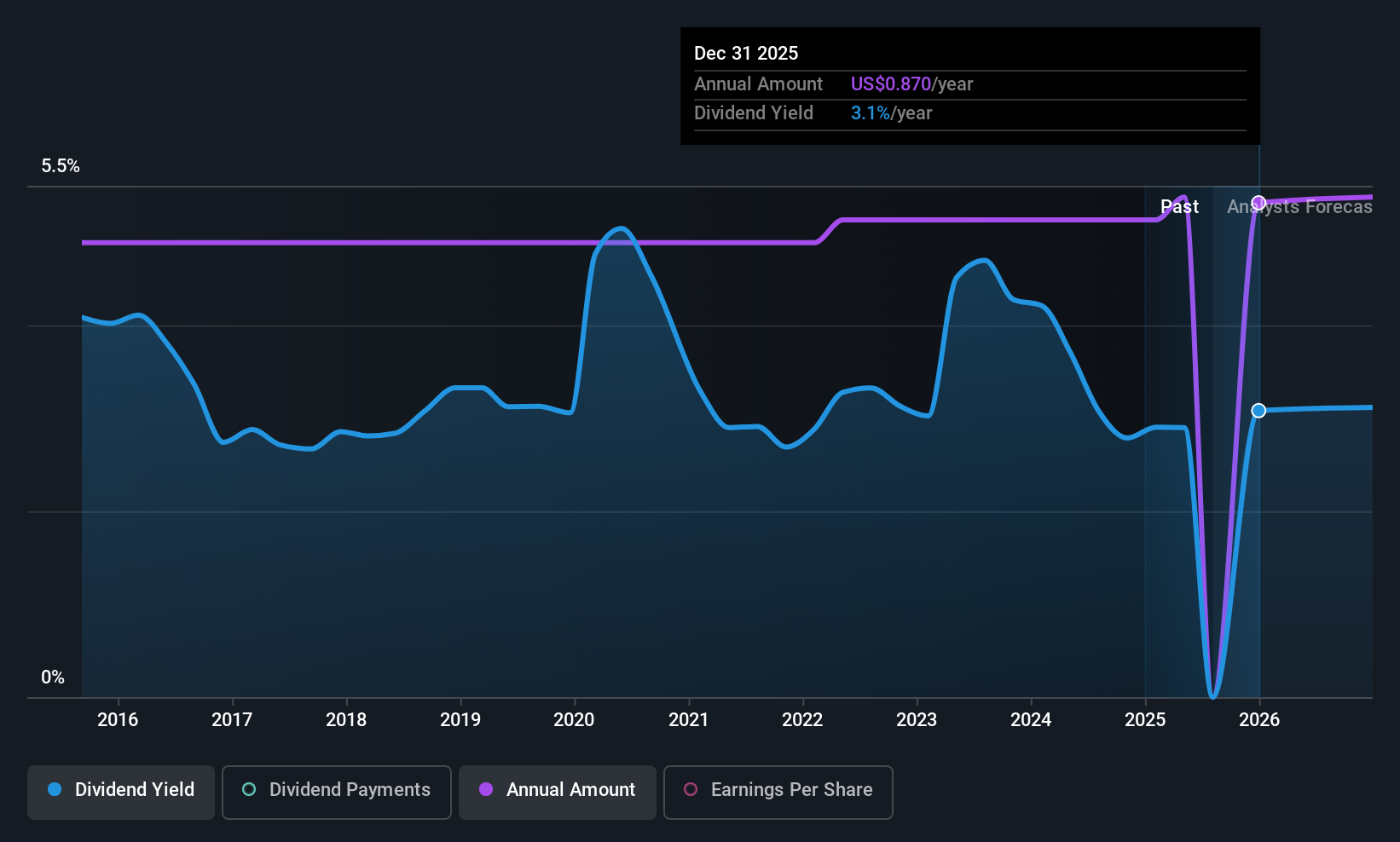

Univest Financial (UVSP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Univest Financial Corporation is the bank holding company for Univest Bank and Trust Co., with a market cap of $831.89 million.

Operations: Univest Financial Corporation's revenue segments are not specified in the provided text.

Dividend Yield: 3.1%

Univest Financial Corporation's dividend payments have been stable and growing over the past decade, supported by a low payout ratio of 31.2%, ensuring dividends are well covered by earnings. Despite a recent $7.8 million net charge-off impacting financials, the company declared a quarterly cash dividend of $0.22 per share on July 23, 2025. Trading at a significant discount to its estimated fair value, Univest offers good relative value compared to peers despite its lower-than-top-tier dividend yield of 3.05%.

- Navigate through the intricacies of Univest Financial with our comprehensive dividend report here.

- The analysis detailed in our Univest Financial valuation report hints at an deflated share price compared to its estimated value.

