Why We Think Radius Residential Care Limited's (NZSE:RAD) CEO Compensation Is Not Excessive At All

Key Insights

- Radius Residential Care's Annual General Meeting to take place on 6th of August

- CEO Andrew Peskett's total compensation includes salary of NZ$511.1k

- The total compensation is similar to the average for the industry

- Over the past three years, Radius Residential Care's EPS grew by 30% and over the past three years, the total shareholder return was 31%

AI is about to change healthcare. These 20 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10bn in marketcap - there is still time to get in early.

CEO Andrew Peskett has done a decent job of delivering relatively good performance at Radius Residential Care Limited (NZSE:RAD) recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 6th of August. Here is our take on why we think the CEO compensation looks appropriate.

See our latest analysis for Radius Residential Care

Comparing Radius Residential Care Limited's CEO Compensation With The Industry

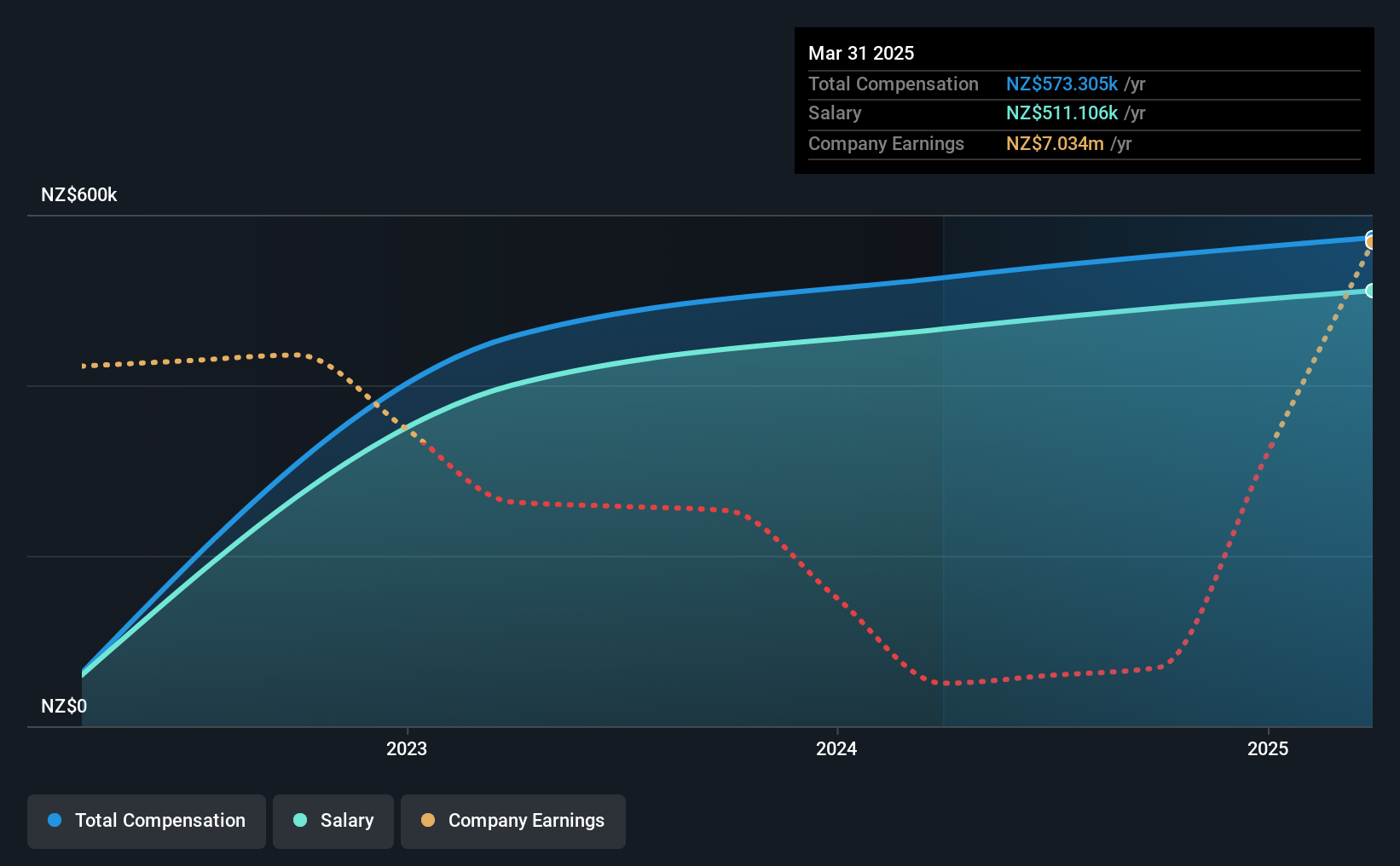

According to our data, Radius Residential Care Limited has a market capitalization of NZ$114m, and paid its CEO total annual compensation worth NZ$573k over the year to March 2025. That's a notable increase of 9.0% on last year. In particular, the salary of NZ$511.1k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the New Zealander Healthcare industry with market capitalizations under NZ$339m, the reported median total CEO compensation was NZ$601k. So it looks like Radius Residential Care compensates Andrew Peskett in line with the median for the industry.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | NZ$511k | NZ$466k | 89% |

| Other | NZ$62k | NZ$60k | 11% |

| Total Compensation | NZ$573k | NZ$526k | 100% |

Talking in terms of the industry, salary represented approximately 58% of total compensation out of all the companies we analyzed, while other remuneration made up 42% of the pie. Radius Residential Care is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Radius Residential Care Limited's Growth

Radius Residential Care Limited has seen its earnings per share (EPS) increase by 30% a year over the past three years. It achieved revenue growth of 3.6% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Radius Residential Care Limited Been A Good Investment?

Radius Residential Care Limited has generated a total shareholder return of 31% over three years, so most shareholders would be reasonably content. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

In Summary...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. Despite the pleasing results, we still think that any proposed increases to CEO compensation will be examined based on a case by case basis and linked to performance outcomes.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 4 warning signs for Radius Residential Care (of which 1 is potentially serious!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10