Can Quaker Chemical's (KWR) Capital Moves Offset Impairment Challenges for Long-Term Investors?

- Quaker Chemical Corporation recently reported second quarter results, recording sales of US$483.4 million and a net loss of US$66.58 million, reflecting a significant US$88.8 million goodwill impairment charge in its EMEA segment.

- Despite this loss, the company increased its quarterly dividend and completed a sizable share repurchase, highlighting continued shareholder return initiatives amid cost-reduction plans and ongoing market challenges.

- We’ll explore how the combination of cost savings actions and shareholder returns could influence Quaker Chemical’s investment outlook moving forward.

AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Quaker Chemical Investment Narrative Recap

To invest in Quaker Chemical, you need to believe the company’s cost-saving initiatives and portfolio realignment will help overcome current earnings pressures, particularly in the EMEA region, and restore profitability despite soft market conditions. The recent goodwill impairment was significant, but, for now, the company’s focus on cost reductions and operational efficiency remains the primary short-term catalyst, while a slower-than-expected recovery in end markets stands out as the biggest risk, neither of which appears materially changed by this news, though both will need close monitoring going forward.

Among the recent announcements, the $20 million cost savings program, targeted to be realized by the end of 2026, stands out as especially relevant, directly addressing margin pressures and providing a buffer against ongoing market softness, which could influence expectations on profit growth and efficiency by absorbing shocks like this quarter’s one-time impairment.

However, investors should not overlook that, despite the increased focus on efficiency, persistent weakness in the Americas and EMEA could still place further pressure on the path to improved earnings...

Read the full narrative on Quaker Chemical (it's free!)

Quaker Chemical's outlook forecasts $2.0 billion in revenue and $157.4 million in earnings by 2028. To achieve this, analysts expect a 3.8% annual revenue growth rate and a $63.3 million increase in earnings from the current $94.1 million.

Uncover how Quaker Chemical's forecasts yield a $151.80 fair value, a 24% upside to its current price.

Exploring Other Perspectives

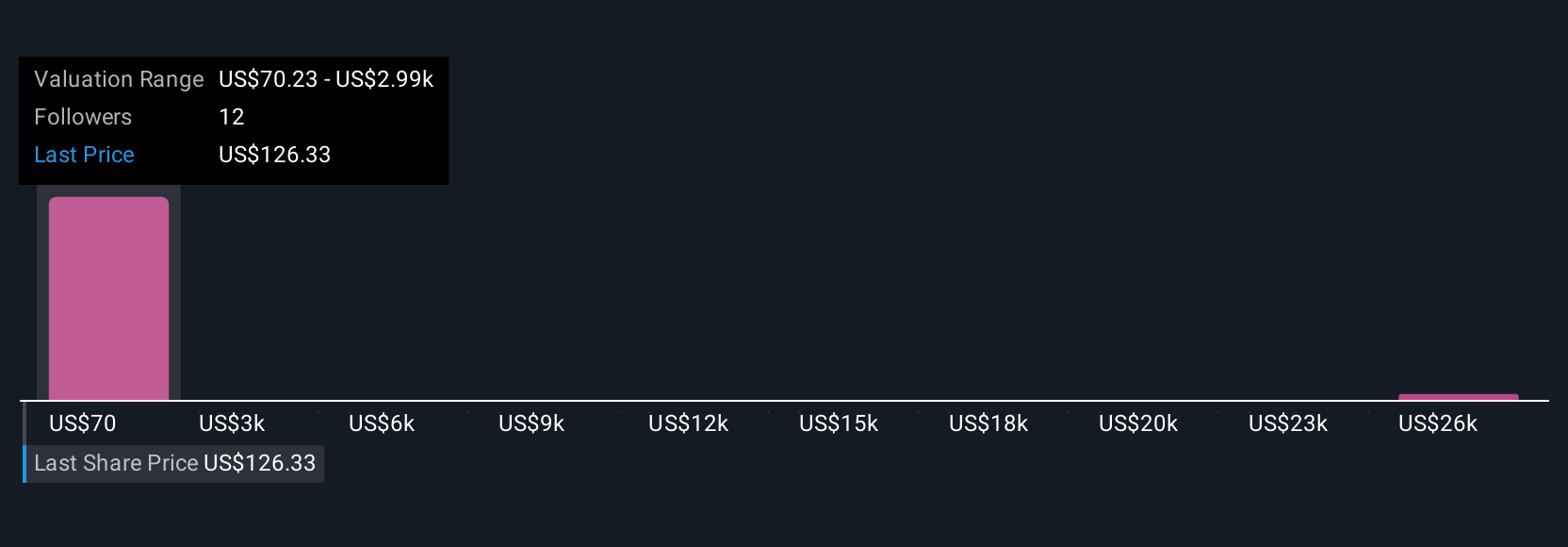

Simply Wall St Community fair value estimates for Quaker Chemical range from US$70 to an outsized US$29,241, with four distinct opinions included. While such varied outlooks illustrate widely different expectations, ongoing market softness in key regions may challenge optimistic forecasts, be sure to consider the full spectrum of investor viewpoints.

Explore 4 other fair value estimates on Quaker Chemical - why the stock might be a potential multi-bagger!

Build Your Own Quaker Chemical Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Quaker Chemical research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Quaker Chemical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Quaker Chemical's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quaker Chemical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10