Spotlight On 3 Penny Stocks With Market Caps As Low As $10M

The United States market recently experienced a downturn, with major indices like the Dow Jones and S&P 500 reacting to new tariff announcements and weaker-than-expected job data. In such volatile times, investors often look for opportunities in less conventional areas of the stock market. Penny stocks, despite their somewhat outdated moniker, continue to present intriguing possibilities for those interested in smaller or newer companies. These stocks can offer growth potential at lower price points when backed by solid financials and fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.61 | $582.28M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.85 | $264.88M | ✅ 3 ⚠️ 3 View Analysis > |

| WM Technology (MAPS) | $0.8928 | $152.17M | ✅ 4 ⚠️ 1 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $92.33M | ✅ 3 ⚠️ 2 View Analysis > |

| Cardno (COLD.F) | $0.1701 | $6.64M | ✅ 2 ⚠️ 4 View Analysis > |

| BAB (BABB) | $0.897275 | $6.47M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.40 | $99.52M | ✅ 3 ⚠️ 3 View Analysis > |

| North European Oil Royalty Trust (NRT) | $4.98 | $46.5M | ✅ 2 ⚠️ 2 View Analysis > |

| TETRA Technologies (TTI) | $4.10 | $520.32M | ✅ 2 ⚠️ 2 View Analysis > |

| Tandy Leather Factory (TLF) | $3.49 | $29.37M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 421 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Art's-Way Manufacturing (ARTW)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Art's-Way Manufacturing Co., Inc. produces and distributes agricultural equipment and specialized modular science and agricultural buildings globally, with a market cap of $16.14 million.

