Uxin (NASDAQ:UXIN) pulls back 20% this week, but still delivers shareholders strong 129% return over 1 year

It hasn't been the best quarter for Uxin Limited (NASDAQ:UXIN) shareholders, since the share price has fallen 29% in that time. But that doesn't change the fact that the returns over the last year have been very strong. During that period, the share price soared a full 129%. So it is important to view the recent reduction in price through that lense. The real question is whether the business is trending in the right direction.

In light of the stock dropping 20% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive one-year return.

Trump has pledged to "unleash" American oil and gas and these 15 US stocks have developments that are poised to benefit.

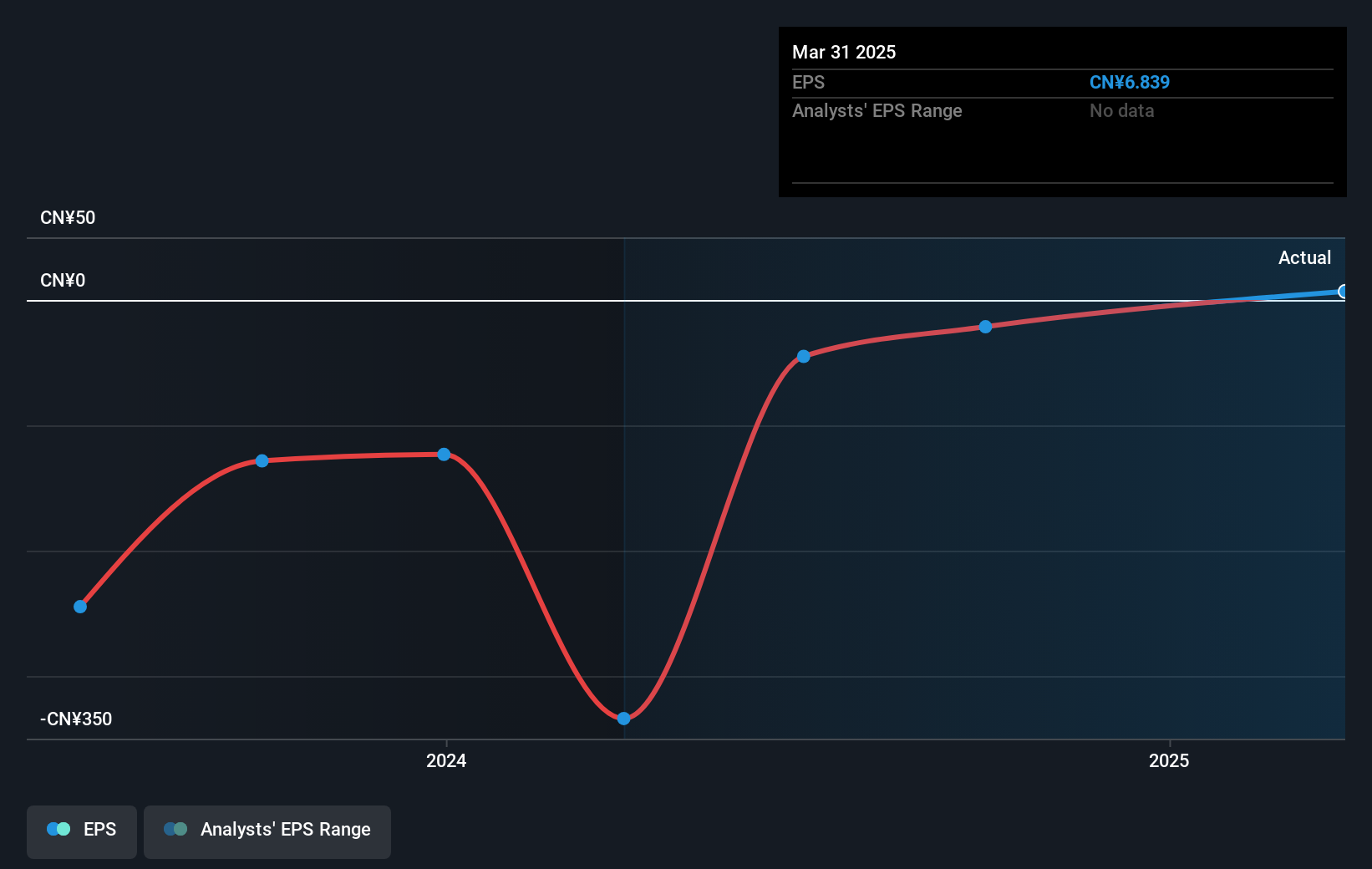

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last year Uxin grew its earnings per share, moving from a loss to a profit.

We think the growth looks very prospective, so we're not surprised the market liked it too. Inflection points like this can be a great time to take a closer look at a company.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into Uxin's key metrics by checking this interactive graph of Uxin's earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that Uxin shareholders have received a total shareholder return of 129% over one year. There's no doubt those recent returns are much better than the TSR loss of 15% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Uxin (at least 2 which are a bit concerning) , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10