Newmark Group, Inc. Just Beat Analyst Forecasts, And Analysts Have Been Updating Their Predictions

As you might know, Newmark Group, Inc. (NASDAQ:NMRK) just kicked off its latest quarterly results with some very strong numbers. The company beat forecasts, with revenue of US$759m, some 9.8% above estimates, and statutory earnings per share (EPS) coming in at US$0.11, 38% ahead of expectations. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

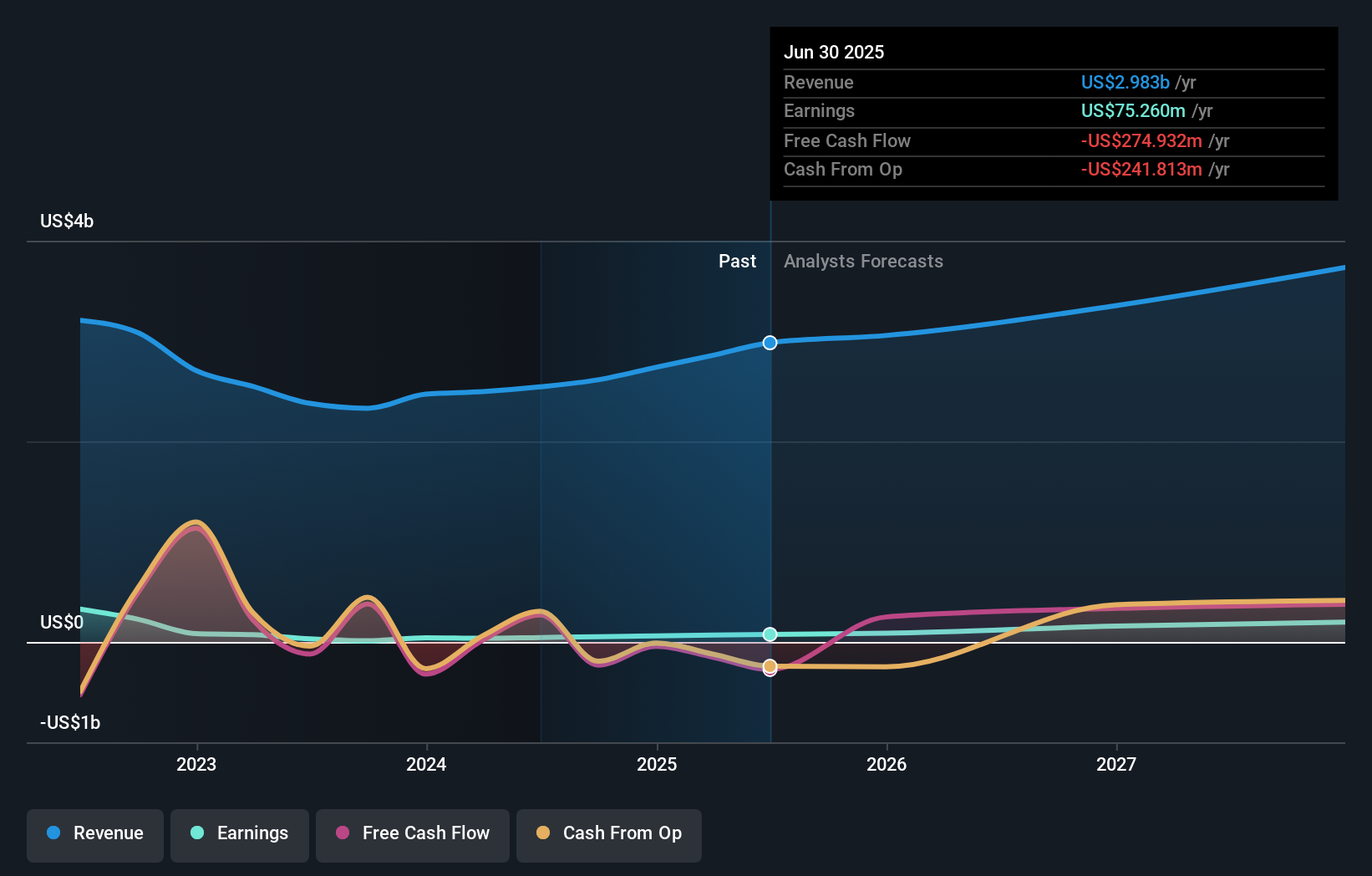

Taking into account the latest results, the current consensus from Newmark Group's five analysts is for revenues of US$3.06b in 2025. This would reflect a reasonable 2.4% increase on its revenue over the past 12 months. Statutory earnings per share are predicted to leap 62% to US$0.66. Before this earnings report, the analysts had been forecasting revenues of US$3.07b and earnings per share (EPS) of US$0.50 in 2025. There was no real change to the revenue estimates, but the analysts do seem more bullish on earnings, given the sizeable expansion in earnings per share expectations following these results.

View our latest analysis for Newmark Group

The analysts have been lifting their price targets on the back of the earnings upgrade, with the consensus price target rising 9.4% to US$16.95. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on Newmark Group, with the most bullish analyst valuing it at US$19.00 and the most bearish at US$14.00 per share. The narrow spread of estimates could suggest that the business' future is relatively easy to value, or thatthe analysts have a strong view on its prospects.

Of course, another way to look at these forecasts is to place them into context against the industry itself. The period to the end of 2025 brings more of the same, according to the analysts, with revenue forecast to display 4.9% growth on an annualised basis. That is in line with its 5.0% annual growth over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenues grow 10.0% per year. So it's pretty clear that Newmark Group is expected to grow slower than similar companies in the same industry.

The Bottom Line

The biggest takeaway for us is the consensus earnings per share upgrade, which suggests a clear improvement in sentiment around Newmark Group's earnings potential next year. Fortunately, the analysts also reconfirmed their revenue estimates, suggesting that it's tracking in line with expectations. Although our data does suggest that Newmark Group's revenue is expected to perform worse than the wider industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have forecasts for Newmark Group going out to 2027, and you can see them free on our platform here.

Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Newmark Group that you should be aware of.

Valuation is complex, but we're here to simplify it.

Discover if Newmark Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10