Should Neogen's (NEOG) Goodwill Impairment and CEO Appointment Prompt a Closer Look at Its Strategy?

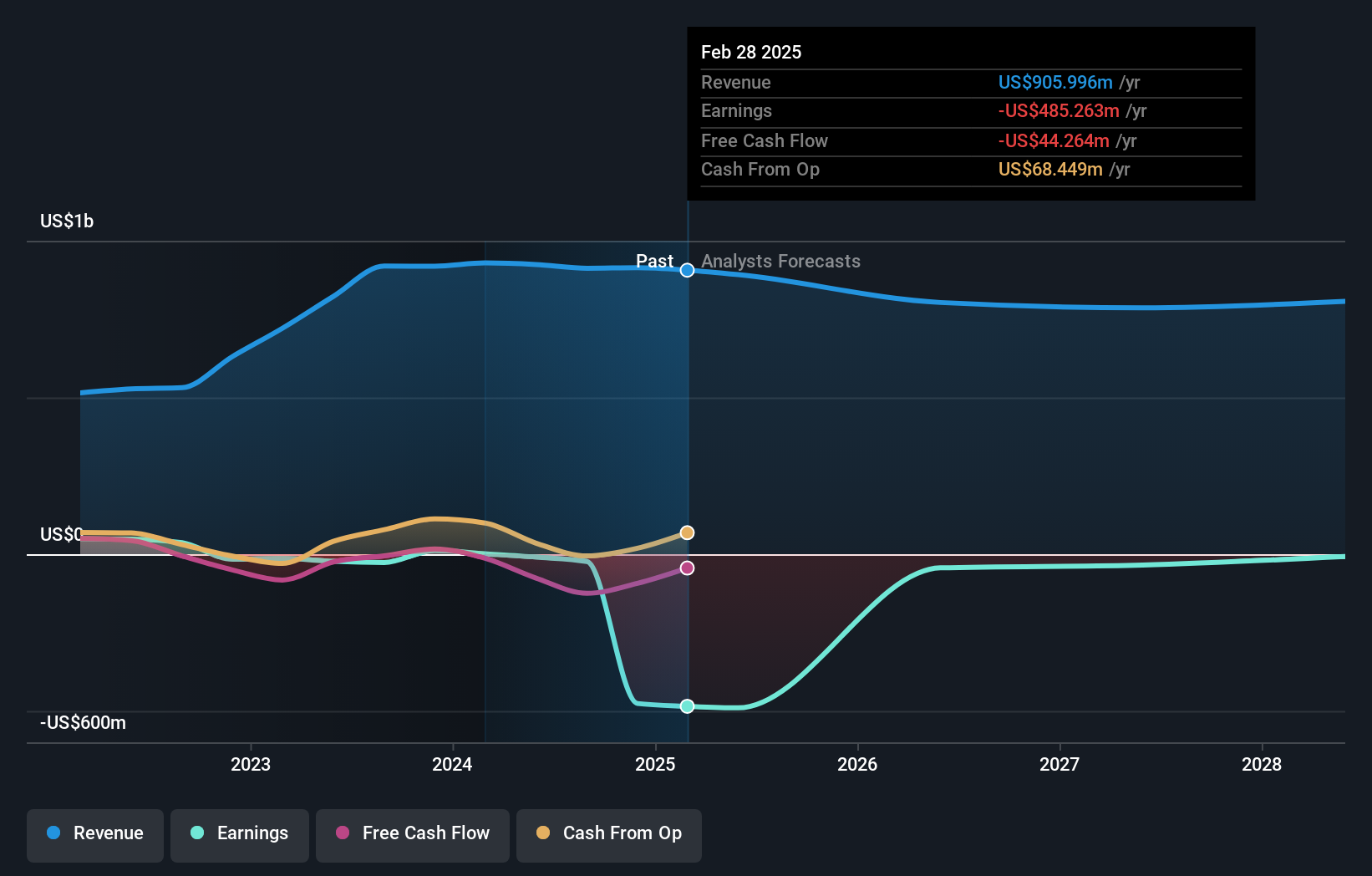

- Neogen Corporation recently reported a goodwill impairment charge of US$597.93 million and a full-year net loss of US$1.09 billion, with sales declining to US$894.66 million for the period ended May 31, 2025.

- In addition to these financial results, Neogen announced the appointment of Mike Nassif as CEO and launched a rapid, enrichment-free Listeria detection assay, highlighting both leadership change and ongoing product innovation.

- We'll explore how the sizable goodwill impairment and new leadership may influence Neogen's long-term investment outlook and industry position.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Neogen Investment Narrative Recap

To hold Neogen shares, I think investors have to believe that the company's focus on food safety innovation and operational improvement will eventually overcome near-term earnings setbacks and integration hurdles. The recent goodwill impairment charge and steep net loss reinforce that the primary risk remains ongoing integration and operational execution challenges, particularly as Neogen works to realize benefits from its 3M Food Safety acquisition. At this stage, these developments have materially heightened the risk profile, while persistent end-market weakness is tempering the pace of any turnaround catalyst.

Among the latest developments, Neogen's launch of its rapid, enrichment-free Listeria detection assay stands out. The focus on product innovation in core food safety, despite weaker sales, aligns with the company's efforts to maintain customer relevance and grow share in high-value diagnostic markets, supporting the case for longer-term revenue acceleration if operational challenges are contained.

In contrast, ongoing integration risks, especially around the 3M Food Safety business, are now even more important for investors to track if they want to understand how...

Read the full narrative on Neogen (it's free!)

Neogen's narrative projects $812.9 million revenue and $105.6 million earnings by 2028. This requires a 3.6% annual revenue decline and an earnings increase of $590.9 million from current earnings of -$485.3 million.

Uncover how Neogen's forecasts yield a $6.50 fair value, a 36% upside to its current price.

Exploring Other Perspectives

Two private investors in the Simply Wall St Community see Neogen's fair value anywhere from US$6.50 to US$14.15 per share. While recent operational setbacks have raised concerns about integration and profit recovery, you can review these varied perspectives to consider how outlooks differ sharply on potential.

Explore 2 other fair value estimates on Neogen - why the stock might be worth just $6.50!

Build Your Own Neogen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Neogen research is our analysis highlighting 1 important warning sign that could impact your investment decision.

- Our free Neogen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Neogen's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Neogen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10