Chemung Financial Leads These 3 High Insider Ownership Growth Stocks

As the U.S. stock market faces volatility due to recent tariff announcements and a weaker-than-expected jobs report, investors are re-evaluating their strategies amidst these economic uncertainties. In such an environment, growth companies with high insider ownership can be particularly attractive as they often signal strong confidence from those closest to the company's operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Victory Capital Holdings (VCTR) | 10.1% | 32.4% |

| Super Micro Computer (SMCI) | 13.9% | 36.3% |

| QT Imaging Holdings (QTIH) | 26.4% | 84.5% |

| Prairie Operating (PROP) | 34.4% | 80.8% |

| OS Therapies (OSTX) | 19.5% | 16.5% |

| Niu Technologies (NIU) | 37.2% | 88.1% |

| FTC Solar (FTCI) | 23.1% | 62.5% |

| Credo Technology Group Holding (CRDO) | 11.7% | 36.4% |

| Atour Lifestyle Holdings (ATAT) | 22.6% | 23.4% |

| Astera Labs (ALAB) | 12.8% | 45.6% |

Click here to see the full list of 185 stocks from our Fast Growing US Companies With High Insider Ownership screener.

We'll examine a selection from our screener results.

Chemung Financial (CHMG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Chemung Financial Corporation is a bank holding company for Chemung Canal Trust Company, offering various banking, financing, fiduciary, and financial services, with a market cap of $251.14 million.

Operations: Chemung Canal Trust Company provides a diverse array of services, including banking, financing, and fiduciary offerings.

