Is Criteo's (CRTO) WPP Media Partnership and AI Focus Shifting Its Commerce Media Strategy?

- In the past week, Criteo reported second-quarter sales of US$482.67 million and announced a new partnership with WPP Media to expand commerce intelligence in Connected TV advertising.

- This collaboration aims to link ad exposure to measurable business outcomes, while executive appointments highlight Criteo's continued focus on AI innovation and retail media leadership.

- We'll examine how the WPP partnership and leadership expansion impact Criteo's long-term strategy in commerce and performance media.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Criteo Investment Narrative Recap

To own a stake in Criteo, you need conviction in its ability to drive measurable outcomes for advertisers through AI-driven commerce media, particularly as channels like Connected TV (CTV) become more performance-focused. The recent partnership with WPP Media has the potential to unlock a critical short-term catalyst by enabling advertisers to link CTV ad exposure to tangible business results, but the key risk of stagnant top-line growth and client concentration remains unaddressed, so the impact is not yet material for financial momentum. Among Criteo’s recent announcements, the appointment of Wilfried Schobeiri as Senior Vice President, Head of Product, Performance Media directly supports the push towards advanced, cross-channel self-service advertising, a timely move as partnerships like those with WPP demand deeper technology integration to capture spending in high-growth media channels. Yet, it's important to note that some risks, such as slower than anticipated ramp-up in new channels, could mean investors should be aware of the possibility that...

Read the full narrative on Criteo (it's free!)

Criteo is expected to reach $985.8 million in revenue and $153.1 million in earnings by 2028. This reflects a 20.1% annual decline in revenue and a $10.8 million increase in earnings from the current $142.3 million.

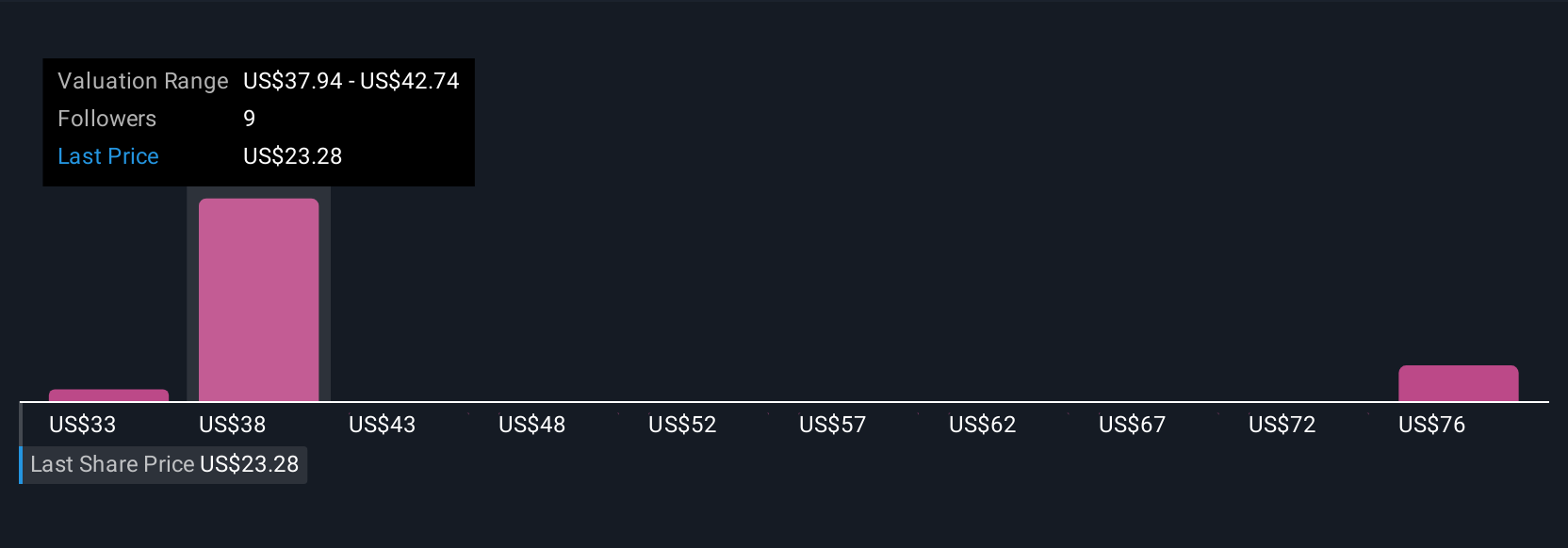

Uncover how Criteo's forecasts yield a $38.75 fair value, a 69% upside to its current price.

Exploring Other Perspectives

Three individual fair value estimates from the Simply Wall St Community range from US$33.14 to US$83.68, reflecting wide divergence. While this shows confidence from some on Criteo’s future growth, slow adoption in key growth areas remains a central issue shaping expectations, explore several perspectives before drawing your own conclusion.

Explore 3 other fair value estimates on Criteo - why the stock might be worth over 3x more than the current price!

Build Your Own Criteo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Criteo research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Criteo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Criteo's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 21 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10