How Investors May Respond To Toll Brothers (TOL) Expanding Luxury Communities Across Key U.S. Markets

- Over the past two weeks, Toll Brothers announced a series of new luxury community launches and amenity unveilings across key U.S. markets, including Arizona, New Jersey, Pennsylvania, Texas, Florida, North Carolina, Oregon, and Nevada.

- This wave of product expansion spotlights Toll Brothers' focused effort to address diverse buyer segments through premium offerings in both established and emerging locations, reflecting an intensified push for national growth.

- We'll explore how the acceleration in multi-market community launches may strengthen Toll Brothers' investment narrative of resilient luxury housing demand.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 21 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Toll Brothers Investment Narrative Recap

To own Toll Brothers shares, you need to believe that robust demand for luxury homes will persist despite recent indicators of softening buyer appetite and backlog declines. The wave of new community launches, while signaling a push for growth, does not appear to materially change the near-term catalyst, true stabilization or rebound in high-end housing demand, or address the biggest short-term risk from continued weakness in net orders and rising sales incentives.

Among the recent announcements, the new Scottsdale, Arizona, luxury community, Toll Brothers at Storyrock, stands out for its high price points and broad customization. This aligns with the company’s core focus on affluent buyers, directly tying into both the near-term opportunity to capture premium market share and the risk of overexposure if consumer confidence continues to falter. But on the flip side, any prolonged softness in luxury demand and increasing incentive pressure is something investors should be watching...

Read the full narrative on Toll Brothers (it's free!)

Toll Brothers' outlook anticipates $12.8 billion in revenue and $1.6 billion in earnings by 2028. Achieving this requires a 6.2% annual revenue growth rate and a $0.2 billion increase in earnings from the current $1.4 billion.

Uncover how Toll Brothers' forecasts yield a $141.12 fair value, a 16% upside to its current price.

Exploring Other Perspectives

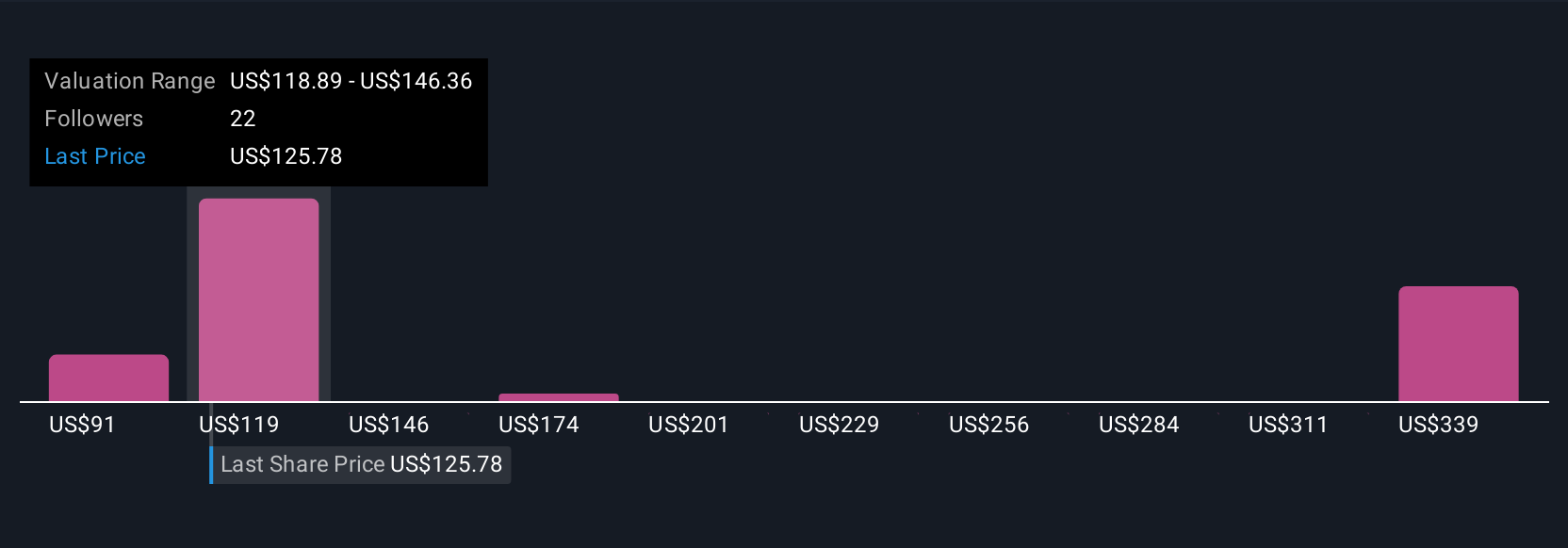

Twelve Simply Wall St Community members put Toll Brothers’ fair value as low as US$91.41 and as high as US$395.59, covering a wide spectrum of outcomes. While many see value, investor attention has shifted toward signs of softer demand affecting future revenue and earnings, underscoring the value of examining multiple viewpoints before making decisions.

Explore 12 other fair value estimates on Toll Brothers - why the stock might be worth 25% less than the current price!

Build Your Own Toll Brothers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Toll Brothers research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Toll Brothers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Toll Brothers' overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toll Brothers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10