Invesco’s (IVZ) Fixed Income ETF Launches Might Change The Case For Investing In IVZ

- Invesco recently expanded its active fixed income platform by launching the Invesco Core Fixed Income ETF (GTOC) and Invesco Intermediate Municipal ETF (INTM), increasing assets managed across its fixed income products to over US$491 billion globally.

- This development comes alongside the company’s mixed second-quarter financial results and continued shareholder returns through dividend payments and the completion of a share buyback tranche.

- Next, we'll explore how the fixed income ETF launches and asset growth shape Invesco's evolving investment narrative.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Invesco Investment Narrative Recap

To be a shareholder in Invesco right now, you need to believe in the firm's ability to innovate and expand its ETF and fixed income platforms, while managing margin pressures from industry-wide shifts toward lower-fee investment products. The recent launch of new active fixed income ETFs does reinforce Invesco's commitment to product innovation, but it does not materially change the most significant near-term catalyst, further growth and scale in its ETF business, or the main risk, which remains margin compression as competition intensifies and traditional revenue yields decline.

Among Invesco’s recent updates, the affirmation of a Q2 cash dividend to common shareholders, despite soft quarterly earnings, stands out as particularly relevant. This steady capital return signals a focus on rewarding shareholders even as the company faces both industry headwinds and profitability challenges, intersecting closely with near-term catalysts around operational efficiency and scale-driven margin improvement.

However, before getting too comfortable with the company’s income reliability, investors should watch for signs that intensifying fee pressure could...

Read the full narrative on Invesco (it's free!)

Invesco's projections indicate $4.4 billion in revenue and $1.0 billion in earnings by 2028. This outlook assumes an annual revenue decline of 10.8% and an earnings increase of $577.1 million from the current $422.9 million.

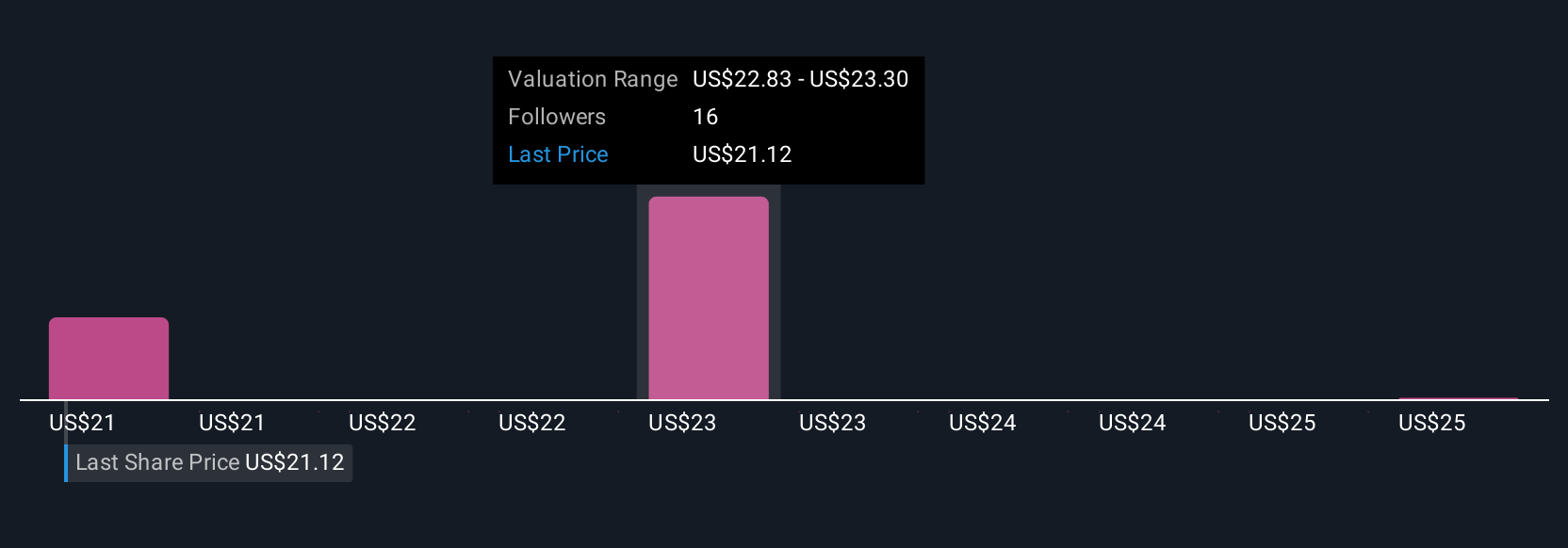

Uncover how Invesco's forecasts yield a $23.00 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community valuations for Invesco range from US$22.75 to US$25.61, reflecting diverse expectations among private analysts. Many point to the growth of Invesco’s ETF and index products as an important factor for future performance, review these perspectives to discover how sharply opinions can diverge.

Explore 3 other fair value estimates on Invesco - why the stock might be worth as much as 22% more than the current price!

Build Your Own Invesco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Invesco research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Invesco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Invesco's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10