Why Carvana (CVNA) Is Up 19.7% After Strong Q2 Results and Seattle Facility Expansion

- Carvana recently reported its second quarter 2025 results, showing increases in revenue to US$4.84 billion and net income to US$183 million, alongside announcing an expansion of its Inspection and Reconditioning Center at the ADESA Seattle site to boost operational capacity and create new jobs.

- The integration of the ADESA Seattle facility, backed by proprietary technology and new hiring, highlights Carvana's efforts to improve delivery times and service offerings for both retail and wholesale customers.

- We'll explore how Carvana's expanded reconditioning network in Seattle could enhance its operational efficiency and growth narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 24 best rare earth metal stocks of the very few that mine this essential strategic resource.

Carvana Investment Narrative Recap

To be a Carvana shareholder, you’ll need confidence in the company’s ability to scale its operational footprint efficiently while defending margins in a highly competitive used-car market. The latest earnings and expansion news materially support the short-term catalyst of boosting operational efficiency but persistent risks remain around execution, especially the challenge of integrating new facilities without driving up costs or impacting margin stability.

Among recent announcements, Carvana’s integration of Inspection and Reconditioning Center capabilities at ADESA Seattle stands out. This move directly supports the company’s central catalyst: expanding reconditioning capacity to process more vehicles, which could allow for higher sales volumes and quicker deliveries, key pillars for short-term and longer-term growth ambitions.

However, as Carvana grows, a critical question remains about whether its rapid scaling could expose shareholders to...

Read the full narrative on Carvana (it's free!)

Carvana's narrative projects $27.2 billion in revenue and $1.6 billion in earnings by 2028. This requires 22.4% yearly revenue growth and a $1.2 billion earnings increase from the current earnings of $398.0 million.

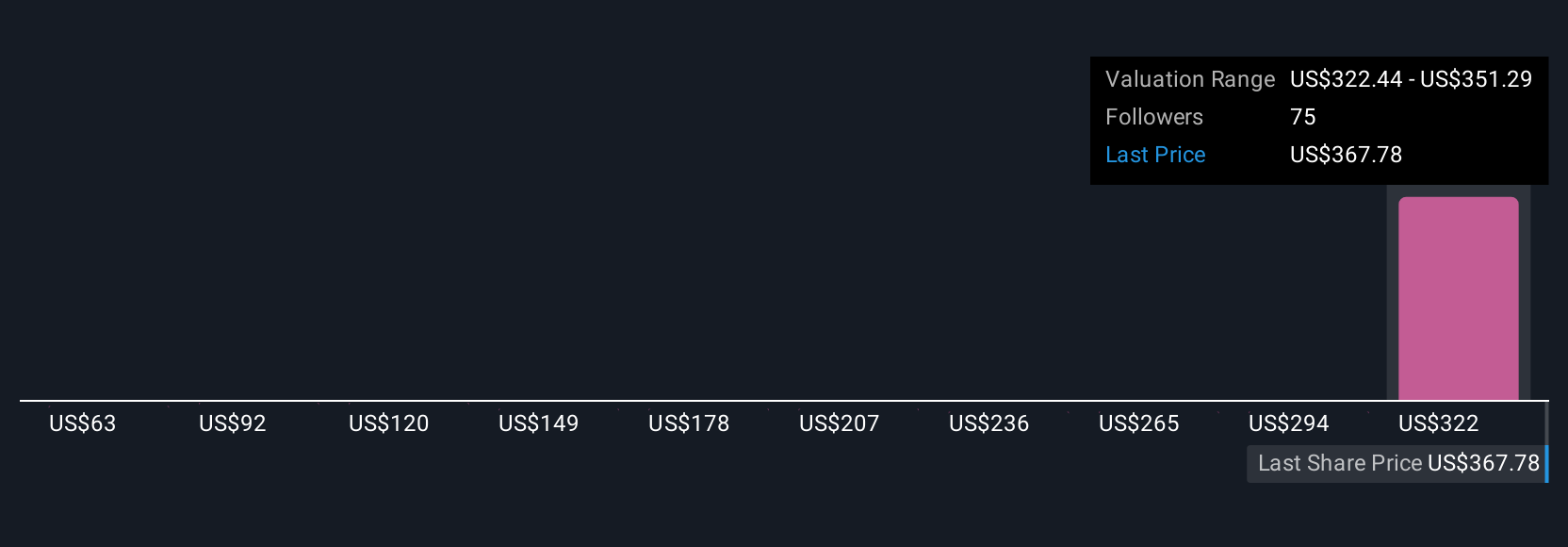

Uncover how Carvana's forecasts yield a $338.55 fair value, a 13% downside to its current price.

Exploring Other Perspectives

Twelve fair value estimates from the Simply Wall St Community range widely from US$62.76 to US$361.57 per share. While opinions differ, efficient scaling of Carvana’s facility network will be crucial for future performance, making it worthwhile to review alternative perspectives before deciding for yourself.

Explore 12 other fair value estimates on Carvana - why the stock might be worth less than half the current price!

Build Your Own Carvana Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carvana research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Carvana research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carvana's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10