Standex International (SXI) Up 8.9% After Strong Q4 Results and Upbeat 2026 Outlook—Has the Growth Narrative Shifted?

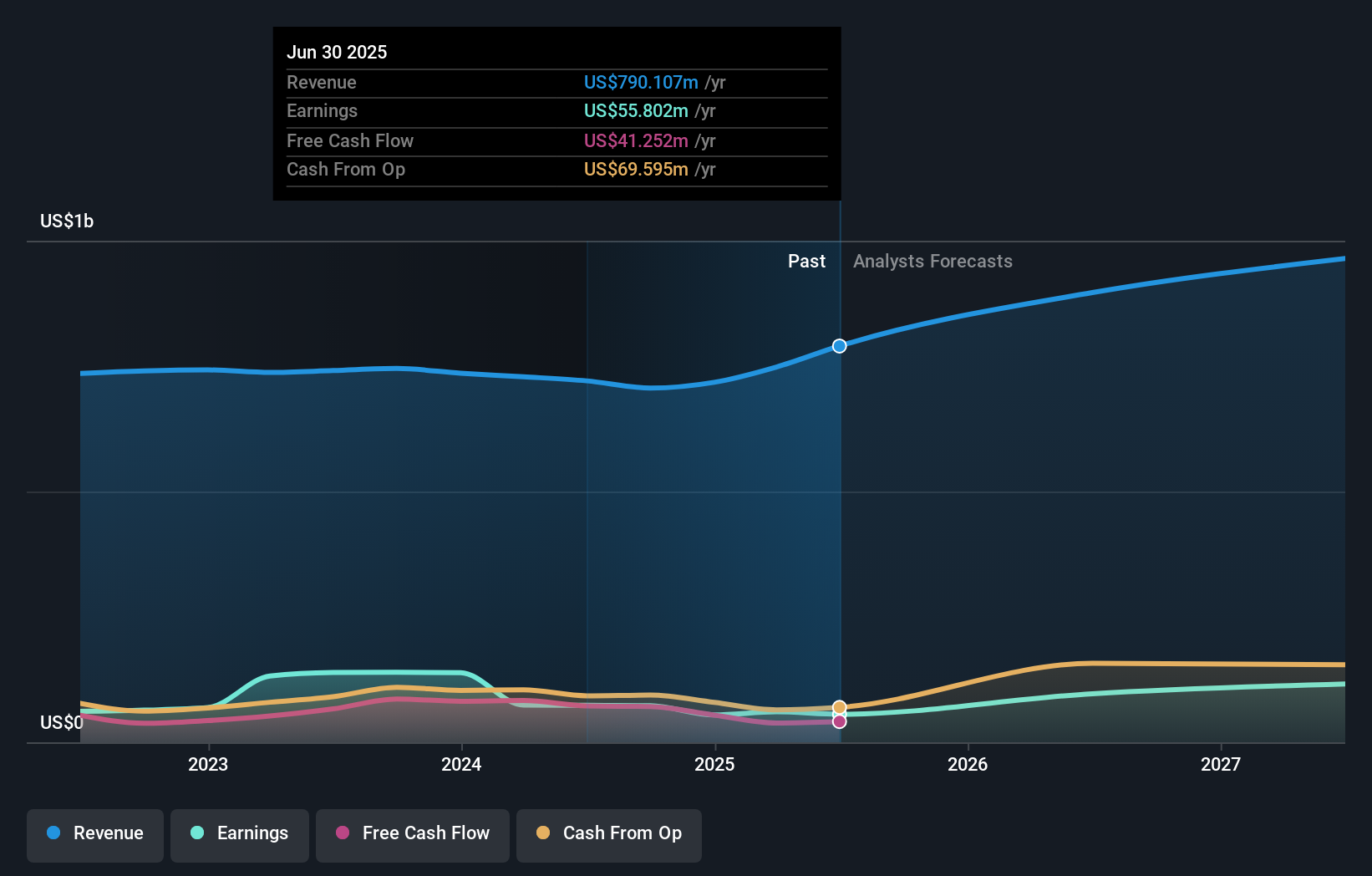

- Standex International reported its fourth quarter 2025 results on July 31, delivering sales of US$222.05 million and net income of US$14.83 million, while also providing upbeat guidance for fiscal 2026 with expectations of higher revenue and margin expansion.

- The company highlighted contributions from recent acquisitions and robust sales growth in fast-expanding markets, positioning itself for accelerated expansion in key business segments.

- We’ll examine how Standex’s strong 2026 outlook, driven by acquisitions and fast-growth market sales, impacts its overall investment story.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Standex International Investment Narrative Recap

To be a shareholder in Standex International, you need to believe in its ability to drive sustainable growth through acquisitions and capital allocation into fast-expanding markets, allowing it to unlock margin expansion despite sector headwinds. The latest earnings report and upbeat guidance strengthen the case for acquisitions and new market growth as key short-term catalysts, although concerns about organic revenue declines and elevated debt remain front of mind; the recent news does not materially shift the biggest fundamental risks to the business at this time.

The recent increase in the quarterly dividend to US$0.32 per share is particularly relevant, as it signals management's confidence in future cash flows and strengthens the case for improving financial performance, an important counterpoint to the higher debt levels taken on to fund recent acquisitions, which now drive much of the anticipated top-line growth.

But while guidance is pointing upwards, investors should also consider that the company’s higher leverage and recent softness in organic sales mean...

Read the full narrative on Standex International (it's free!)

Standex International's narrative projects $1.0 billion in revenue and $139.1 million in earnings by 2028. This requires 11.5% yearly revenue growth and a $78.4 million earnings increase from $60.7 million today.

Uncover how Standex International's forecasts yield a $197.00 fair value, a 9% upside to its current price.

Exploring Other Perspectives

One estimate from the Simply Wall St Community places Standex International’s fair value at US$197 per share. While community opinions vary, many are watching how recent acquisition-driven revenue growth might impact future risks and opportunities, read on to see how market expectations could evolve.

Explore another fair value estimate on Standex International - why the stock might be worth as much as 9% more than the current price!

Build Your Own Standex International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Standex International research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Standex International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Standex International's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10