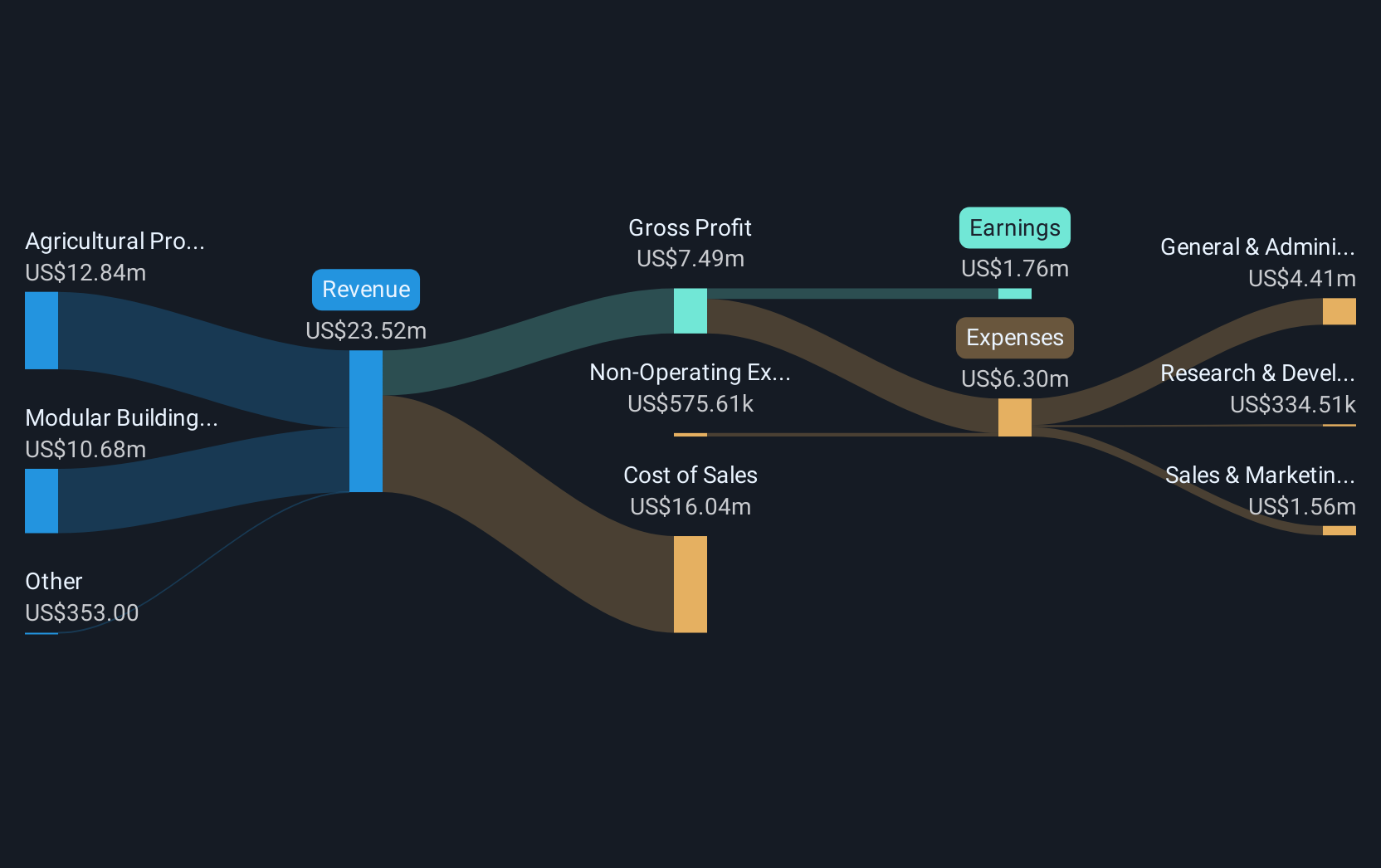

Operations: The company's revenue is derived from two main segments: $12.84 million from agricultural products and $10.68 million from modular buildings.

