Metalpha Technology Holding And 2 Other Penny Stocks To Watch Closely

The U.S. stock market recently experienced a rebound, with major indices such as the Dow Jones and S&P 500 showing significant gains after a period of decline driven by economic concerns. In this context, investors often look beyond large-cap stocks to explore opportunities in lesser-known areas like penny stocks. Though the term may seem outdated, penny stocks still represent potential growth avenues for smaller or newer companies, particularly when these firms demonstrate strong financial health and fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.66 | $600.36M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.9224 | $155.13M | ✅ 4 ⚠️ 1 View Analysis > |

| Performance Shipping (PSHG) | $1.68 | $20.89M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $90.04M | ✅ 3 ⚠️ 2 View Analysis > |

| Cricut (CRCT) | $4.64 | $982.65M | ✅ 2 ⚠️ 1 View Analysis > |

| Riverview Bancorp (RVSB) | $4.82 | $101.11M | ✅ 3 ⚠️ 1 View Analysis > |

| BAB (BABB) | $0.89 | $6.46M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.27 | $95.71M | ✅ 3 ⚠️ 3 View Analysis > |

| Resources Connection (RGP) | $4.78 | $159.36M | ✅ 3 ⚠️ 1 View Analysis > |

| TETRA Technologies (TTI) | $3.86 | $513.66M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 424 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Metalpha Technology Holding (MATH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Metalpha Technology Holding Limited, with a market cap of $125.48 million, offers wealth management services in Hong Kong through its subsidiaries.

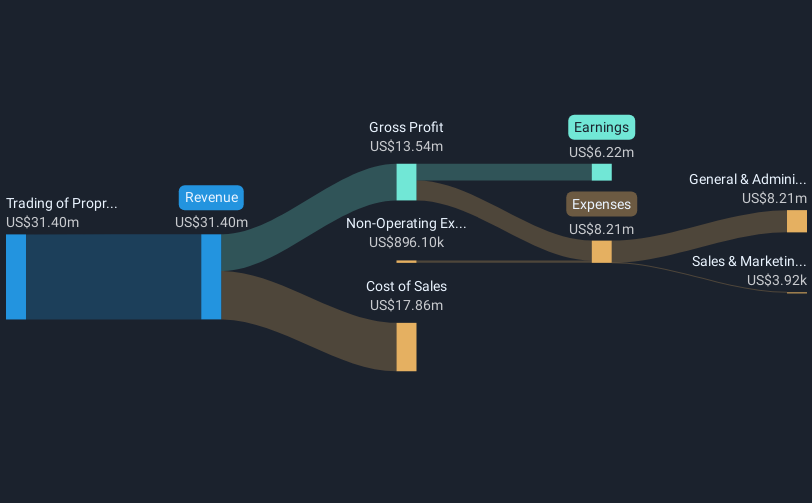

Operations: The company's revenue is primarily derived from the trading of proprietary digital assets and derivative contracts, totaling $44.57 million.

