Will Peabody Energy's (BTU) New Cost Savings Alter Its Long-Term Production Ambitions?

- In the past week, Peabody Energy released its second-quarter 2025 results, reporting sales of US$890.1 million and a net loss of US$27.6 million, down from a net income of US$199.4 million the previous year; the company also announced a quarterly dividend of US$0.075 per share, payable in September.

- A key highlight is that despite weaker earnings, Peabody raised its full-year guidance and stands to benefit from new U.S. legislation cutting federal royalty rates on mining leases, pointing toward significant cost savings ahead.

- We'll explore how Peabody's increased guidance and expected cost reductions may influence the company's long-term coal production plans.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Peabody Energy Investment Narrative Recap

For an investor to be comfortable holding Peabody Energy stock, belief in a sustained recovery in global coal demand, especially metallurgical coal, and the company's ability to capitalize on U.S. policy tailwinds is essential. The latest news, with disappointing quarterly results but raised full-year guidance and the promise of cost savings from new U.S. royalty legislation, does not materially change the picture: the main catalyst remains operational execution on mine ramp-ups, while the biggest risk continues to be soft demand and volatility in seaborne markets.

One relevant announcement was Peabody's confirmation of a US$0.075 per share dividend, reinforcing the company's intention to return capital to shareholders even as quarterly earnings dip. This sustainability of dividends, despite near-term headwinds, will be watched closely in the context of Peabody’s growth plans, especially as future profitability hinges heavily on successful integration of newly acquired assets and realization of forecast cost reductions.

In contrast, with weaker margins and volatile demand, investors should be aware that even improved guidance does not fully insulate the business from...

Read the full narrative on Peabody Energy (it's free!)

Peabody Energy's outlook anticipates $5.0 billion in revenue and $262.8 million in earnings by 2028. This projection assumes annual revenue growth of 6.3% but a decrease in earnings of $106.3 million from the current $369.1 million.

Uncover how Peabody Energy's forecasts yield a $17.93 fair value, a 4% upside to its current price.

Exploring Other Perspectives

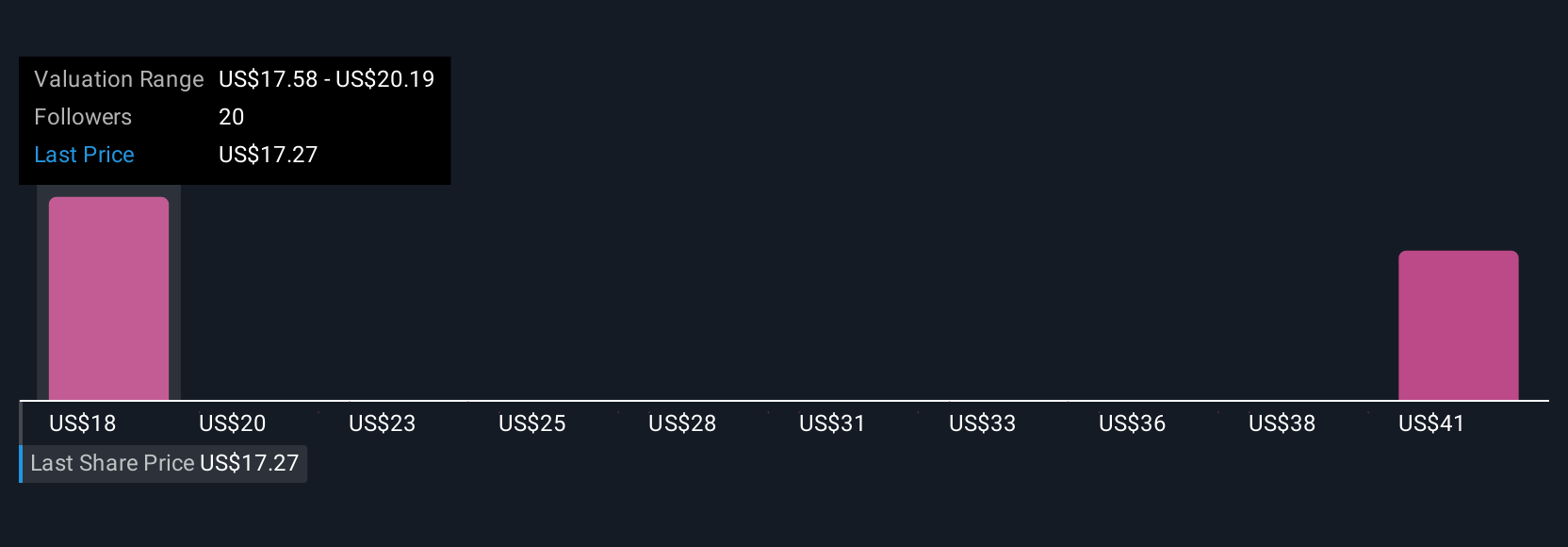

Five members of the Simply Wall St Community estimate Peabody’s fair value from US$17.93 to US$43.65 per share. While investor views can span a wide range, ongoing supply challenges in seaborne coal may continue to influence Peabody’s performance and should be a key consideration as you explore other viewpoints.

Explore 5 other fair value estimates on Peabody Energy - why the stock might be worth just $17.93!

Build Your Own Peabody Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Peabody Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Peabody Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Peabody Energy's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10