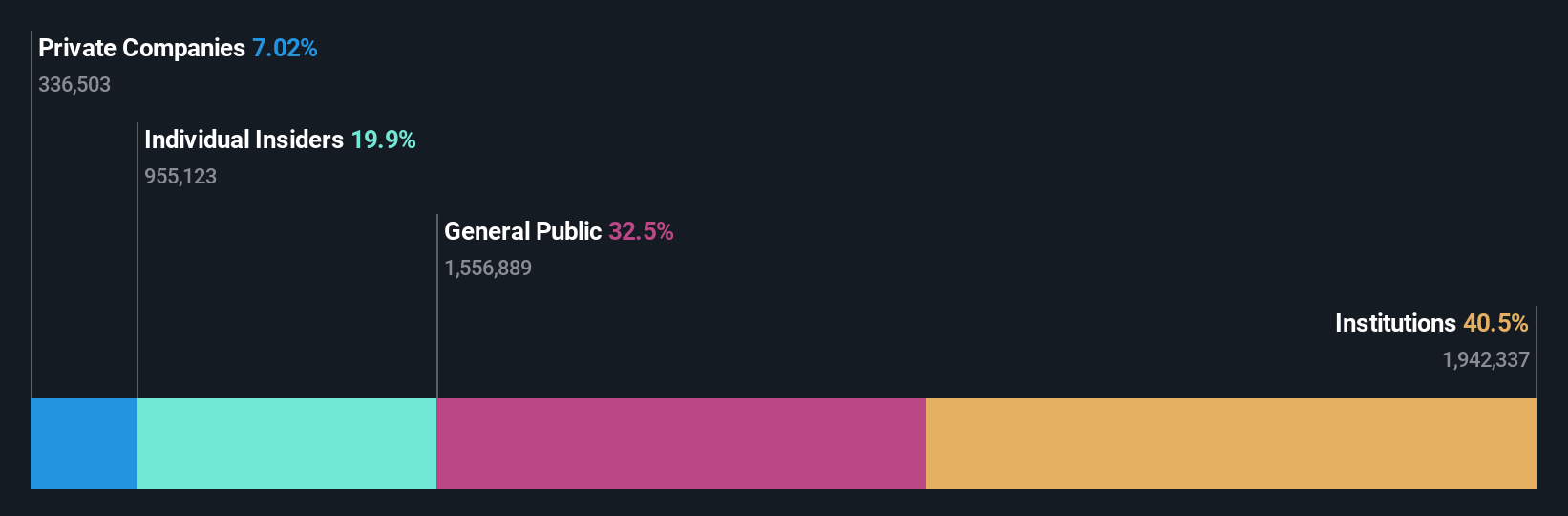

Insider Ownership: 19.9%

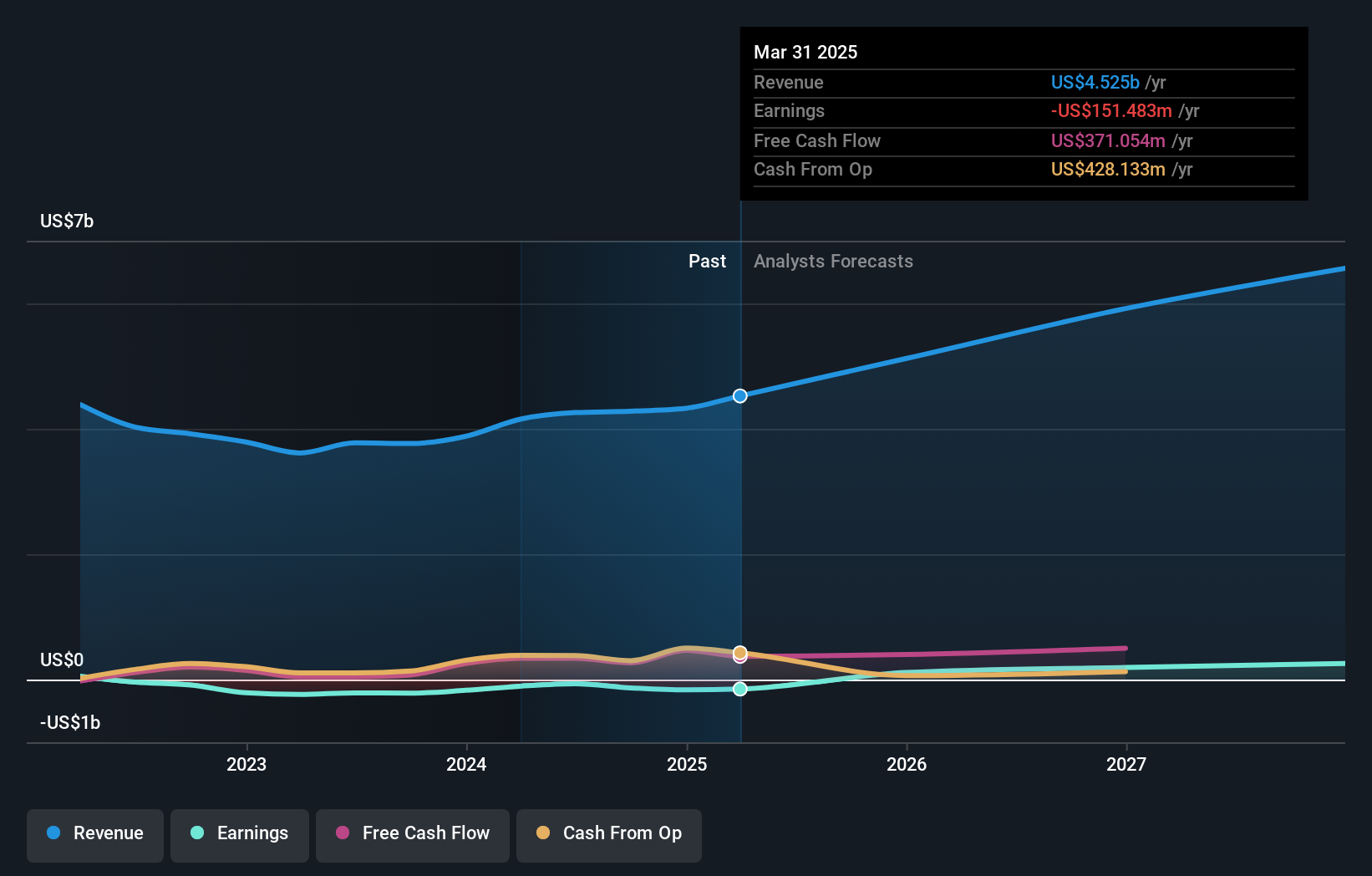

Chemung Financial is forecasted for significant earnings growth of 78.3% annually, outpacing the US market. Insider ownership remains strong, with more shares bought than sold in recent months. Despite trading at a substantial discount to its fair value, the company reported a net loss for recent quarters and reduced profit margins from last year. Recent debt financing could support growth initiatives, while dividends remain steady at US$0.32 per share quarterly.

- Dive into the specifics of Chemung Financial here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that Chemung Financial is priced lower than what may be justified by its financials.

HCI Group (HCI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HCI Group, Inc. operates in the United States across property and casualty insurance, insurance management, reinsurance, real estate, and information technology sectors with a market cap of approximately $1.62 billion.

Operations: The company's revenue is primarily derived from its insurance operations at $717.80 million, with additional contributions from reciprocal exchange operations at $42.11 million and real estate activities generating $13.46 million.

Insider Ownership: 15.3%

HCI Group exhibits robust earnings growth, with a forecasted annual increase of 25.2%, surpassing the US market average. Despite recent index exclusions, it maintains strong insider ownership and trades at a significant discount to its estimated fair value. Revenue is projected to grow at 10.8% annually, outpacing the broader market's growth rate. Recent earnings showed substantial improvement, with net income rising to US$69.68 million from US$47.61 million year-over-year.

- Click here to discover the nuances of HCI Group with our detailed analytical future growth report.

- Our expertly prepared valuation report HCI Group implies its share price may be lower than expected.

Tutor Perini (TPC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tutor Perini Corporation is a construction company offering general contracting, construction management, and design-build services to private and public clients globally, with a market cap of $2.51 billion.

Operations: The company's revenue segments consist of Civil (Including Management Services) at $2.39 billion, Building (Including Management Services) at $1.73 billion, and Specialty Contractors at $602.75 million.

Insider Ownership: 15.8%

Tutor Perini's recent $1.871 billion contract for the Midtown Bus Terminal project in New York City boosts its backlog significantly. Despite low forecasted return on equity, the company's revenue is projected to grow at 13.9% annually, outpacing the US market, and earnings are expected to increase by 87.36% per year. Insider transactions show more buying than selling recently, indicating confidence in future growth prospects despite trading at a substantial discount to estimated fair value.

- Delve into the full analysis future growth report here for a deeper understanding of Tutor Perini.

- In light of our recent valuation report, it seems possible that Tutor Perini is trading behind its estimated value.

Seize The Opportunity

- Delve into our full catalog of 185 Fast Growing US Companies With High Insider Ownership here.

- Want To Explore Some Alternatives? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10