- In July 2025, Elanco Animal Health received European Commission approval for Zenrelia™ (ilunocitinib), a once-daily oral JAK inhibitor for dogs with allergic and atopic dermatitis, marking a new entry in the EU canine dermatology market.

- This regulatory milestone follows successful clinical trials against the market incumbent and expands Zenrelia's footprint, reinforcing Elanco’s global innovation and geographic growth strategy.

- We'll explore how EU approval for Zenrelia could shape Elanco's outlook and support long-term innovation-led market expansion.

These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Elanco Animal Health Investment Narrative Recap

To be a shareholder in Elanco Animal Health, one must believe in the company’s ability to drive sustainable growth through innovation and new product launches like Zenrelia, while managing near-term headwinds such as margin pressure from increased sales and marketing investments. The recent EU approval for Zenrelia marks a positive development supporting Elanco’s innovation-led growth thesis, though its immediate impact on margin challenges and rapid revenue ramp-up remains to be seen.

Among recent announcements, Zenrelia’s prior positive opinion from the European Medicines Agency stands out as directly relevant, setting up the formal EU approval as a central catalyst. Together, these regulatory milestones reinforce Elanco’s push to diversify and expand within global pet health markets, yet they also elevate execution risk as the company works to translate approvals into commercial success.

However, depending on the pace of adoption and success in clinic penetration, the real test for investors may come if...

Read the full narrative on Elanco Animal Health (it's free!)

Elanco Animal Health's outlook projects $4.9 billion in revenue and $160.1 million in earnings by 2028. This assumes 3.2% annual revenue growth but a decrease in earnings of $177.9 million from current earnings of $338.0 million.

Uncover how Elanco Animal Health's forecasts yield a $15.55 fair value, a 13% upside to its current price.

Exploring Other Perspectives

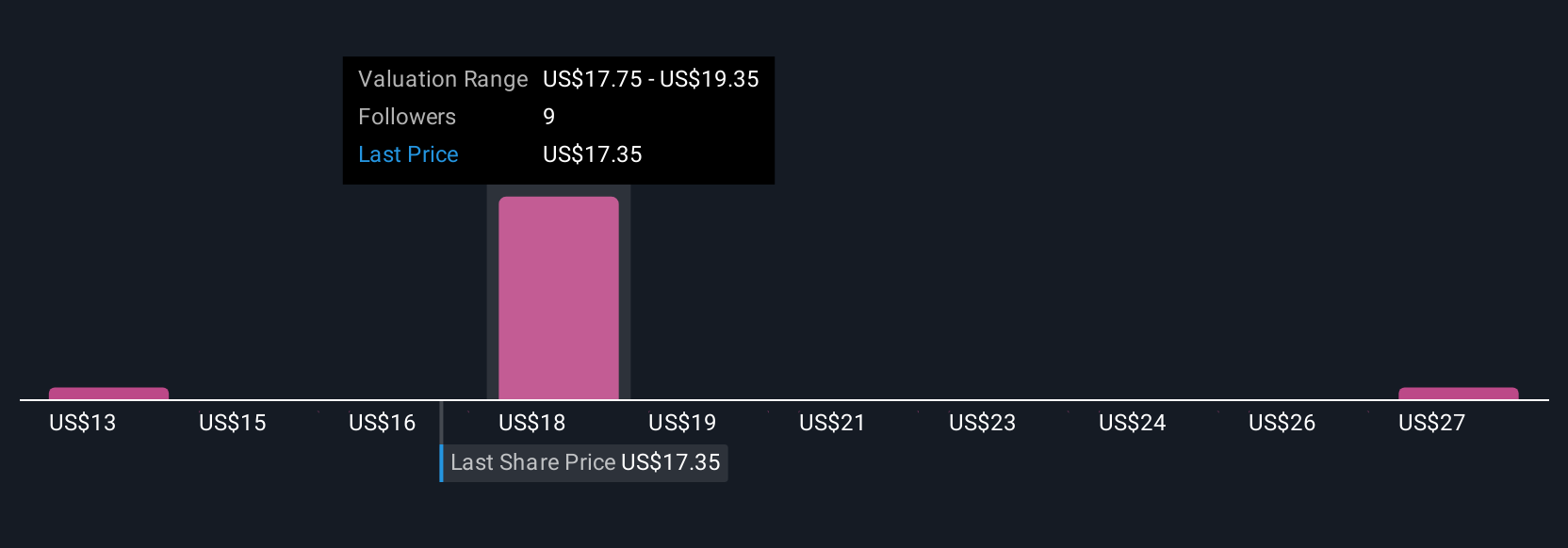

Simply Wall St Community members provided three fair value estimates for Elanco Animal Health, ranging from US$12.93 to US$31.14 per share. With this wide span of perspectives, consider that margin pressure from increased product launch investments could influence the company’s ability to meet optimistic growth expectations, explore how others view these risks and potential rewards.

Explore 3 other fair value estimates on Elanco Animal Health - why the stock might be worth over 2x more than the current price!

Build Your Own Elanco Animal Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Elanco Animal Health research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Elanco Animal Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Elanco Animal Health's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elanco Animal Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com