Marcus & Millichap (NYSE:MMI) Is Due To Pay A Dividend Of $0.25

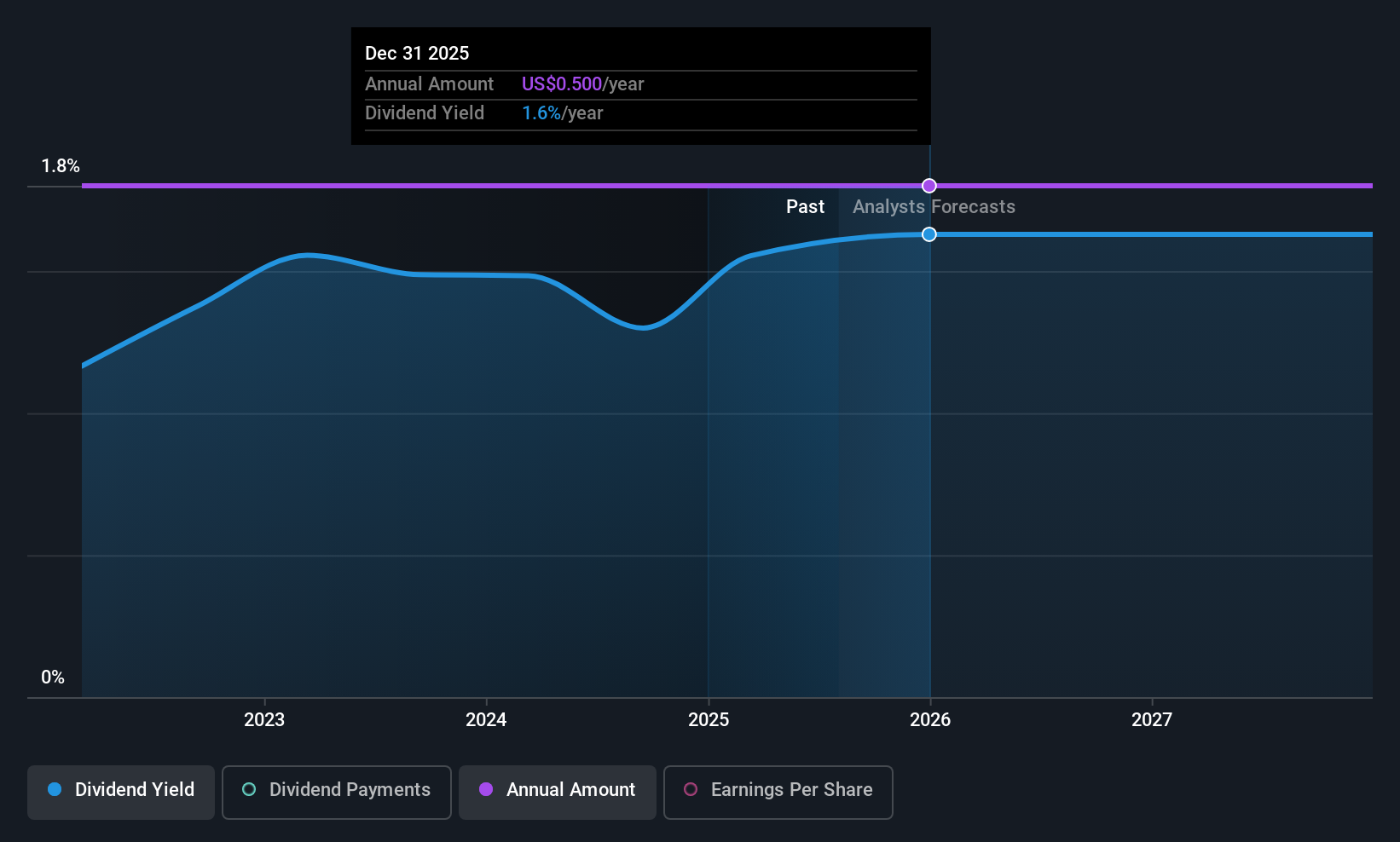

Marcus & Millichap, Inc.'s (NYSE:MMI) investors are due to receive a payment of $0.25 per share on 6th of October. The dividend yield is 1.6% based on this payment, which is a little bit low compared to the other companies in the industry.

This technology could replace computers: discover the 20 stocks are working to make quantum computing a reality.

Marcus & Millichap's Long-term Dividend Outlook appears Promising

It would be nice for the yield to be higher, but we should also check if higher levels of dividend payment would be sustainable. Marcus & Millichap isn't generating any profits, and it is paying out a very high proportion of the cash it is earning. This is quite a strong warning sign that the dividend may not be sustainable.

Looking forward, earnings per share is forecast to rise exponentially over the next year. If the dividend extends its recent trend, estimates say the dividend could reach 47%, which we would be comfortable to see continuing.

Check out our latest analysis for Marcus & Millichap

Marcus & Millichap Doesn't Have A Long Payment History

The dividend has been pretty stable looking back, but the company hasn't been paying one for very long. This makes it tough to judge how it would fare through a full economic cycle. The last annual payment of $0.50 was flat on the annual payment from3 years ago. We like that the dividend hasn't been shrinking. However we're conscious that the company hasn't got an overly long track record of dividend payments yet, which makes us wary of relying on its dividend income.

Dividend Growth Potential Is Shaky

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Let's not jump to conclusions as things might not be as good as they appear on the surface. Marcus & Millichap's EPS has fallen by approximately 36% per year during the past five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

Marcus & Millichap's Dividend Doesn't Look Great

Overall, while some might be pleased that the dividend wasn't cut, we think this may help Marcus & Millichap make more consistent payments in the future. The company's earnings aren't high enough to be making such big distributions, and it isn't backed up by strong growth or consistency either. Overall, this doesn't get us very excited from an income standpoint.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. For instance, we've picked out 1 warning sign for Marcus & Millichap that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10