Market Cap: $125.48M

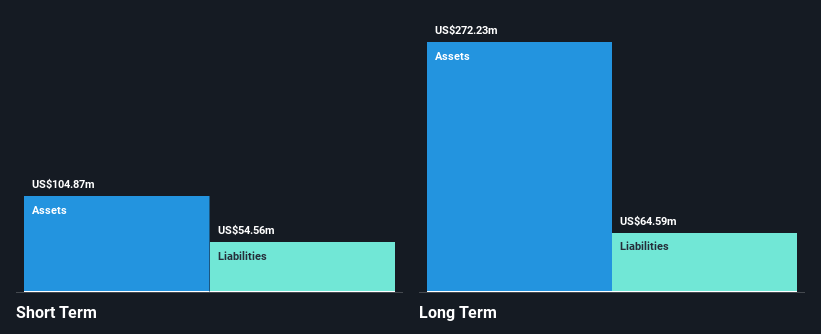

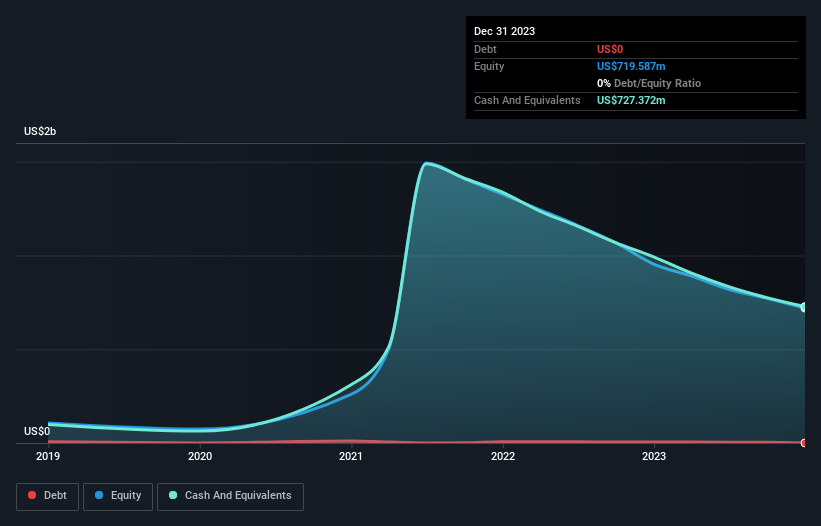

Metalpha Technology Holding Limited, with a market cap of US$125.48 million, has shown significant growth in profitability, reporting US$44.57 million in revenue and US$15.89 million net income for the year ended March 2025. The company is debt-free and boasts strong short-term asset coverage over liabilities, alongside an outstanding return on equity at 43.5%. Recent strategic moves include a partnership with DogeOS to enhance Dogecoin's utility in DeFi and AI sectors, potentially expanding Metalpha's influence in digital asset management. However, high share price volatility remains a concern for investors seeking stability amidst rapid industry changes.

- Dive into the specifics of Metalpha Technology Holding here with our thorough balance sheet health report.

- Gain insights into Metalpha Technology Holding's past trends and performance with our report on the company's historical track record.

Village Farms International (VFF)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Village Farms International, Inc. operates in North America producing, marketing, and distributing greenhouse-grown tomatoes, bell peppers, cucumbers, and mini-cukes with a market cap of approximately $173 million.

Operations: The company generates revenue from its Canadian cannabis operations amounting to $146.25 million, U.S. cannabis activities totaling $16.76 million, and its produce segment, VF Fresh, which contributes $170.51 million.

Market Cap: $173M

Village Farms International, Inc., with a market cap of approximately US$173 million, is navigating the penny stock landscape with a focus on cannabis expansion. Despite being unprofitable and experiencing losses over recent years, the company maintains stable short-term asset coverage over liabilities. Recent strategic efforts include expanding its Canadian cannabis operations by converting greenhouse space to increase production capacity by 33%. Additionally, Village Farms has regained Nasdaq compliance and is exploring entry into the US THC market. The company also formed Vanguard Food LP to privatize certain produce assets while retaining significant long-term growth potential in both produce and cannabis sectors.

- Unlock comprehensive insights into our analysis of Village Farms International stock in this financial health report.

- Gain insights into Village Farms International's future direction by reviewing our growth report.

CreateAI Holdings (TSPH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CreateAI Holdings Inc. specializes in artificial intelligence technology for video game and anime production and publishing, with a market cap of $77.27 million.

Operations: CreateAI Holdings Inc. has not reported any specific revenue segments.

Market Cap: $77.27M

CreateAI Holdings Inc., with a market cap of US$77.27 million, operates in the AI technology space for video game and anime production. As a pre-revenue company, it focuses on innovation, recently unveiling major advancements at ChinaJoy 2025, including the AAA RPG Heroes of Jin Yong and AI products like B breath of You and ACG Fans. The launch of Animon.ai's Studio Version enhances anime creation efficiency with professional-grade tools. Despite its unprofitable status, CreateAI demonstrates strong technological leadership through accepted research papers at ICCV 2025 and strategic market expansion into Korea with Animon.ai updates.

- Get an in-depth perspective on CreateAI Holdings' performance by reading our balance sheet health report here.

- Gain insights into CreateAI Holdings' historical outcomes by reviewing our past performance report.

Next Steps

- Embark on your investment journey to our 424 US Penny Stocks selection here.

- Ready For A Different Approach? Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10