Glaukos (GKOS) Narrows Loss and Lifts Full-Year Outlook After Second-Quarter Results – What's Changed

- Last week, Glaukos Corporation reported its second-quarter 2025 results, with sales rising to US$124.12 million and net loss narrowing to US$19.66 million compared to the same period a year ago.

- Alongside these financial improvements, Glaukos also raised its full-year 2025 revenue guidance, highlighting increased management confidence in business trends.

- We'll explore how the raised revenue guidance and improved earnings have potential implications for Glaukos's updated investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Glaukos Investment Narrative Recap

To be a shareholder in Glaukos, you need to believe in the expanding market for innovative glaucoma and corneal therapies, anchored by the commercial success of products like iDose TR, and the company’s ability to overcome regulatory and competitive hurdles. While Glaukos’s raised revenue guidance and improved earnings reflect healthy momentum, these updates do not materially alter the biggest near-term catalyst, the upcoming regulatory decision for Epioxa, or reduce the significant risks from regulatory headwinds or competitive product launches.

Among recent announcements, the achieved EU MDR Certification for iStent infinite and other MIGS technologies stands out, as this opens doors to expanded European access and may support stronger international revenue. This is especially relevant given Glaukos’s ongoing exposure to regulatory changes and the opportunity for geographic growth as a counterbalance to US reimbursement risks.

However, investors should also keep in mind that despite new certifications, the turbulence caused by recent LCD regulatory changes could...

Read the full narrative on Glaukos (it's free!)

Glaukos' outlook calls for $838.6 million in revenue and $55.7 million in earnings by 2028. This requires 27.5% annual revenue growth and a $179.4 million earnings increase from the current earnings of -$123.7 million.

Uncover how Glaukos' forecasts yield a $122.31 fair value, a 39% upside to its current price.

Exploring Other Perspectives

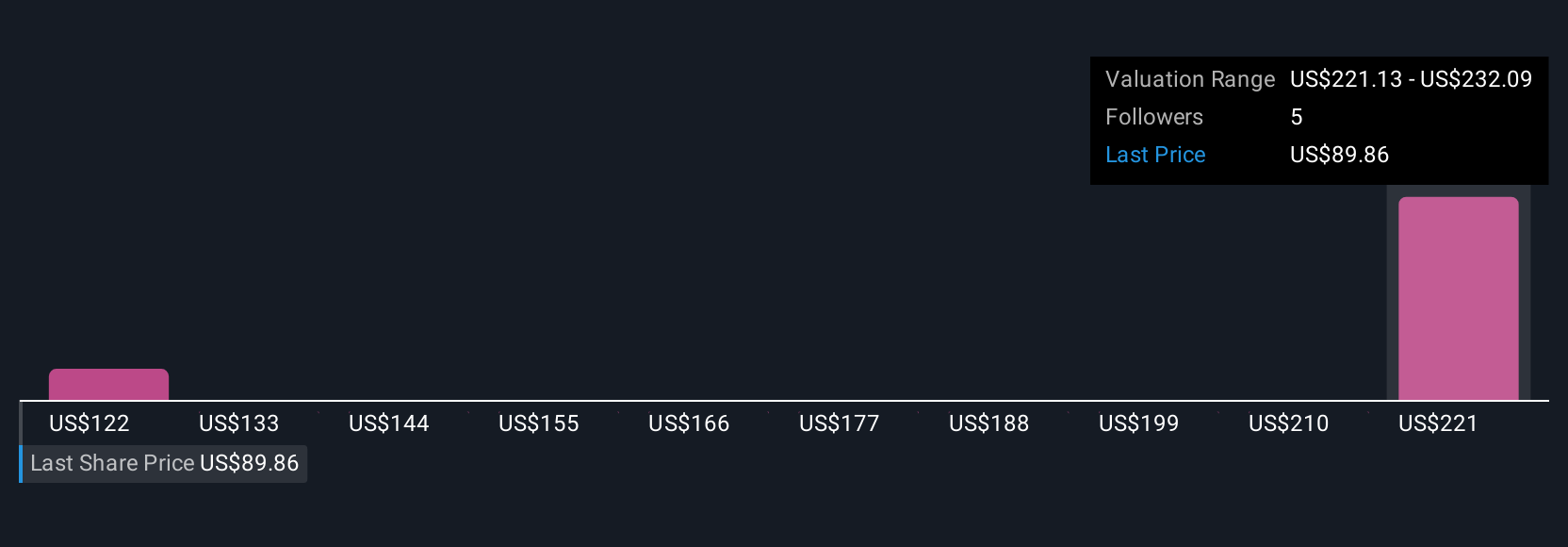

Two fair value estimates from the Simply Wall St Community range from US$122 to US$232 per share, reflecting broad differences in growth assumptions and risk tolerance. While many see international expansion and new product launches as long-term positives, the effects of regulatory hurdles still weigh on consensus, so review several views when forming your own outlook.

Explore 2 other fair value estimates on Glaukos - why the stock might be worth over 2x more than the current price!

Build Your Own Glaukos Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Glaukos research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Glaukos research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Glaukos' overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10