Bruker Corporation (NASDAQ:BRKR) reported worse-than-expected second-quarter financial results and cut its FY25 guidance on Monday.

Bruker reported quarterly earnings of 32 cents per share which missed the analyst consensus estimate of 44 cents per share. The company reported quarterly sales of $797.40 million which missed the analyst consensus estimate of $810.43 million.

Bruker cut its FY2025 adjusted EPS guidance from $2.40-$2.48 to $1.95-$2.05 and also lowered FY2025 sales guidance from $3.480 billion-$3.550 billion to $3.430 billion-$3.500 billion.

Frank H. Laukien, Bruker’s President and CEO, said, “Life-science research instruments demand is under pressure at the moment. Our second quarter came in below expectations, as we experienced challenging demand conditions in the US academic market, as well as in biopharma and industrial markets. Tariffs and a stiff currency headwind could not yet be compensated for by our mitigating price, supply chain and cost actions in the second quarter. We are lowering our financial guidance for FY 2025, while we gain improved visibility into US academic funding trends, China stimulus, finalized tariffs, as well as into the timing of a recovery in biopharma drug discovery and industrial research instruments demand.”

Bruker shares fell 4% to trade at $33.32 on Tuesday.

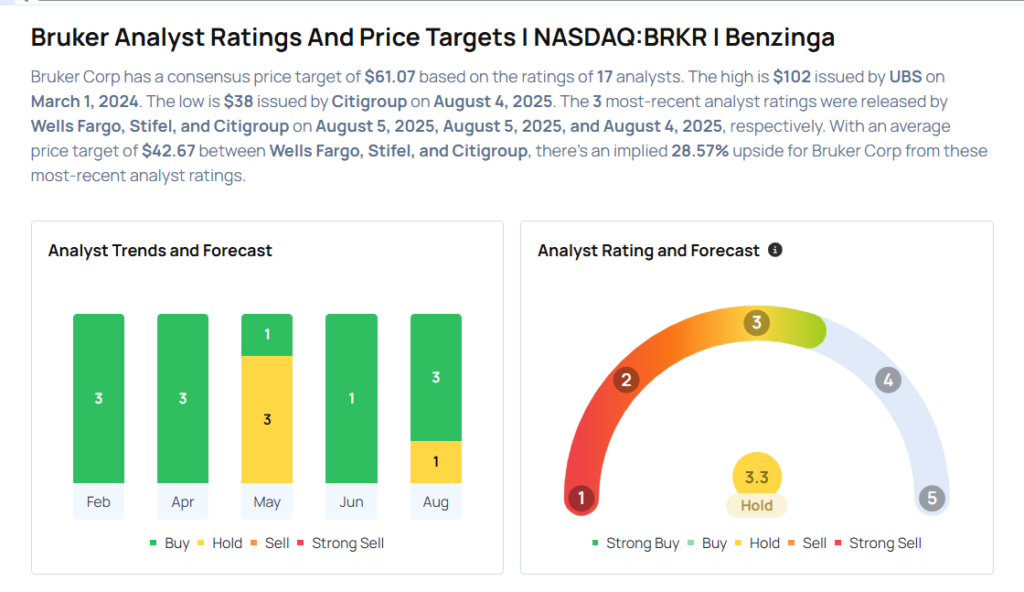

These analysts made changes to their price targets on Bruker following earnings announcement.

- Stifel analyst Daniel Arias maintained Bruker with a Hold and lowered the price target from $48 to $40.

- Wells Fargo analyst Brandon Couillard maintained Bruker with an Overweight rating and lowered the price target from $60 to $50.

Considering buying BRKR stock? Here’s what analysts think:

Read This Next:

- Top 2 Financial Stocks That May Collapse This Month

Photo via Shutterstock