What Regis Resources (ASX:RRL)'s Shift Toward Reinvestment Over Profits Means For Shareholders

- In recent news, Regis Resources reported a significant decrease in its return on capital employed, dropping to 1.2% from 26% over the past five years, while simultaneously increasing capital invested and revenue.

- This combination suggests the company is shifting its focus toward long-term growth and reinvestment in its operations, even at the expense of short-term profitability.

- We’ll explore how Regis Resources’ decision to prioritize long-term growth through reinvestment may alter its investment narrative moving forward.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Regis Resources Investment Narrative Recap

To be a Regis Resources shareholder today, you need to trust in the company’s path of aggressive capital reinvestment, betting that short-term pressure on returns will ultimately drive future cash flow growth. While the recent decline in return on capital employed is significant, it does not appear to directly affect the company’s primary short-term catalysts, steady gold production and successful execution at existing operations, although it does amplify the risk of higher costs squeezing margins if gold prices stagnate.

The Q3 2025 production results, showing year-to-date gold production of 285,500 ounces and reaffirmed annual guidance, stand out as particularly relevant. This announcement reassures investors that operational delivery remains on track amid reinvestment, maintaining confidence in the delivery of near-term production targets while management prioritizes longer-term value creation.

By contrast, the sustainability of returns in the face of persistent inflationary pressures remains a key concern that investors should be aware of...

Read the full narrative on Regis Resources (it's free!)

Regis Resources is projected to achieve A$1.7 billion in revenue and A$400.6 million in earnings by 2028. This outlook is based on an assumed annual revenue growth rate of 5.0% and an increase in earnings of A$406.4 million from current earnings of A$-5.8 million.

Uncover how Regis Resources' forecasts yield a A$4.44 fair value, a 11% upside to its current price.

Exploring Other Perspectives

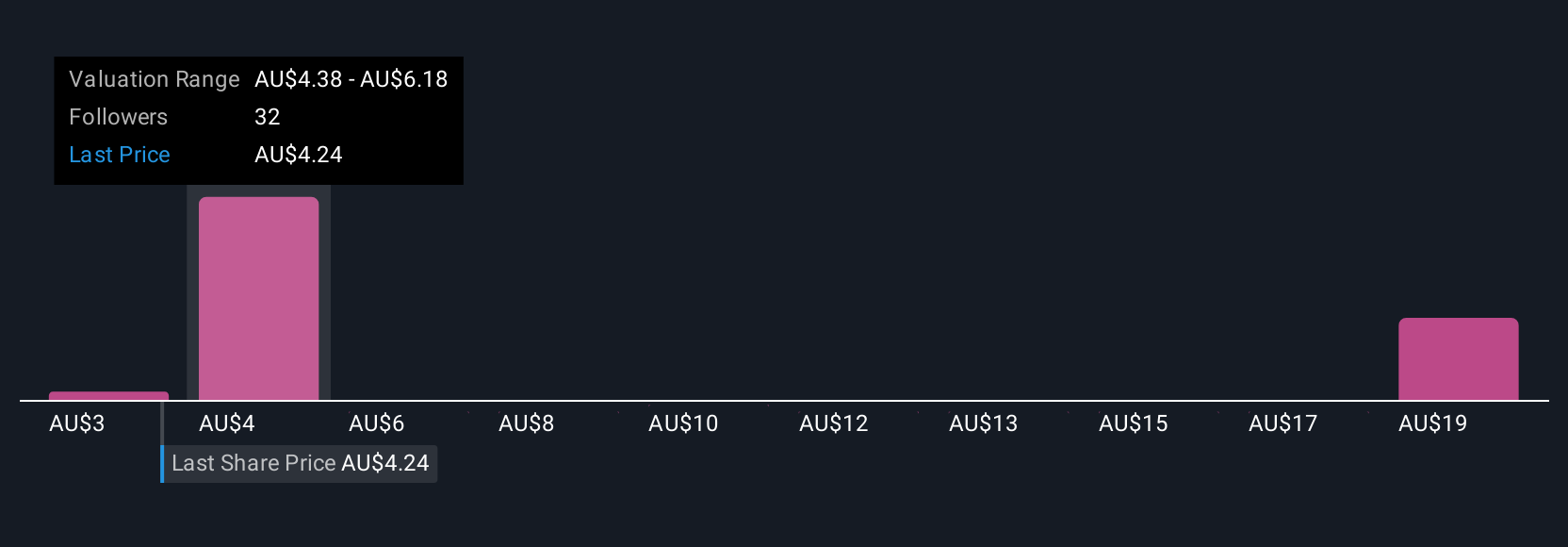

Seven private investor fair value estimates from the Simply Wall St Community range from A$2.58 to A$19.41 per share. While opinions vary, persistent inflation and rising all-in sustaining costs could shape future outcomes, so consider multiple viewpoints before deciding.

Explore 7 other fair value estimates on Regis Resources - why the stock might be worth 36% less than the current price!

Build Your Own Regis Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Regis Resources research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Regis Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Regis Resources' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10