Shopify (SHOP) Empowers FST Corp. With Enhanced E-Commerce Capabilities

Shopify (SHOP) recently experienced a price move of 27% over the last quarter, potentially buoyed by significant developments such as FST Corp.'s rollout of Shopify Plus. This integration aims to enhance operational efficiency and customer engagement, arguably adding weight to the company's overall market performance. During the period, the market showed a similar upward trend, with major indexes posting gains. These structural improvements from client announcements and partnership moves complemented the broader tech market's positive direction, as evidenced by strong earnings reports from other major tech firms, reinforcing investor confidence in Shopify's growth trajectory.

Shopify has 2 possible red flags we think you should know about.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

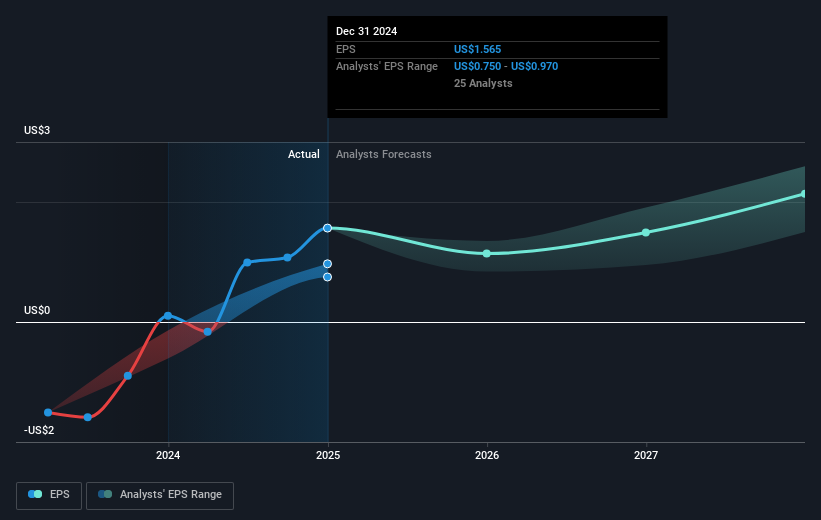

The recent 27% quarterly surge in Shopify's stock price, following the integration of Shopify Plus by FST Corp., offers an interesting context to the company's growth narrative. This significant news could possibly influence revenue and earnings forecasts by increasing operational efficiency for merchants and enhancing customer engagement, although ongoing global ecommerce trends and platform localization remain key drivers. The expansion into new markets and the growing merchant base support long-term revenue growth, culminating in consensus estimates of US$16.8 billion in revenue by 2028.

For perspective, Shopify's shares have seen a substantial total return of 193.37% over the last three years, reflecting a more extended period of performance enhancement. Over the past year, the company's stock return outpaced both the US market and the US IT industry, indicating robust relative performance. This suggests that investor confidence might be bolstered not only by short-term developments but also by sustained growth in international markets and product offerings.

The current share price of US$123.01 exceeds the analyst consensus price target of US$118.76, representing a 4.2% decline from the present level. This discrepancy suggests a disparity in short-term market expectations versus analyst forecasts. While analysts expect reduced profit margins over the next three years and a necessary alignment with the industry's average PE ratio, the continued rollout of strategic solutions and potential efficiency gains from recent developments could address this valuation gap over time.

Take a closer look at Shopify's potential here in our financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10