3 Stocks That May Be Priced Below Their Estimated Value In August 2025

As the U.S. stock market rebounds from a recent sell-off, with major indices like the Dow Jones and S&P 500 showing significant gains, investors are closely monitoring economic indicators and corporate earnings reports to gauge future trends. In such a volatile environment, identifying stocks that may be priced below their estimated value can offer potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| WesBanco (WSBC) | $29.51 | $58.27 | 49.4% |

| Similarweb (SMWB) | $7.91 | $15.58 | 49.2% |

| RXO (RXO) | $15.00 | $29.83 | 49.7% |

| Origin Bancorp (OBK) | $35.32 | $69.82 | 49.4% |

| NBT Bancorp (NBTB) | $40.56 | $79.86 | 49.2% |

| Inspire Medical Systems (INSP) | $126.10 | $250.83 | 49.7% |

| Horizon Bancorp (HBNC) | $15.01 | $29.92 | 49.8% |

| FB Financial (FBK) | $47.47 | $93.90 | 49.4% |

| Definitive Healthcare (DH) | $3.74 | $7.38 | 49.3% |

| Camden National (CAC) | $36.60 | $72.91 | 49.8% |

Click here to see the full list of 173 stocks from our Undervalued US Stocks Based On Cash Flows screener.

Let's explore several standout options from the results in the screener.

Oddity Tech (ODD)

Overview: Oddity Tech Ltd. is a consumer tech company that develops digital-first brands for the beauty and wellness sectors both in the United States and globally, with a market cap of $4 billion.

Operations: The company generates revenue from its Personal Products segment, amounting to $703.49 million.

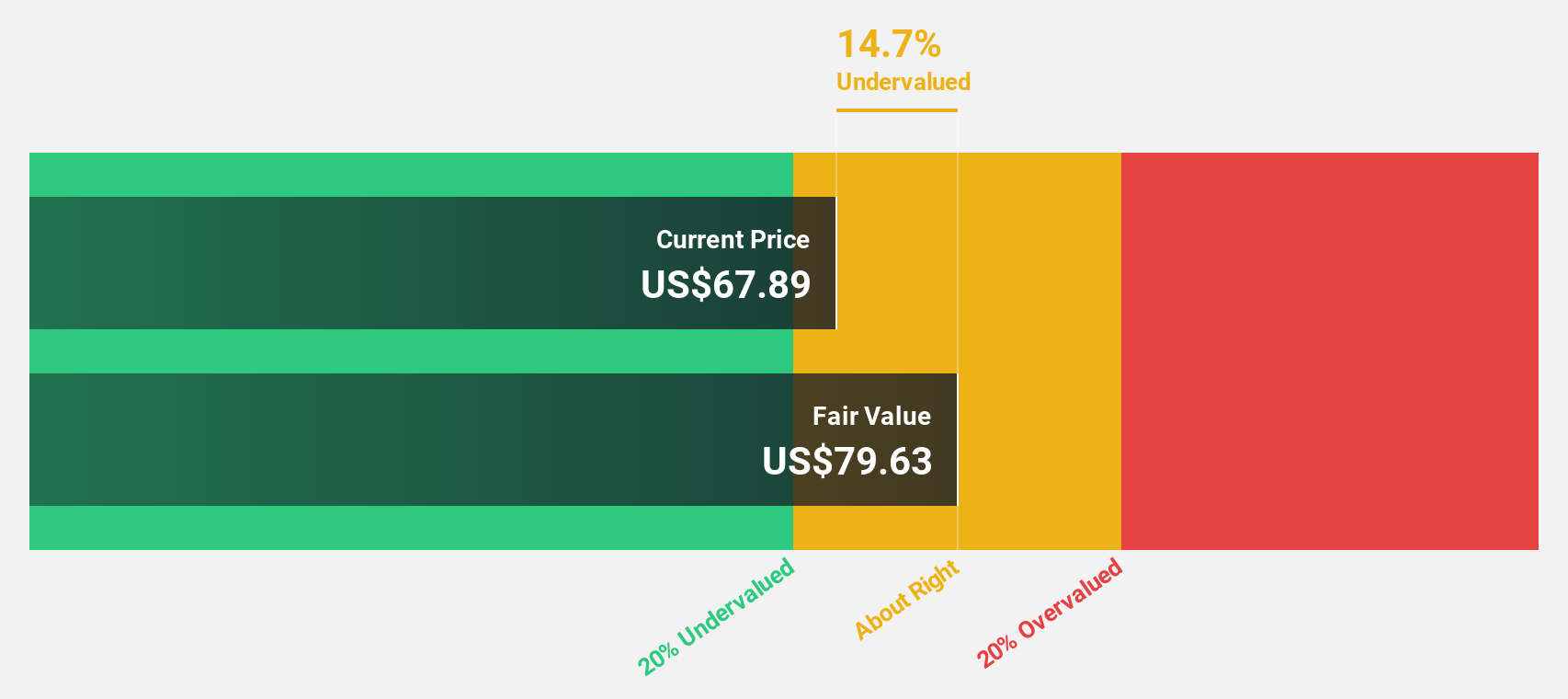

Estimated Discount To Fair Value: 10%

Oddity Tech is trading at US$71.70, approximately 10% below its estimated fair value of US$79.70, indicating potential undervaluation based on cash flows. The company's earnings are expected to grow significantly at 24.88% annually, surpassing the broader US market growth rate of 14.7%. Revenue growth is also strong at 16.2% per year, although not as rapid as earnings growth. Investors should note the upcoming Q2 2025 earnings release scheduled for August 4th after-market hours.