Market Cap: $16.14M

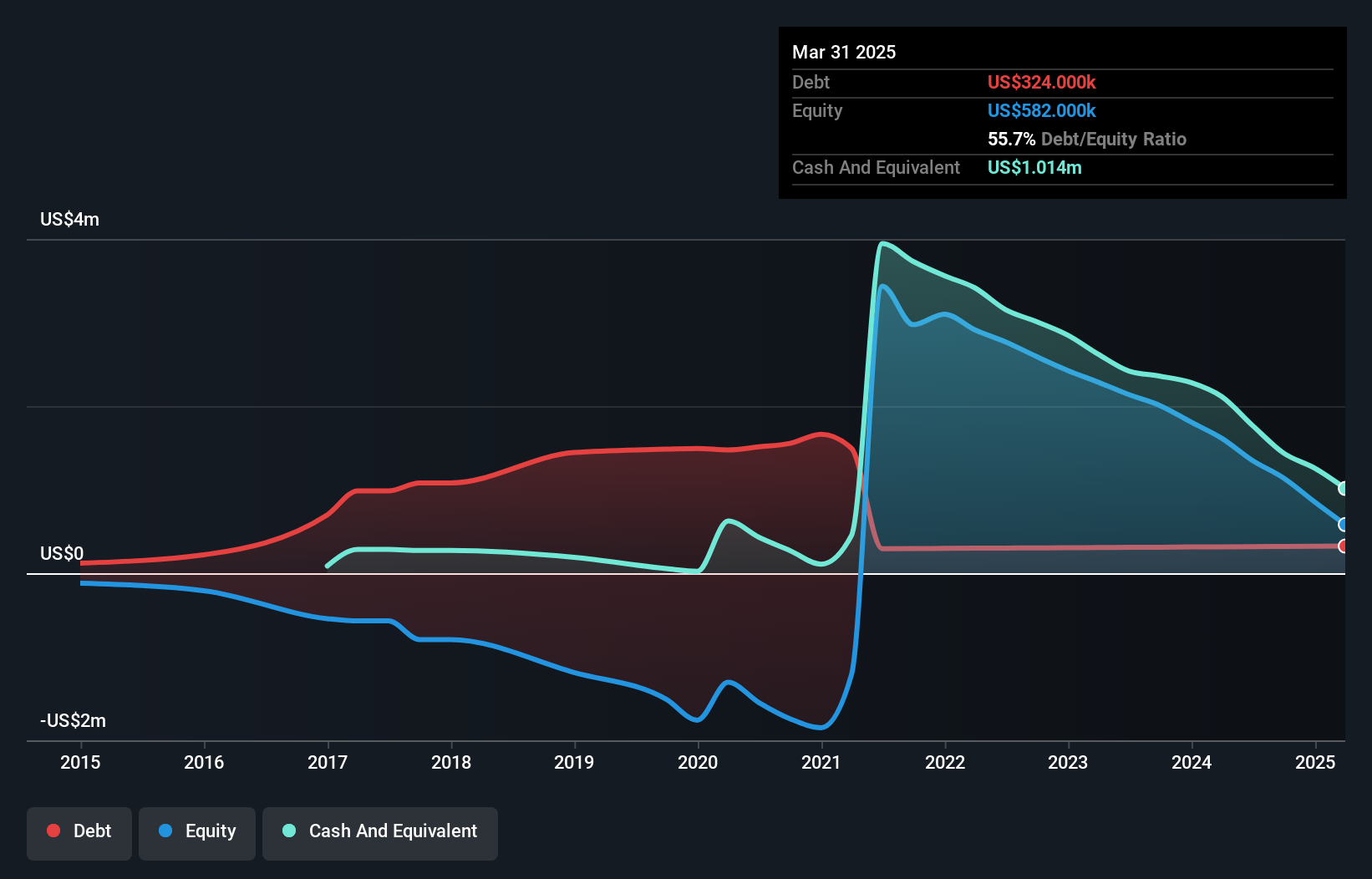

Art's-Way Manufacturing, with a market cap of US$16.14 million, has shown financial improvement by becoming profitable in the last year. Its short-term assets (US$13.3M) effectively cover both short-term (US$4.9M) and long-term liabilities (US$2.4M). The company's debt is well-managed with a net debt to equity ratio of 22.7%, and its operating cash flow covers 90.4% of its debt, indicating solid financial health for a penny stock. Recent earnings reports highlight a turnaround from losses to net income, although sales have slightly decreased compared to the previous year.

- Take a closer look at Art's-Way Manufacturing's potential here in our financial health report.

- Learn about Art's-Way Manufacturing's historical performance here.

Gaia (GAIA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Gaia, Inc. operates a digital video subscription service and online community targeting an underserved member base across the United States, Canada, Australia, and internationally with a market cap of $100.28 million.

Operations: The company generates $92.89 million in revenue from its digital video subscription service and online community, catering to audiences in the United States, Canada, Australia, and other international markets.

Market Cap: $100.28M

Gaia, Inc., with a market cap of US$100.28 million, is navigating its position in the penny stock landscape by focusing on strategic financial management and leadership changes. The company recently extended its revolving credit facility up to US$15 million, providing flexibility for operations and growth initiatives. Despite being unprofitable with a net loss of US$1.01 million in Q1 2025, Gaia's short-term assets exceed long-term liabilities, indicating some balance sheet strength. The appointment of Kiersten Medvedich as CEO aims to leverage her extensive industry experience to enhance community engagement and drive revenue growth through advanced AI tools and new platforms.

- Navigate through the intricacies of Gaia with our comprehensive balance sheet health report here.

- Gain insights into Gaia's outlook and expected performance with our report on the company's earnings estimates.

DUKE Robotics (DUKR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: DUKE Robotics Corp. is a robotics company operating in Israel, Greece, and the United States with a market cap of $15.41 million.

Operations: DUKE Robotics has not reported any specific revenue segments.

Market Cap: $15.41M

DUKE Robotics Corp., with a market cap of US$15.41 million, is pre-revenue but making strides in the penny stock domain through strategic collaborations and technological advancements. Recent announcements highlight its partnership with Elbit Land Systems Ltd., which is expected to generate initial royalties from the Birds of Prey drone systems. Additionally, DUKE's Insulator Cleaning Drone (IC Drone) operations have commenced for 2025, marking a full-season deployment in Israel and an expansion into Greece. While volatility remains high, DUKE's financial position shows more cash than debt and positive shareholder equity improvements over five years.

- Get an in-depth perspective on DUKE Robotics' performance by reading our balance sheet health report here.

- Assess DUKE Robotics' previous results with our detailed historical performance reports.

Taking Advantage

- Reveal the 421 hidden gems among our US Penny Stocks screener with a single click here.

- Curious About Other Options? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10