热点栏目

客户端

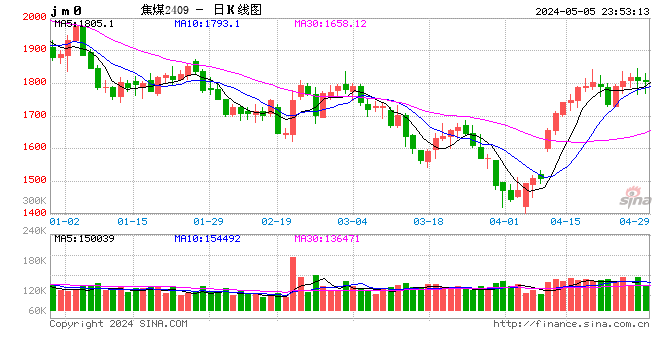

2025年8月6日,早盘开盘,国内期货主力合约涨跌不一。焦煤涨超3%,尿素、多晶硅、焦炭、沪银涨超1%,菜粕涨近1%。跌幅方面,SC原油跌超1%,鸡蛋、碳酸锂、铁矿石、国际铜跌近1%。

光大期货:

数据方面,美国6月贸易帐录得-602亿美元,为2023年9月以来最小逆差。美国7月标普全球服务业PMI终值 55.7,预期55.2,前值55.2。

降息方面,美国总统表示许多美联储主席候选人非常优秀,可能很快宣布新的美联储主席,我喜欢贝森特,但他想留在财政部。最新CME“美联储观察”数据显示,9月维持利率不变的概率为7.6%,降息25个基点的概率为92.4%,到10月维持利率不变的概率为2.7%,累计降息25个基点的概率为38%,累计降息50个基点的概率为59.2%。

综合而言,目前市场认为美联储九月降息25基点概率已超90%,降息预期不断得以强化,为黄金价格偏强运行提供助力,关注今日多名美联储官员讲话内容。

新浪合作大平台期货开户 安全快捷有保障

![]()

责任编辑:赵思远

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.