- Upon reviewing our latest growth report, Oddity Tech's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Oddity Tech stock in this financial health report.

D-Market Elektronik Hizmetler ve Ticaret (HEPS)

Overview: D-Market Elektronik Hizmetler ve Ticaret A.S. operates as an e-commerce platform in Turkey, with a market cap of approximately $842.02 million.

Operations: The company's revenue is primarily generated from its e-commerce operations, amounting to ₺58.83 billion.

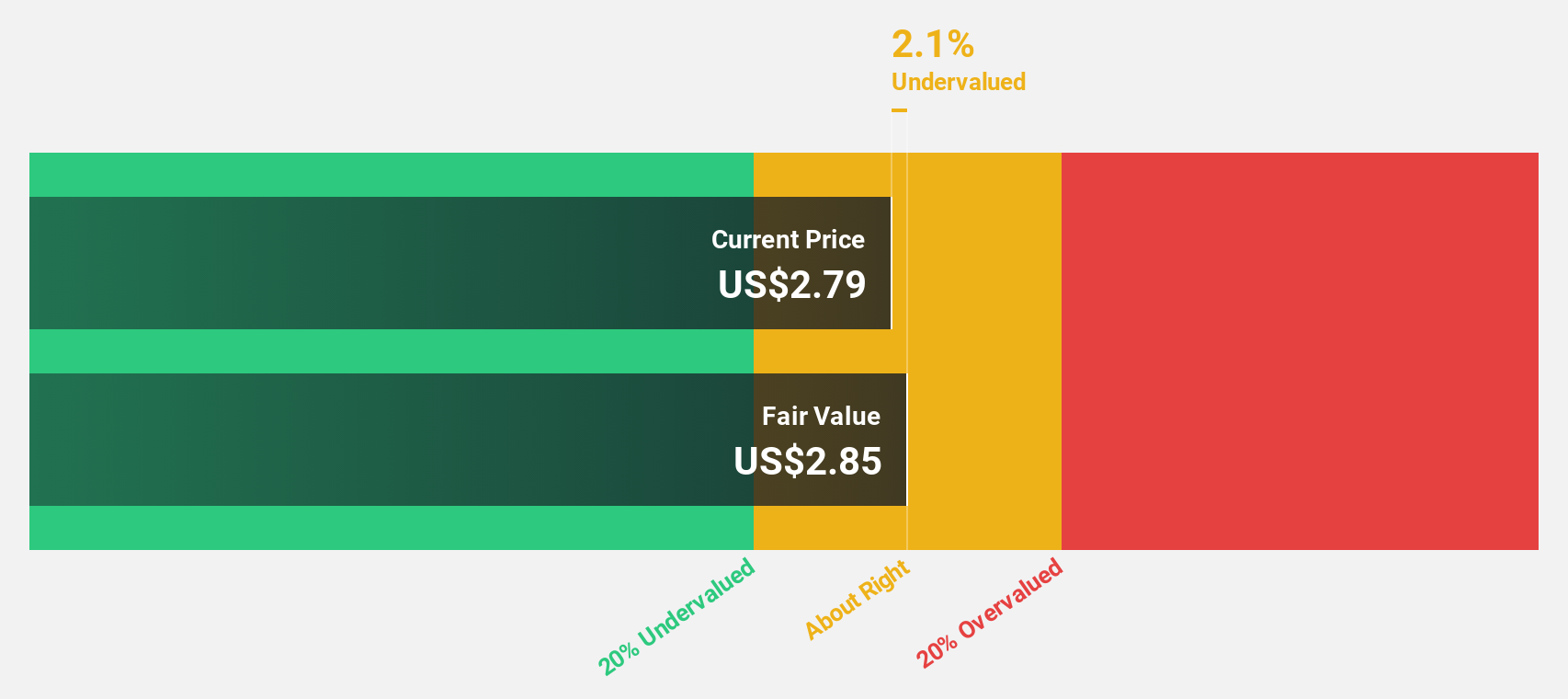

Estimated Discount To Fair Value: 11.3%

D-Market Elektronik Hizmetler ve Ticaret is trading at a good value, approximately 11.3% below its estimated fair value of $2.95 per share. Despite recent net losses, the company's revenue is projected to grow at 24.5% annually, significantly outpacing the US market's growth rate of 9.2%. Earnings are forecast to increase by over 100% per year, with profitability expected within three years, highlighting potential for cash flow-driven undervaluation recognition in the future.

