Is Corcept Therapeutics' Steady Q2 Earnings Shaping Perceptions of Long-Term Consistency for CORT?

- Corcept Therapeutics reported its second quarter 2025 financial results on July 31, showing net income of US$35.15 million, nearly unchanged from the previous year.

- This stability in earnings came as most analysts maintained their outlook for ongoing revenue growth and consistent business performance.

- We’ll examine how steady net income and analyst optimism could influence Corcept Therapeutics' investment narrative and future expectations.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Corcept Therapeutics Investment Narrative Recap

To be a Corcept Therapeutics shareholder, you need confidence in the company’s ability to deliver new therapies, especially relacorilant, while maintaining profitability amid evolving competition and pricing dynamics. The Q2 2025 earnings, virtually unchanged year on year, do not significantly shift the picture for Corcept’s most important catalyst: the potential approval and launch of relacorilant. The biggest risk remains ongoing patent litigation over Korlym and its impact on future revenues, and these results do not materially alter that concern.

Among recent developments, Corcept’s July 2025 submission of an NDA to the FDA for relacorilant in platinum-resistant ovarian cancer stands out as the most relevant. This milestone is closely tied to the company’s growth catalyst, representing a potential new revenue stream and supporting the investment narrative as analyst optimism persists.

But despite these promising signs, investors should not overlook the ongoing risk from potential generic competition, which could...

Read the full narrative on Corcept Therapeutics (it's free!)

Corcept Therapeutics' narrative projects $1.8 billion in revenue and $713.3 million in earnings by 2028. This requires 38.5% yearly revenue growth and a $580.8 million increase in earnings from $132.5 million today.

Uncover how Corcept Therapeutics' forecasts yield a $138.25 fair value, a 100% upside to its current price.

Exploring Other Perspectives

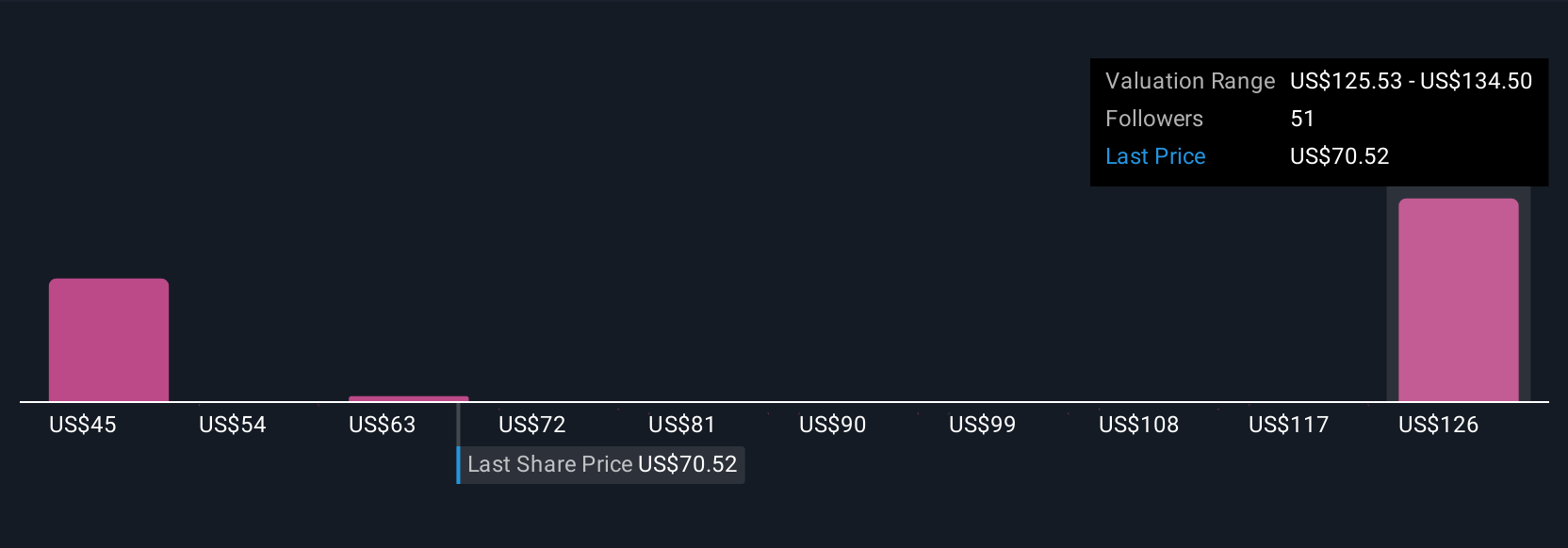

Ten fair value estimates from the Simply Wall St Community span US$47.95 to US$138.25, highlighting significant differences in outlook. With relacorilant’s regulatory progress as a key catalyst, investor opinions on future performance diverge sharply, invite yourself to consider various viewpoints.

Explore 10 other fair value estimates on Corcept Therapeutics - why the stock might be worth 31% less than the current price!

Build Your Own Corcept Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Corcept Therapeutics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Corcept Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Corcept Therapeutics' overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 18 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10