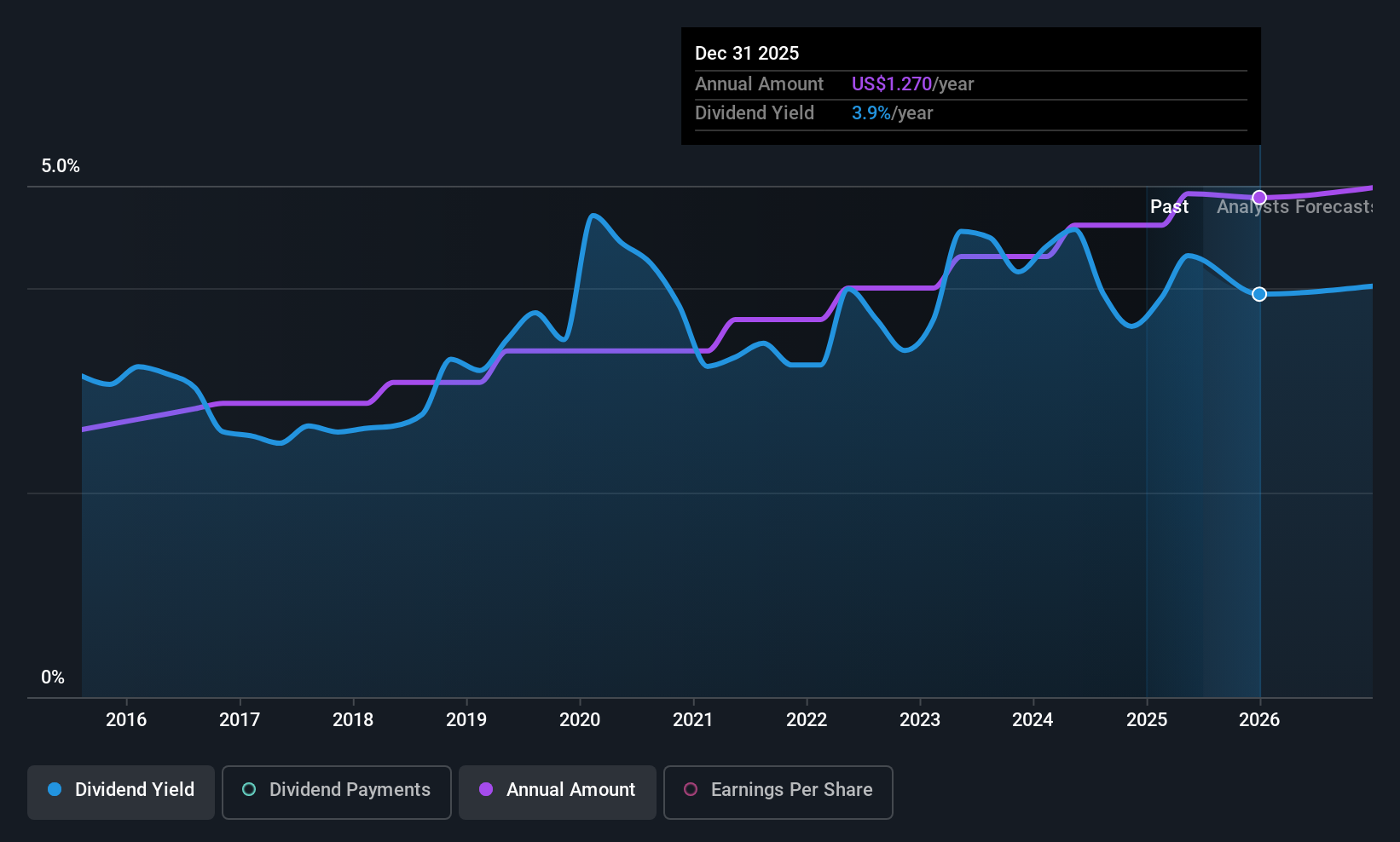

Bar Harbor Bankshares (BHB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bar Harbor Bankshares, with a market cap of $448.16 million, operates as the holding company for Bar Harbor Bank & Trust, offering a range of banking and nonbanking products and services to consumers and businesses.

Operations: Bar Harbor Bankshares generates its revenue primarily from the Community Banking Industry, amounting to $147.01 million.

Dividend Yield: 4.4%

Bar Harbor Bankshares has consistently increased and maintained stable dividends over the past decade, with a current yield of 4.41%. The company’s dividend is well covered by earnings due to a reasonable payout ratio of 47.2%. Despite recent declines in net income for Q2 2025, Bar Harbor affirmed its quarterly dividend of US$0.32 per share. Trading significantly below its estimated fair value, it presents potential value despite not being among the top-tier yielders.

- Click to explore a detailed breakdown of our findings in Bar Harbor Bankshares' dividend report.

- According our valuation report, there's an indication that Bar Harbor Bankshares' share price might be on the cheaper side.

Make It Happen

- Dive into all 145 of the Top US Dividend Stocks we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10