Bitcoin price analysis: BTC defends key zone, bull run toward ATH still in play

Bitcoin has defended a key support zone following its recent all-time high, maintaining the bullish structure. As long as this level holds, a continuation toward higher price discovery remains likely.

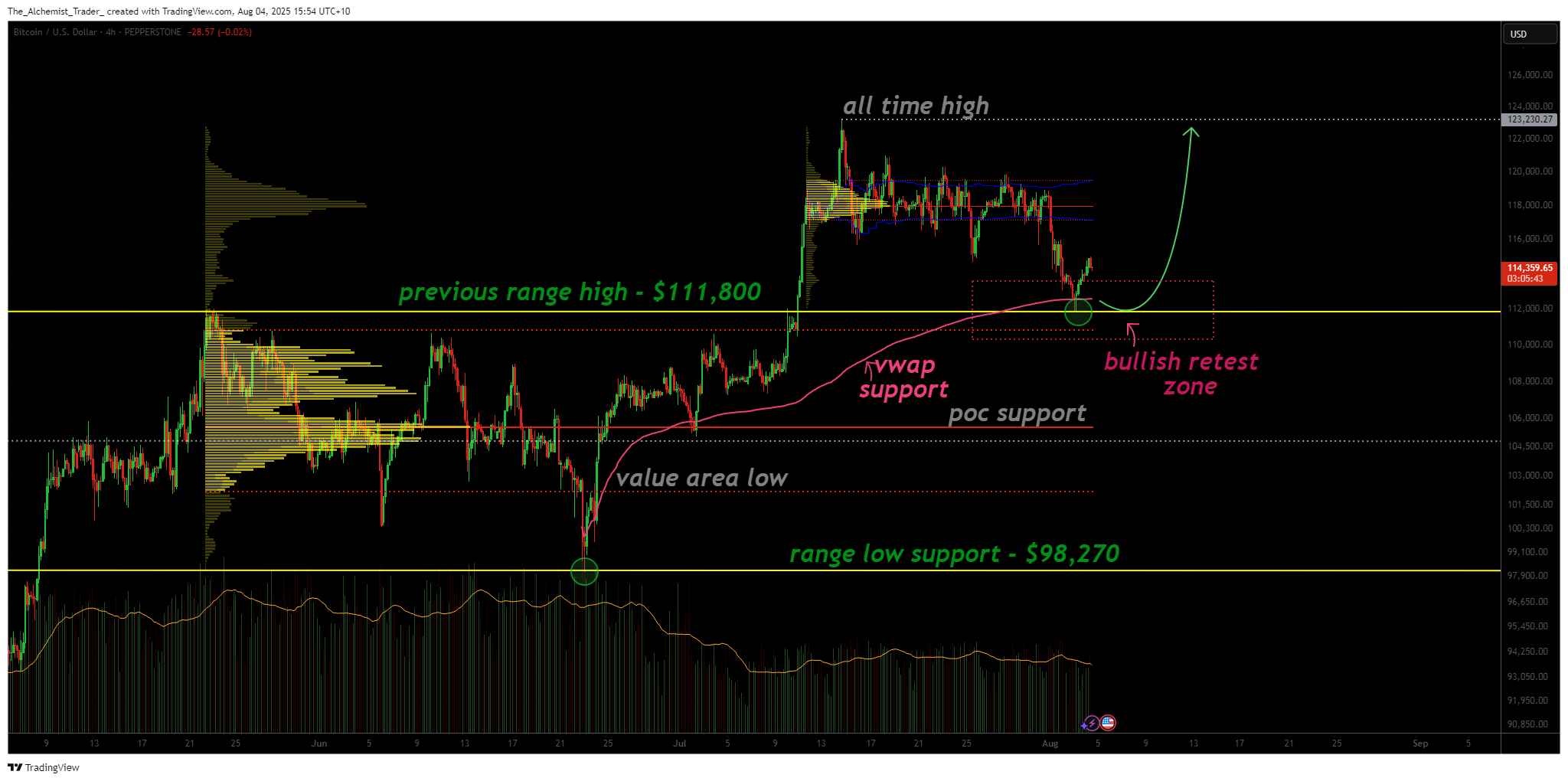

- Bitcoin is holding above key confluence support at $111,800 after a post-ATH correction

- Volume and structure support the potential for a bullish continuation toward $123,230

- Loss of this level would invalidate the bullish thesis and target $98,200 range support

After setting a new all-time high at $123,230, Bitcoin (BTC) has undergone a healthy correction and is now trading just above a pivotal support zone around $111,800. This level previously acted as range-high resistance and is now confirmed as support. It aligns with multiple technical confluences, making it a critical zone for price to base before another potential leg higher.

Key technical points

- Critical Support at $111,800: Former range-high resistance now acting as support with strong technical confluence.

- Confluence Zone: Support aligned with point of control, value area high, VWAP, and 0.618 Fibonacci retracement.

- Volume Confirmation: Increasing volume above support suggests active demand and potential reversal underway.

From a structural perspective, Bitcoin remains in a clear uptrend, and this latest corrective move has tested but not broken the bullish formation. Price has now retraced into a high-probability zone for continuation, supported by the point of control, value area high, VWAP, and the 0.618 Fibonacci retracement. This gives the $111,800 level strong credibility as a base for the next wave higher.

Price action has respected this support closely, with a clean reaction and bounce from the level, showing that demand is present. This sets up a scenario where a higher low is being confirmed, strengthening the case for further bullish continuation toward the recent all-time high.

The volume profile is also beginning to confirm the bullish case. There has been a visible uptick in volume as price hovered above support, suggesting that buying interest is returning. If this volume sustains, it will validate demand and increase the probability of an upward breakout.

The next target remains the $123,230 all-time high. If that is broken, price could quickly move into new price discovery with resistance levels between $130,000 and $135,000 based on Fibonacci extensions and historical pivots. However, if the $111,800 level fails and price gains acceptance back into the previous range, then the structure shifts and $98,200 becomes the next critical support target.

What to expect in the coming price action

Bitcoin’s bullish structure remains intact as long as $111,800 holds. A continuation above this level, especially with increasing volume, could trigger a rally to new all-time highs. Failure to hold would invalidate the setup and shift the bias toward deeper retracement.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10