Intuitive Machines (LUNR) Wins US$10M Contract To Advance Orbital Transfer Vehicle

Intuitive Machines (LUNR) recently secured a $9.8 million government contract to advance its Orbital Transfer Vehicle through the Critical Design Review phase, signaling portfolio growth and diversification in space operations. This achievement aligns with the company's 34% share price increase over the past quarter, despite recent index removals and earnings showing reduced losses year-over-year. The broader market trend with strong tech earnings would have added weight to these moves. However, investor caution may remain due to highlighted company risks and uncertainties within commercial space growth, which could temper optimism about the government's continued demand for Intuitive Machines' solutions.

We've identified 2 weaknesses for Intuitive Machines (1 is potentially serious) that you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

The recent government contract worth US$9.8 million positions Intuitive Machines (LUNR) for potential growth in its Orbital Transfer Vehicle offerings. This aligns with the company's narrative of expanding its commercial service footprint beyond lunar missions, networking more heavily with government reforms. The contract underscores LUNR's drive for revenue growth, strategically fitting into their broader business model focused on diversifying revenue streams and leveraging government demand.

Over the last year, Intuitive Machines achieved a total return of 190.20%, significantly outpacing both the US market, which returned 15.7%, and the US Aerospace & Defense industry return of 35%. This robust performance suggests investor optimism, perhaps driven by expectations of future profitability and revenue enhancements aligned with its strategic expansion and government contracts.

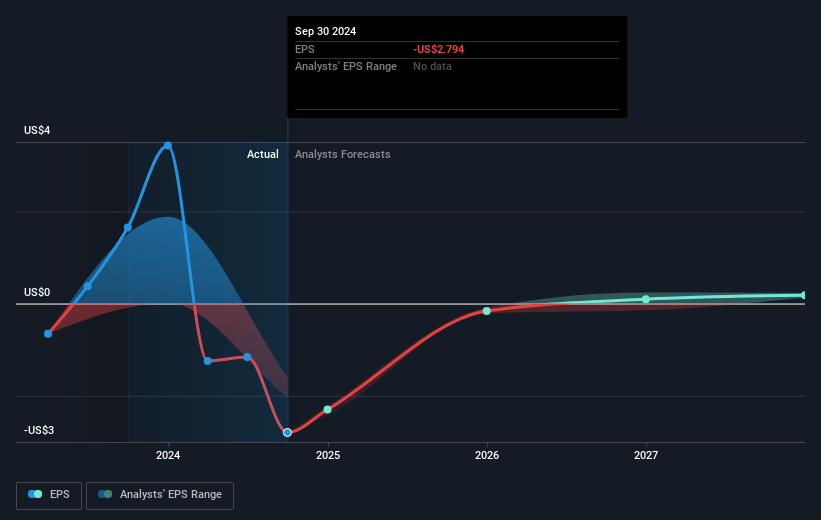

The new contract could bolster revenue forecasts, suggesting a potential uplift in earnings as Intuitive Machines continues to broaden its market engagement beyond NASA. However, challenges such as higher SG&A costs and competitive pressures remain. With a current share price of US$11.55 and an analyst price target of US$15.11, representing a 30.83% discount, the stock may appear undervalued based on projected earnings growth, profit margins, and potential revenue acceleration. Investors should weigh these factors within the context of long-term strategic positioning and current market conditions.

Review our growth performance report to gain insights into Intuitive Machines' future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10