Will Acadia’s (ACAD) New Chief Data Officer Accelerate Its Digital and AI Strategy?

- Acadia Pharmaceuticals recently appointed Scott Cenci as Senior Vice President, Chief Information and Data Officer to lead the company’s digital transformation and oversee its technology, data, and AI strategy, reporting directly to CEO Catherine Owen Adams.

- Cenci’s extensive track record in implementing enterprise-wide digital and AI initiatives across global biopharma companies could have meaningful impacts on Acadia’s operational efficiency and future technology-driven growth initiatives.

- We'll examine how bringing in a leader with deep digital transformation expertise may reshape Acadia's long-term growth outlook and investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

ACADIA Pharmaceuticals Investment Narrative Recap

To own shares in ACADIA Pharmaceuticals, investors need confidence in the company's ability to execute on its neuroscience and rare disease growth plans, particularly through commercialization of DAYBUE and NUPLAZID, while managing expanding costs and regulatory shifts. The appointment of Scott Cenci to lead digital transformation is a step toward operating efficiency, but does not immediately alter the reliance on timely product launches or mitigate prominent risks such as margin pressure from SG&A investments and market expansion challenges.

A recent legal win, which affirmed the validity of the NUPLAZID patent, is particularly relevant, as it secures a major revenue stream and allows more focus on growth initiatives, which Cenci’s digital expertise could support through streamlined operations and smarter data usage. As investors track these catalysts, the company’s execution on European market entry and revenue diversification remains central to the near-term outlook.

But, in contrast to the optimism around operational improvements, investors should be aware of execution risks tied to entering new markets and managing...

Read the full narrative on ACADIA Pharmaceuticals (it's free!)

ACADIA Pharmaceuticals' outlook anticipates $1.4 billion in revenue and $278.6 million in earnings by 2028. This scenario assumes 11.0% annual revenue growth and a $49.7 million increase in earnings from the current $228.9 million.

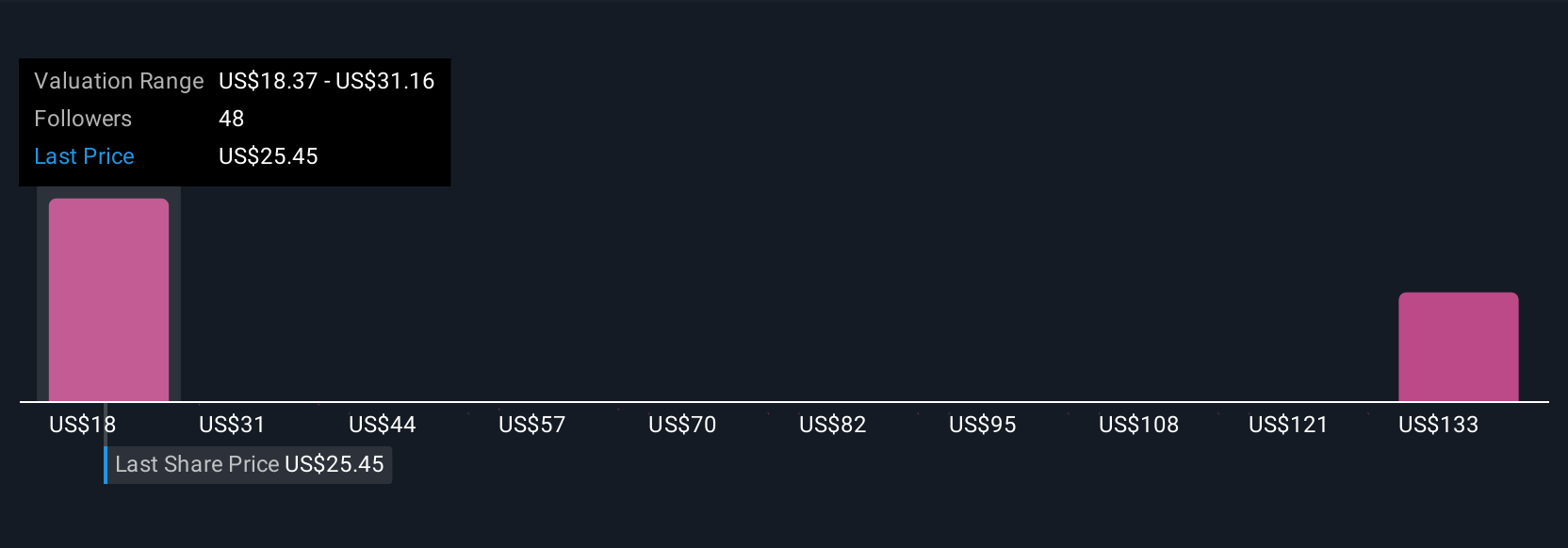

Uncover how ACADIA Pharmaceuticals' forecasts yield a $28.95 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community span a striking US$16 to US$4,900 per share, reflecting a wide spectrum of individual perspectives. With the company’s expanding product portfolio and ambitious market entry plans, your own outlook on execution and margin risks could shape a very different valuation, see how other investors approach it.

Explore 8 other fair value estimates on ACADIA Pharmaceuticals - why the stock might be a potential multi-bagger!

Build Your Own ACADIA Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ACADIA Pharmaceuticals research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free ACADIA Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ACADIA Pharmaceuticals' overall financial health at a glance.

No Opportunity In ACADIA Pharmaceuticals?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10