- In light of our recent growth report, it seems possible that D-Market Elektronik Hizmetler ve Ticaret's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of D-Market Elektronik Hizmetler ve Ticaret.

Guild Holdings (GHLD)

Overview: Guild Holdings Company, with a market cap of $1.24 billion, operates in the United States through its subsidiary to originate, sell, and service residential mortgage loans.

Operations: Guild Holdings generates revenue through two primary segments: $828.98 million from origination and $153.36 million from servicing residential mortgage loans in the United States.

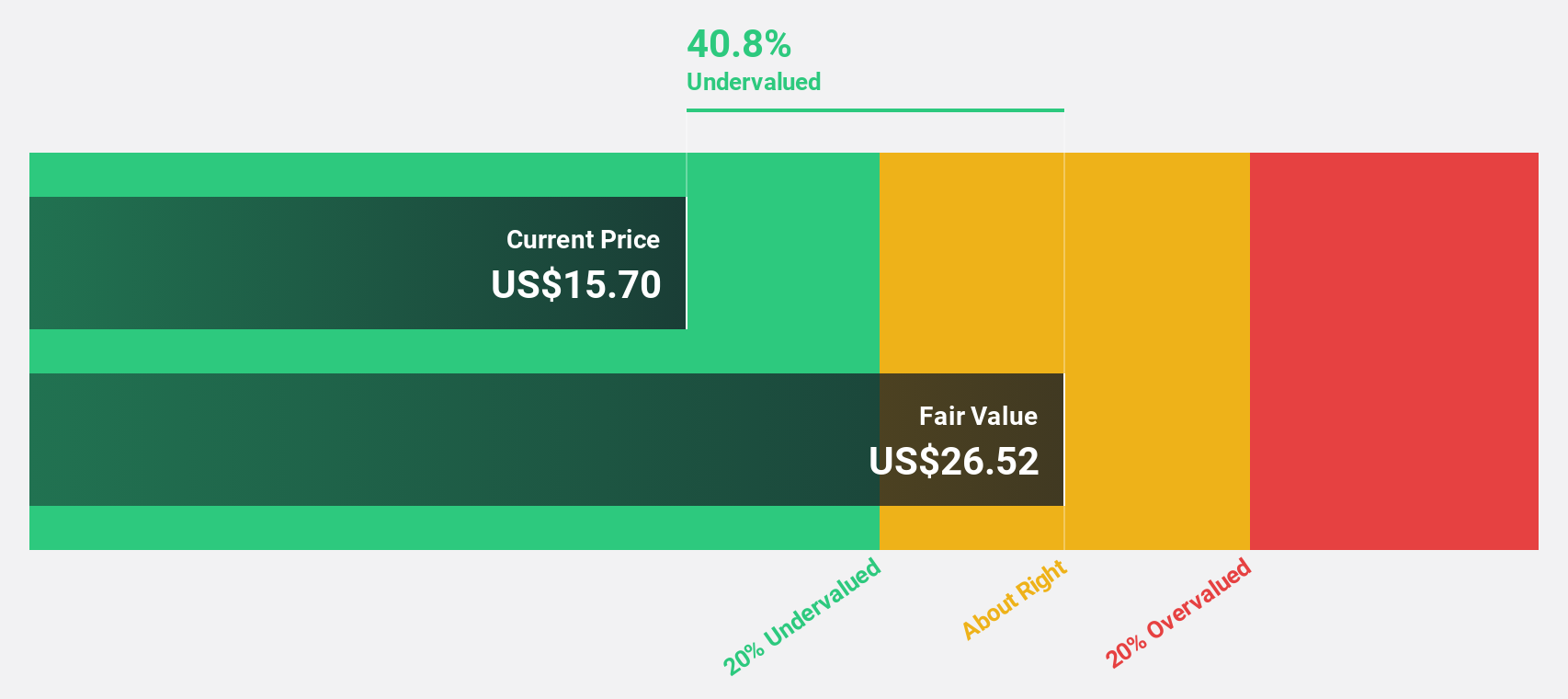

Estimated Discount To Fair Value: 27.7%

Guild Holdings is trading at a significant discount, approximately 27.7% below its estimated fair value of US$27.48 per share, highlighting potential undervaluation based on cash flows. Despite a recent net loss of US$23.9 million for Q1 2025, earnings are projected to grow significantly at 39.9% annually, outpacing the broader US market's growth rate of 14.7%. Recent M&A activity may further influence its valuation as it transitions to private ownership by Bayview Asset Management for approximately $1.3 billion in Q4 2025.

- Our growth report here indicates Guild Holdings may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Guild Holdings' balance sheet health report.

Turning Ideas Into Actions

- Click here to access our complete index of 173 Undervalued US Stocks Based On Cash Flows.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10